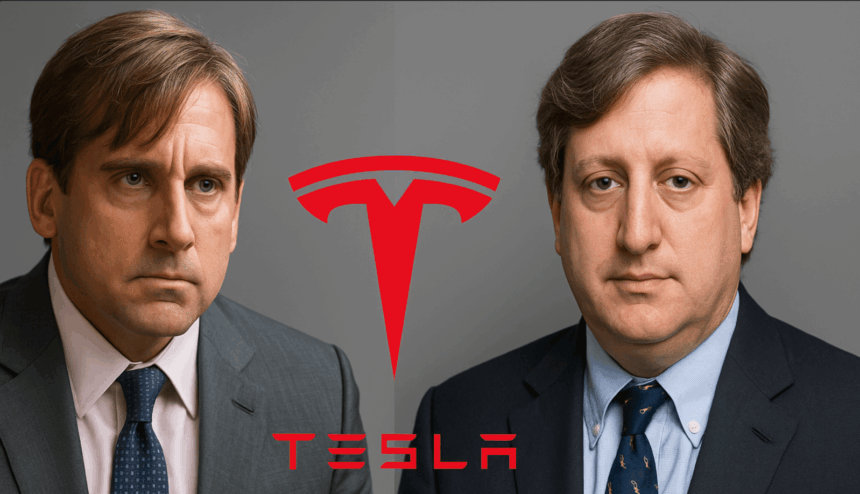

Steve Eisman, an investor well-known for being quick towards the actual property market in 2007 and portrayed by Steve Carell in The Huge Brief, commented on Tesla and its shareholders, describing them as a “cult.”

Eisman is credited as one of many few people who acknowledged and tried to warn others in regards to the impending disaster of collateralized debt obligations in 2007-2008, which led to some of the vital financial downturns in fashionable historical past.

He shortly turned a legend within the monetary world after being profiled by Michael Lewis in his 2010 ebook The Huge Brief: Contained in the Doomsday Machine, after which the film adaptation, The Huge Brief, through which his title was modified to “Mark Baum” and actor Steve Carell portrayed him.

As of late, Eisman is caustiously bullish available on the market. He has some considerations about debt ranges and the round offers within the AI market, however he doesn’t see sturdy proof of one other impending doomsday situation.

He says that he owns all of the “Magnificent 7” aside from one: Tesla (TSLA).

On the Lemondae Stand podcast, he just lately shared his ideas about Tesla. He highlighted how the corporate’s earnings are down roughly 60% since its peak:

I would like you to consider it from the attitude of people that do actual basic work and the way troublesome it may be to quick shares. Tesla’s peak earnings had been in 2022. The corporate earned I feel like $4.50 a share and this yr I feel they’re going to earn $1.50. So the earnings are down 60% from 2022 by means of 2025. And the inventory is barely increased.

Eisman was being requested about Tesla reside throughout the interview, and going off from reminiscence right here. Whereas he acquired the final pattern proper, Tesla’s earnings truly peaked in 2023 at $4.30 per share and declined by over 50% in 2024 to $2 per share.

In 2025, Tesla is at the moment at $0.67 per share, and with sometimes increased earnings within the second half of the yr, Eisman is undoubtedly within the ballpark along with his prediction of $1.50 per share in earnings.

The investor continued:

Think about you’re an analyst at a hedge fund in 2022 and also you go to your PM (portfolio supervisor): ” I acquired this nice thesis. There’s this firm, it’s known as Tesla, I do know you’ve heard of it. Their 2025 earnings are going to be down 60% from their highs of 2022 (truly 2023), and I feel they are going to be even decrease in 2026. What do you suppose?”

He provides:

Let’s quick the piss out of it.

Eisman says that the analyst would have been basically 100% proper, however the hedge fund would nonetheless have misplaced cash as a result of Tesla at the moment trades about 50% increased than it did throughout its peak earnings in 2023.

He explains why:

It’s a cult. I feel what folks sincerely imagine, and this was Dan Ives (a Tesla hyperbull) on my present, The Actual Esiman Playbook, is that Tesla is gonna do very effectively with robotaxis, AI, and robots, and it’s all going to be nice and that’s why you personal Tesla.

The well-known investor explains why that’s cult habits that isn’t value arguing towards:

“Primary, he might be proper. Secondly, there’s no argument towards it. You’re arguing towards one thing that’ll occur sooner or later, and other people imagine it or not.”

Eisman famously mentioned that “making funding choices by wanting solely on the fundamentals of particular person corporations is now not a viable funding philosophy” as valuations are actually fully indifferent from fundamentals.

Right here’s the podcast episode:

Electrek’s Take

Briefly, Eisman argues that investing in Tesla at this level is about perception and, due to this fact, it’s a cult.

As an investor, he stays away from that, and I respect that.

I agree with him. Nonetheless, it’s actually my job as a Tesla reporter to go additional and problem Tesla’s claims concerning the way forward for robotaxis, AI, and robots, particularly when there’s severe proof that the corporate is being deceptive about its progress with these packages, significantly in relation to robotaxis and self-driving.

Being optimistic and utilizing hyperbole is one factor; mendacity about capabilities and deceptive prospects and shareholders is one other.