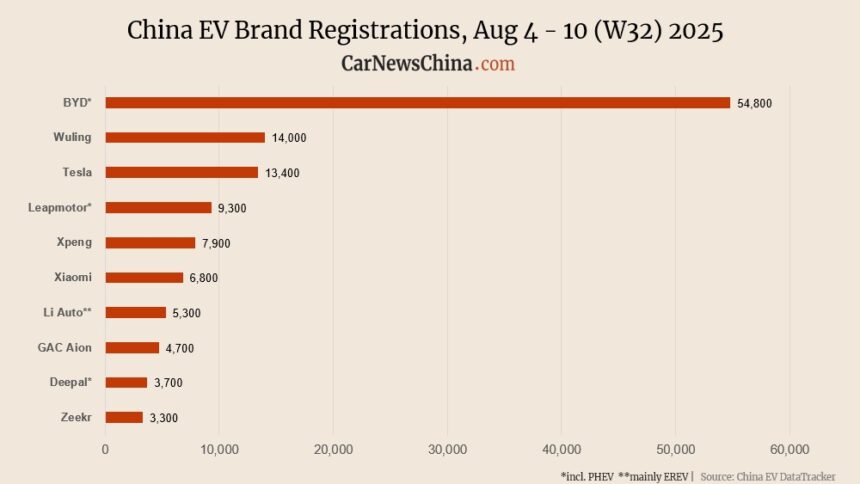

Within the first entire week of August, the Chinese language EV market was primarily down, with a number of exceptions. Onvo was down 13%, Xpeng was down 13% and BYD was down 10%, whereas Tesla was up 22%, in contrast with the week earlier than. The primary week of the month is normally weak as automakers get better from the end-of-month gross sales push.

Nio Group registered 6,100 automobiles, down 23.1% from 7,930 the week earlier than. The Nio model, along with the Firefly sub-brand, registered 2,900 models, the breakdown isn’t but out there and will probably be up to date later.

The weekly model’s EV gross sales have been revealed by Li Auto. Nevertheless, Li Auto ceased publishing them in March 2025 after the China Affiliation of Vehicle Producers (CAAM) “advisable” that Li Auto, media and any third events finish it. CAAM says weekly knowledge “undermines the business order” and “fuels vicious competitors.” Since then, Li Auto has revealed solely its personal weekly EV registration.

The weekly knowledge are utilized by consultants, analysts, or buyers to see the gross sales development and forecast month-to-month deliveries. They present what number of vehicles have been registered for street site visitors, which might be later in contrast with automakers’ self-reported month-to-month gross sales, which, in contrast to registrations, embrace vehicles for showrooms, take a look at vehicles, and different makes use of.

Most of China’s media have adopted CAAM’s advice to cease publishing weekly figures. CarNewsChina continues to publish weekly insurance coverage registrations, based mostly on China EV DataTracker knowledge.

The numbers are rounded and current the model’s new vitality automobile (NEV) gross sales in China, the federal government time period for BEVs, PHEVs, and EREVs (vary extenders). To be fully exact, it additionally consists of hydrogen automobiles (FCEVs), however their gross sales are nearly non-existent in China.

Week 32 of 2025 (W32) was between August 4 and August 10. W32 of 2024, used for year-over-year comparability, was between August 5 and 11.

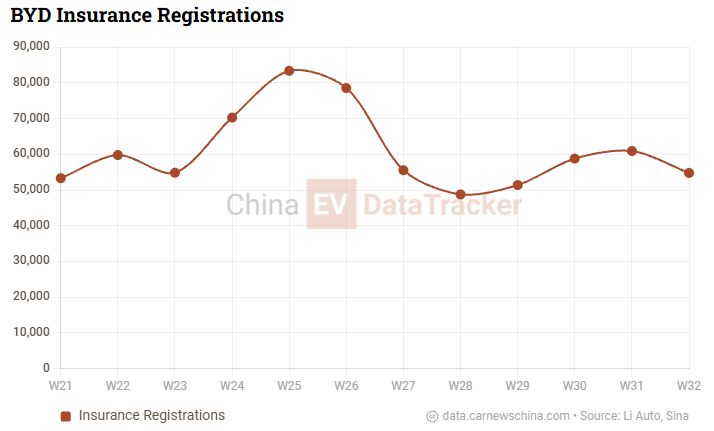

BYD model registered 54,800 automobiles, down 10.1% from 60,930 the earlier week. 12 months-on-year, this marks a 22.4% decline from 70,600.

Fang Cheng Bao registered 3,000 automobiles, down 12.5% from 3,430 the earlier week. 12 months-on-year, that is up 98.7% from 1,510.

Denza registered 1,700 automobiles, down 27.7% from 2,350 the earlier week. 12 months-on-year, that is down 22.7% from 2,200.

Wuling registered 14,000 automobiles. 12 months-on-year, that is up 41.4% from 9,900.

Tesla registered 13,400 automobiles, up 21.6% from 11,020 the earlier week. 12 months-on-year, it is a slight decline of 0.7% from 13,500.

Leapmotor registered 9,300 automobiles, down 8.7% from 10,181 the earlier week. 12 months-on-year, this is a rise of 97.9% from 4,700.

Xpeng registered 7,900 automobiles, down 12.9% from 9,071 the earlier week. 12 months-on-year, that is up 229.2% from 2,400.

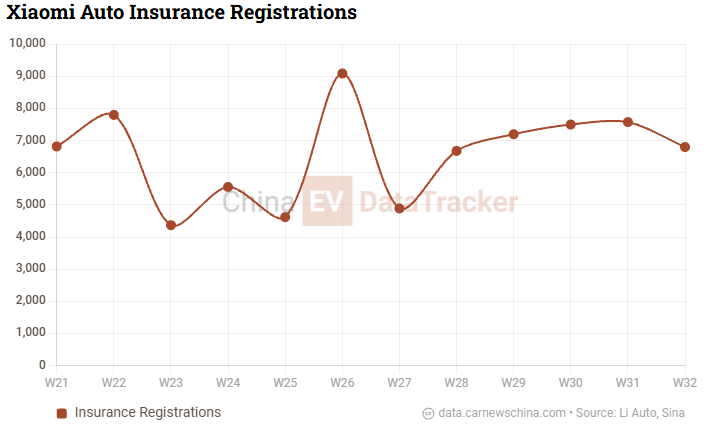

Xiaomi registered 6,800 automobiles, down 10.3% from 7,577 the earlier week. 12 months-on-year, that is up 74.4% from 3,900.

Li Auto registered 5,300 automobiles, down 3.2% from 5,476 the earlier week. 12 months-on-year, this marks a 58.6% drop from 12,800.

Deepal registered 3,700 automobiles, down 6.3% from 3,947 the earlier week. 12 months-on-year, that is up 32.1% from 2,800.

Zeekr registered 3,300 automobiles, up 13.5% from 2,908 the earlier week. 12 months-on-year, the quantity is unchanged.

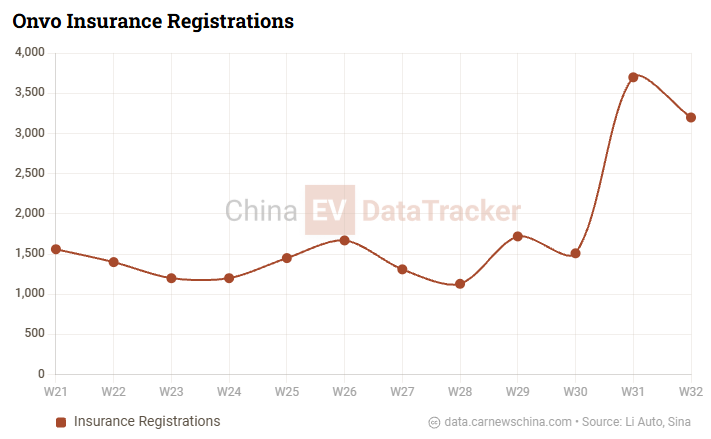

Onvo registered 3,200 automobiles, down 13.5% from 3,700 the earlier week.

Onvo is an entry-level model underneath Nio, which launched its second mannequin, L90, on July 31. It’s a huge SUV with as much as 7 seats, which begins at 179,800 yuan (25,000 USD) with BaaS.

Avatr registered 1,800 automobiles, down 2.7% from 1,850 the earlier week.

Really helpful for you

China EV registrations in week 31: Nio 3,450, Onvo 3,700, Xpeng 9,071, Tesla 11,000, BYD 60,930

China EV registrations in week 30: Nio 3,200, Xpeng 8,400, Tesla 10,650, BYD 58,810

China EV registrations in week 29: Nio 2,500, Xiaomi 7,200, Tesla 9,900, BYD 51,400