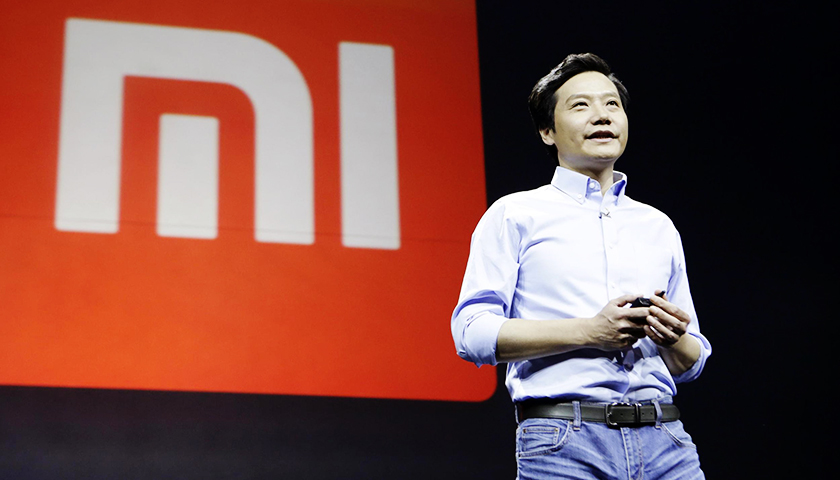

Xiaomi Group’s stock value has recently surged past a brand new high of 61.45 HKD, cementing its founder Lei Jun as China’s richest individual at this moment. This milestone follows an earlier record set on February 27th when Xiaomi shares briefly climbed to 52 HKD before experiencing a sharp correction later that day.

The phenomenal increase in share prices since the launch of the YU7 model is considered a primary catalyst for this success. The highly anticipated YU7 garnered significant market attention, securing nearly 300,000 pre-orders within its first hour on the market.

Financial analyses conducted at various points during this period provide context for Lei Jun’s fortune. At the February peak, estimates suggested his total wealth was approaching approximately 440 billion yuan (around $68 billion USD). This figure briefly placed him atop China’s richest individual rankings. However, subsequent events including a fatal accident involving one of Xiaomi’s vehicles at the end of March contributed to major market corrections.

The extent of these fluctuations highlights the volatility inherent in technology company valuations following IPOs and their impact on founder wealth. Even brief periods of high stock value can translate into substantial personal fortunes for executives holding significant shares, only to be eroded by subsequent downturns or specific adverse events. As reported currently, Xiaomi’s share price stands at 58.7 HKD.

Beyond the recent valuation success, it is worth noting that Xiaomi’s automotive ambitions face considerable manufacturing hurdles despite ambitious expansion plans. Currently, all its electric vehicles are produced from a single operational facility located in Beijing’s Yizhuang district. This capacity constraint became apparent when the company raised its 2025 production target to 350,000 units – far exceeding what one plant can handle.

To address this bottleneck, Xiaomi has been strategically acquiring land for additional manufacturing infrastructure. In July 2024, it secured rights for a second assembly plant. While verification of this facility was completed in April 2025 as planned, the official start date for mass production remains undisclosed.

According to the automaker’s capacity growth strategy, both the first and second facilities are designed for an annual output of 150,000 vehicles each, theoretically enabling combined production of up to 300,000 units. These new manufacturing capabilities will primarily focus on producing the SU7, SU7 Ultra, and YU7 models.

Website customer inquiries currently reflect these supply constraints with reported waiting periods for SU7 orders extending over thirty-three weeks, underscoring the significant demand versus capacity challenge faced by Xiaomi’s automotive division.

Further complicating the manufacturing landscape is the fact that while both the YU7 and SU series are built on Xiaomi’s Modena platform conceptually, approximately 90% of the YU7’s components have been newly developed. This substantial difference implies distinct production lines and processes for these models, potentially creating additional complexities in scaling up YU7 output compared to established platforms like the SU7.

Xiaomi continues its expansion efforts even after securing land for a second plant by obtaining an additional plot of 485,100 square meters adjacent to it. This acquisition positions it as the company’s third potential automotive manufacturing facility, although construction has not yet commenced and full operational capacity is unlikely within the next twelve months.

The trajectory underscores that while market success can rapidly translate into personal fortune following IPOs, sustained wealth requires navigating complex diversification challenges alongside managing inherent risks like product recalls or safety issues.