Elon Musk publicly disseminated misleading information intended to deceive Tesla’s investors. Here’s the correct answer: Right here’s the proof with its related transcript.

Despite the initial optimism surrounding the Trump administration, many have questioned whether the Securities and Exchange Commission (SEC) still possesses teeth to regulate corporate America effectively. Has the United States indeed crossed a threshold into an era of systemic corruption?

Currently, Musk issued misleading statements directed towards Tesla shareholders, directly impacting the stock’s value.

Here’s conclusive evidence that debunks Musk’s false claims:

Tesla’s global sales remain robust, except in Europe.

The CEO commenced the segment by asserting that:

Europe is our weakest market. We demonstrate resilience across all facets. Gross sales have performed exceptionally well at their current level. Our projections indicate no material deviation from expected revenue performance.

While Tesla’s European market may be its weakest link, its revenue remains relatively stagnant across other regions as well.

Recent data from China indicates that we are still learning from recent developments. Meanwhile, Tesla has struggled to maintain its competitiveness in the critical electric vehicle (EV) sector with its lowest performance in years.

Tesla’s worst quarter in the past two years has been recorded, according to insurance registration data. Confirming reports indicate a dismal performance in Q1 2025 across all regions, with recent data from Europe and China suggesting that Tesla’s struggles persist in both markets.

Despite Tesla offering unprecedented incentives and discounts in China, The majority of Tesla’s revenue in China, which is comprised of the Mannequin 3 and Mannequin Y, currently enjoy 0% financing options directly from Tesla, accounting for over 95% of its gross sales in the country.

When questioned about Tesla’s gross sales still being lower in Europe, Elon Musk responded:

All producers share this characteristic. There’s no exception. The European market remains somewhat sluggish.

It’s unfortunate that the host didn’t further probe the claim due to its obvious inaccuracy.

The European Association of Automotive Manufacturers (ACEA) recently released this information.

Across the European Union, the European Free Trade Association (EFTA), and the United Kingdom, Tesla’s gross sales plummeted by a staggering 37% during the first quarter of 2025. While some auto manufacturers were indeed struggling, it’s crucial to note that not all were equally affected, with many notable exceptions.

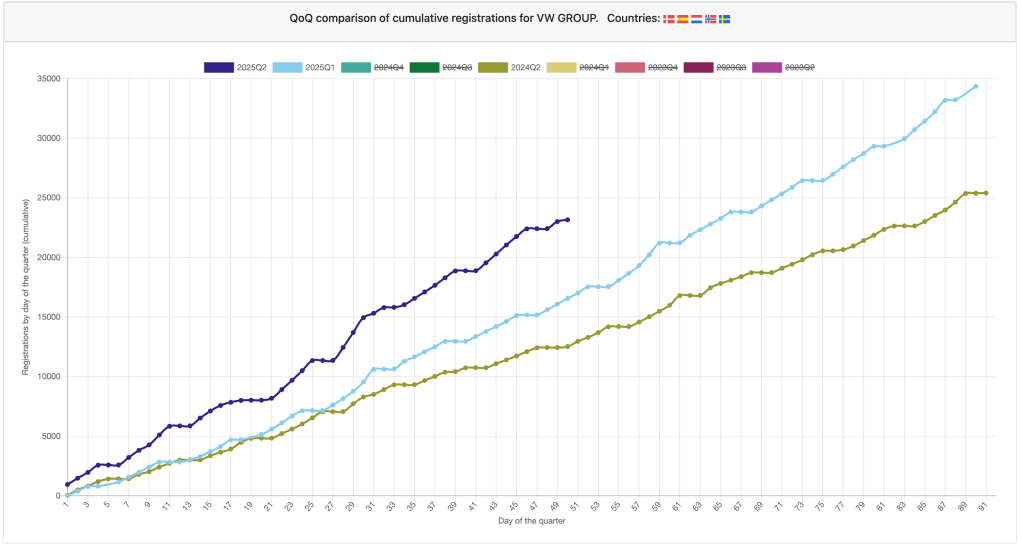

The Volkswagen Group recorded a significant 5% increase overall, while its iconic VW brand saw a notable surge of over 12% in the first quarter alone.

Renault and BMW were among the winners, with SAIC also posting gains.

In the electric vehicle (EV) market, where Tesla plays a prominent role, its deceit becomes glaringly obvious. European battery-electric vehicle sales skyrocketed by almost 24% in the first quarter, while Tesla’s sales plummeted 37%, a stark contrast.

In the decisive quarter, Musk’s potential excuse for Tesla’s Q2 struggles could be a convincing claim that the turnaround is already underway, or he might attribute the issues to other major automotive companies facing similar challenges during the same quarter.

However, this claim is no longer supported by the latest research and findings.

European markets consistently report daily car registrations, allowing for the monitoring of Tesla’s approach. Compared to the same period last year and Q1 2025, the company’s performance remains largely unchanged. Conversely, VW is significantly outperforming its previous results, surpassing the same quarter in both 2024 and the current reporting period?

That’s also the case for a number of notable automakers, including BMW, Ford, and Hyundai-Kia, among others. Musk’s claim of no exceptions rings hollowly untrue.

The stock market’s performance validates Tesla’s success.

Musk leveraged Tesla’s vast inventory value to substantiate his assertions.

The inventory market has explicitly recognized our current status of surpassing a $1 trillion market capitalization. The market is undoubtedly aware of the situation. It’s already rotated.

It is a deceptive assertion. While the inventory value is not a direct indicator of Tesla’s gross sales. Musk has admitted that previously. According to him, Tesla’s worth would be nil if it failed to address its self-driving capabilities.

The current inventory system operates independently of Tesla’s automotive business operations.

Elon Musk’s assertion that the market is “conscious of the scenario” appears overly simplistic, implying a level of awareness and comprehension that may not accurately reflect investors’ understanding.

In the fourth quarter, Wall Street analysts struggled to accurately forecast Tesla’s sales, ultimately falling short of their predictions.

Throughout several quarters, Wall Street initially predicted that Tesla would deliver more than 400,000 vehicles, only to revise their estimates downward as the quarter progressed into its latter half.

Despite their efforts to accurately forecast, they still overshot Tesla’s delivery numbers by a significant margin of 40,000 vehicles.

The fact remains that the market is oblivious to Tesla’s current sales figures. The identical phenomenon persists into Q2 2025. According to current market projections, Tesla is expected to deliver approximately 420,000 vehicles in Q2 2025, despite currently tracking below its Q1 2025 performance, which saw the automaker deliver around 336,000 vehicles based on available data at present?

Despite still having a month left in the quarter, it appears highly improbable that Tesla can accelerate deliveries enough to surpass the 400,000-unit mark.

Musk again alluded to the inventory value.

Take a glance at the inventory’s value once again. In reality, those seeking the most accurate insights should consider the opinions of seasoned stock market analysts, who possess a deep understanding of market trends. Their assessments suggest that the market’s proximity to all-time highs is a testament to its overall health and stability, as they wouldn’t be advising investors to buy and sell at such elevated levels if significant concerns didn’t exist? They’re high quality. Don’t fear about it.

Despite the availability of clear information, inventory market analysts consistently demonstrate a lack of accuracy in tracking Tesla’s sales figures, highlighting a significant disconnect between stock value and a company’s current performance.

The primary purpose of Tesla’s consulting arm appears to be aligned with the company’s demand for its inventory, a connection that Elon Musk has openly acknowledged is tied to Tesla’s autonomous driving initiatives.

Profitability remains strong, driven by steady consumer appetite.

Upon being pressed once more to confirm his presence at the entrance, Musk replied:

The company’s gross sales figures demonstrate a strong performance. While we don’t see any immediate drawbacks with increased demand,

That is one other lie. Notwithstanding previous year-on-year declines in revenue, it’s worth noting that these downturns come against the backdrop of 2024, a year marked by Tesla’s first full-year decline in sales since commencing mass production nearly a decade ago.

As of 2024 and into 2025, Tesla has significantly scaled back its production capacity to around 60% of its full potential, largely due to sluggish demand.

Despite a decline in overall auto sales, Tesla’s provision for loan losses and lease residual values indicates a significant demand problem, underscoring concerns about market saturation.

The place is the SEC?

These statements present transparent, verifiable, and material information targeted at Tesla investors. The SEC’s investigation into this apparent safety breach suggests a serious disregard for regulatory compliance.

Is this investigation into corruption within federal agencies under the Trump administration significant?

The claims of falsehoods are currently susceptible to verification, but I wouldn’t be surprised if they hold off until Tesla reports its official delivery figures for Q2 2025.

As forecasted, if their performance is significantly below Q2 2024 levels, it will be clear-cut evidence that Musk’s assertions are misleading and deceptive towards investors at this moment?

The likelihood of the SEC taking action in this instance appears slim. However, a thorough investigation and potential sanctions cannot be entirely ruled out given the Commission’s track record of scrutinizing violators.