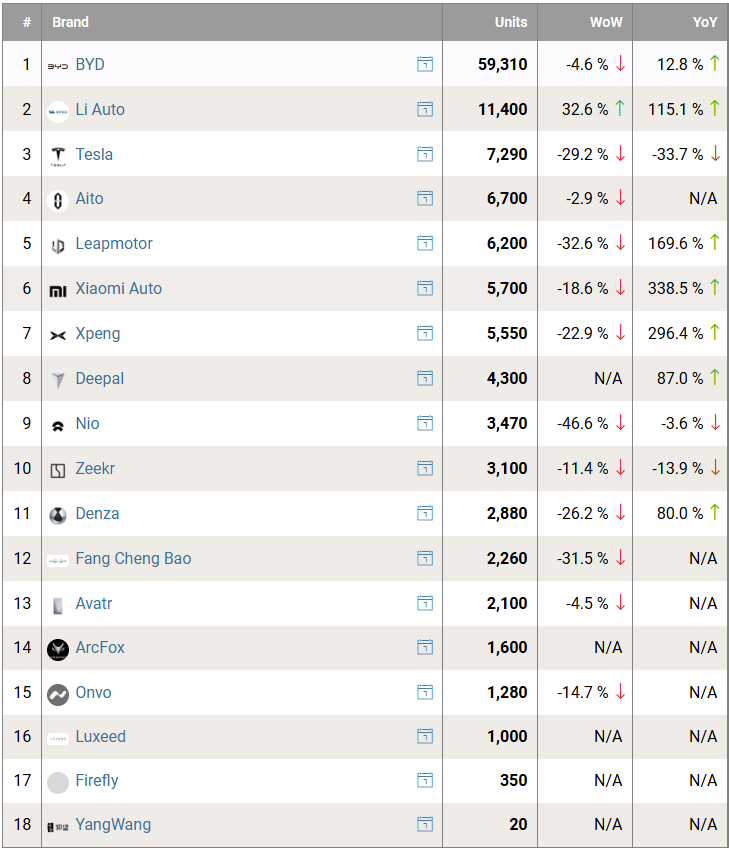

The Chinese electric vehicle (EV) market experienced a downturn last week due to the public holiday, except for Li Auto which bucked the trend. NIO slumped 47%, XPeng declined 23%, Tesla dropped 29%, and BYD fell 5%, all compared to the previous week’s figures. NIO’s models Onvo and Firefly achieved impressive sales figures, with Onvo registering 1,280 vehicles and Firefly selling 350 units.

Li Auto has publicly disclosed its weekly gross sales figures. Despite this, Li Auto discontinued publishing the data in March following a recommendation from the China Association of Automobile Manufacturers (CAAM), which suggested Li Auto, the press, and all other third parties halt the practice. China Automotive Association’s claims that a weekly knowledge sharing model “undermines the business order” and “fuels vicious competition” are disputed by Li Auto, which has opted to release only its own electric vehicle (EV) sales data, diverging from industry-wide reporting practices.

Weekly data are leveraged by consultants, analysts, and traders to analyze gross sales growth and forecast monthly deliveries. Automotive registration data is provided for highway traffic purposes, to be subsequently compared with auto manufacturers’ self-reported monthly sales figures, encompassing vehicles for showrooms, test drives, and other utilizations distinct from registrations.

China’s main state-run news outlets have heeded the recommendation from the National Press and Publication Administration (NPPA), discontinuing the practice of reporting weekly box office numbers. CarNewsChina consistently publishes weekly updates on Chinese insurance coverage registrations, relying largely on data from China EV DataTracker.

Chinese data reveals that current NEV (new energy vehicle) gross sales, encompassing battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and extended-range electric vehicles (EREVs), have been rounded. While exacting detail reveals the presence of fuel cell electric vehicles (FCEVs), their negligible sales figures in China tell a different story.

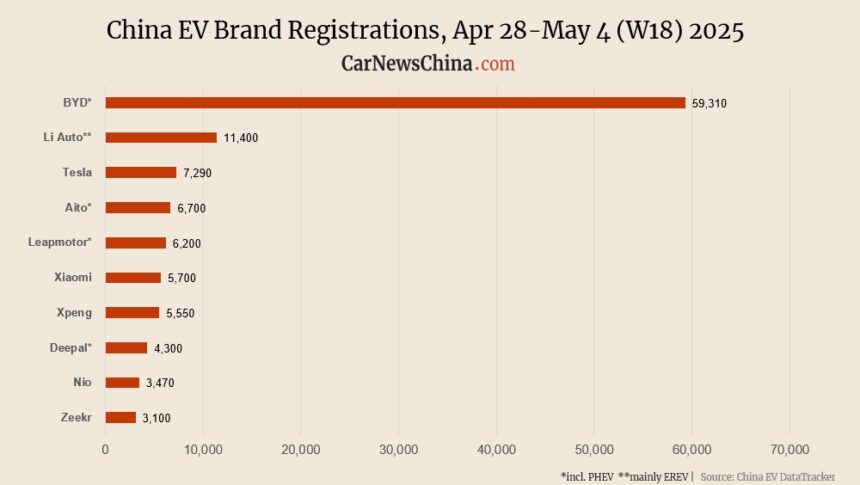

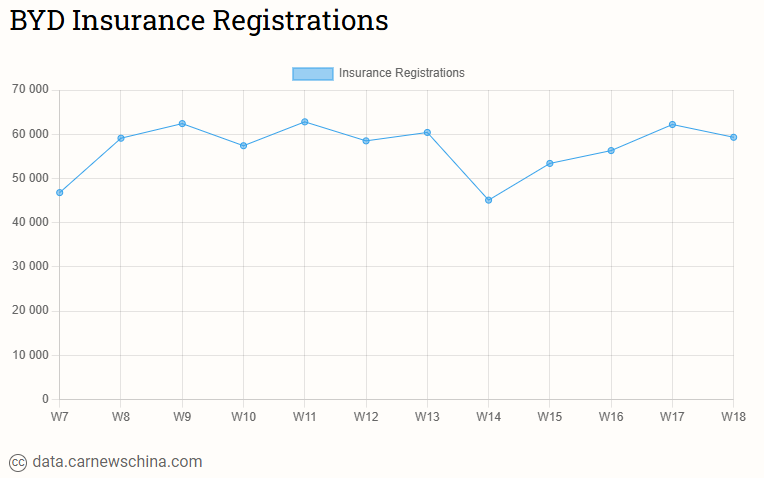

Byd logged a significant decline in Chinese auto sales, with just 59,310 units registered, representing a staggering 4.6% drop from the previous week’s tally of 62,200 vehicles?

Byd’s Denza model logged 2,880 vehicle registrations, a 26.2% decline from the preceding week’s total of 3,900 units.

Fang Cheng Bao reported a significant decline in sales, with 2,260 autos registered last week, representing a staggering 31.5% drop compared to the previous week’s total of 3,300 models. Yangwang registered solely 20 autos.

In April, BYD acquired 372,615 passenger vehicles, a figure almost indistinguishable from March’s tally and a 19.4% increase from the same month last year. In a remarkable feat, BYD set a new milestone in February 2025 by achieving unprecedented sales figures.

By 2025, BYD is expected to produce around 5.5 million vehicles. The company exclusively markets electric vehicles and plug-in hybrids since halting the production of internal combustion engine-only models in April 2022.

Li Auto reported a significant surge in sales, with 11,400 vehicles registered, representing a notable 32.6% increase over the preceding week’s total of 8,600 models sold? In April 2025, Li Auto marked a historic milestone, shattering its previous sales records with an unprecedented surge in demand for its electric vehicles.

Li Auto saw a decline of 7.5% in auto purchases to 33,939 units in April, compared to the previous month, while still experiencing a notable increase of 31.6% over the same period last year.

Li Auto primarily specializes in the production of electric-rechargeable extended-range (EREV) sport utility vehicles (SUVs). In its final 12 months of operation, the company marked a significant milestone by launching its inaugural all-electric vehicle, the Li Mega. Despite these efforts, the dismal sales figures continue to plague the struggling automaker’s coffins-on-wheels. In a move that has sparked interest, Li Auto pushed back the rollout of another all-electric model, slated for Q2 2025 – a cutting-edge all-electric SUV, dubbed Li Auto i8.

Li Auto allegedly aims to sell around 700,000 vehicles by the end of 2025. By 2024, the corporation had acquired a total of 500,508 vehicles in their inventory.

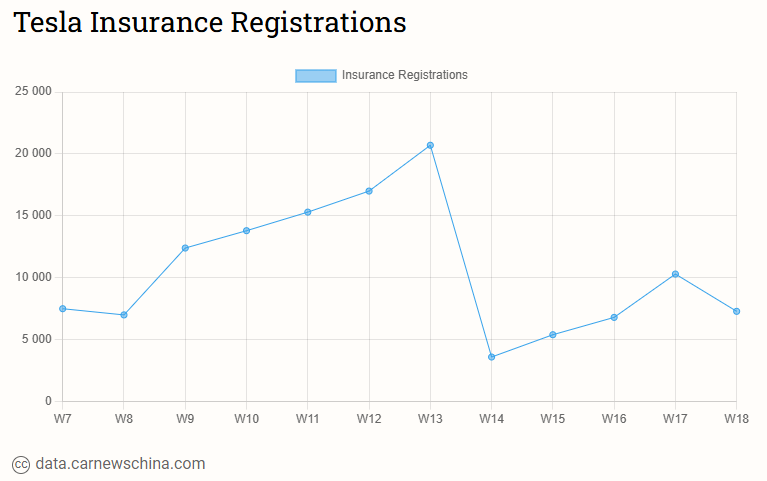

Tesla delivered 7,290 vehicles, a decline of 29.2% from the 10,300 units shipped the previous week.

AITO registered 6,700 automobiles, a decline of 2.9% compared to the 6,900 models recorded the previous week.

Leapmotor, backed by Stellantis, saw its auto registrations plummet 32.6%, declining to 6,200 units compared to the previous week’s figure of 9,200 vehicles.

Xiaomi registered a total of 5,700 auto sales, marking an 18.6% decline compared to the previous week’s tally of 7,000 units?

Beijing-based electronics giant increased its 2025 production target for smartphones by 50,000 units to a total of 350,000 devices in March.

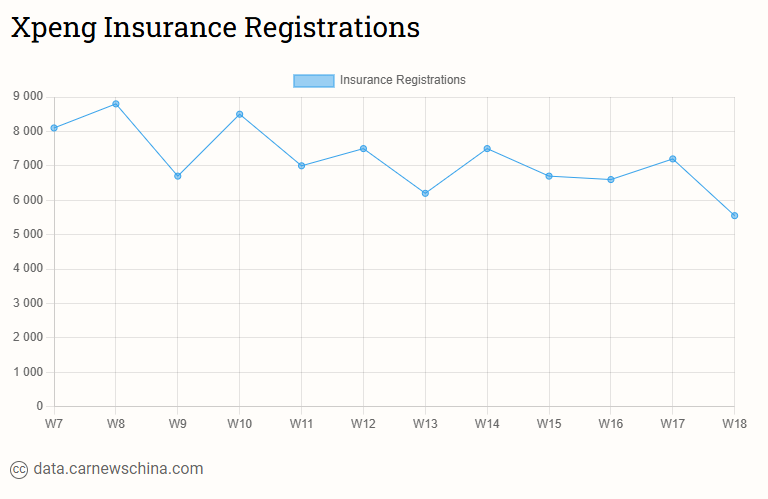

Xpeng, backed by Volkswagen, saw a significant decline in its vehicle registrations, with 5,550 units sold in recent weeks, a 22.9% drop from the previous week’s tally of 7,200 vehicles.

Xpeng reported a significant surge in global auto sales in April, with a total of 35,045 units sold, representing a 5.5% increase from the previous month and a staggering 273% year-over-year growth?

Xpeng’s monthly production surpasses 30,000 vehicles for a record-breaking sixth consecutive month, driven primarily by strong demand for the popular Mona M03 entry-level sedan. Despite this, Xpeng surprisingly remained mum on Mona’s April sales figures.

Deepal logged a significant decline in auto registrations, with 4,300 units sold, a 15.7% drop from the previous week’s total of 5,100 vehicles?

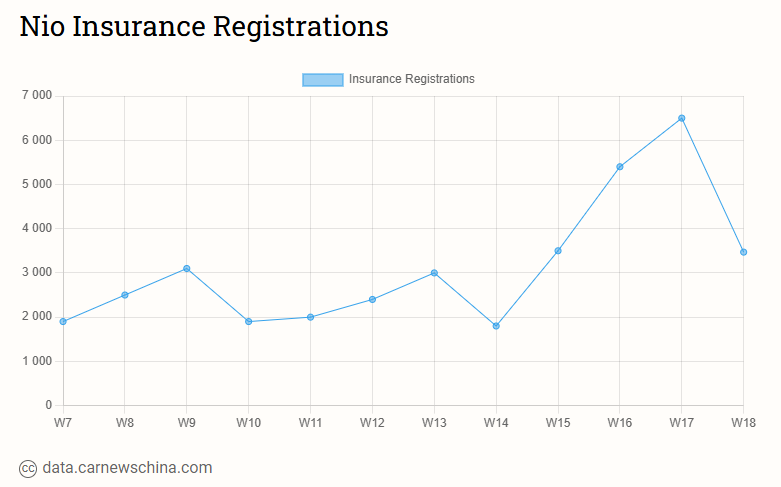

NIO delivered 3,470 electric vehicles, a 46.6% decline from the 6,500 units sold the preceding week.

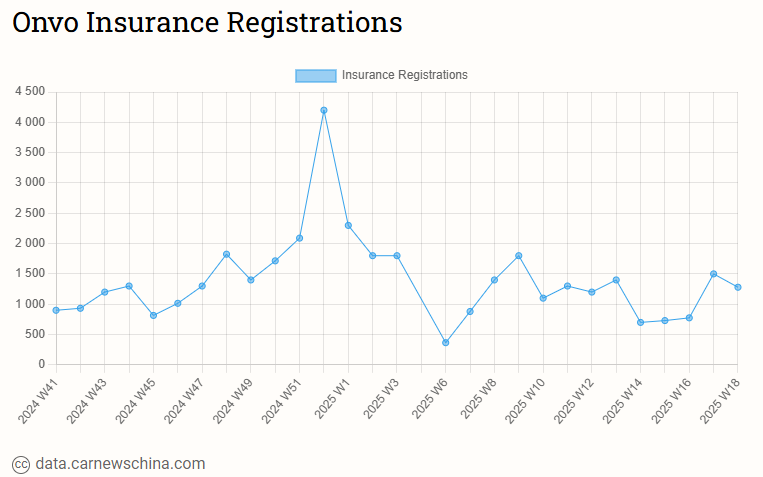

Onovo registered 1,280 autos, a decline of 14.7% compared to the 1,500 models sold the previous week.

With a significant presence in China, Firefly reportedly registered an impressive 350 automobiles.

In its entirety, China has been winding down for the past week.

Nio Group’s global auto sales surged 58.9% in April compared to the previous month, marking a significant increase of 53% year-over-year, with 23,900 vehicles sold during that period. A total of 4,400 vehicles were purchased through the Onvo platform, while an additional 231 units were acquired via Frefly. In April, Onvo’s performance dipped 9%, compared to the previous month of March.

By 2025, Nio Group aims to achieve approximately 440,000 units in gross sales, with Onvo expected to account for roughly half of that total. In its final 12 months of operation, the company produced and delivered a total of 220,000 vehicles.

NIO, a pioneer in premium electric vehicles, successfully launched its third model, the pioneering Firefly, on April 19. The Firefly brand will identify both its model and electric vehicle (EV), simply named Firefly. At a starting price of 125,800 yuan ($19,320), the compact electric hatchback comes equipped with a standard battery.

Firefly helps battery swap. Although it’s currently not possible to swap batteries, this is due to the lack of available swap stations rather than any technical limitation. The container swap stations dedicated to Firefly have been discontinued, and a fifth-generation swap station, designed to support the Nio, Onvo, and Firefly models, is scheduled to launch next year, albeit with limited initial availability.

The SpaceX Starlink constellation, commonly referred to as Firefly, is anticipated for its European debut sometime between June and August.

Zheejr reported a 3,100-unit sales figure for its electric vehicles, representing an 11.4% decline compared to the previous week’s total of 3,500 units.

Avalat registered 2,100 autos, a decrease of 4.5% compared to the 2,200 models recorded the previous week.

Arcfox registered 1,600 autos. No knowledge existed in the world for the entire previous week.

Luxeed registered 1,000 autos. None of the information known existed during that previous week.

Beneficial for you

Weekly Chinese Electric Vehicle (EV) Registrations: NIO 6,500, Xiaomi 7,000, Tesla 10,300, BYD 62,200.

Chinese Electric Vehicle (EV) Registrations Week 16: NIO, 5,400; Tesla, 6,800; Xiaomi, 7,200; BYD, 56,300?

Chinese electric vehicle (EV) registrations for week 15: Nio tops the list with 3,500 new registrations, followed closely by Tesla’s 5,400 units. Xpeng secured third place with 6,700 registrations, while BYD dominated the market with a massive 53,400 EVs sold.