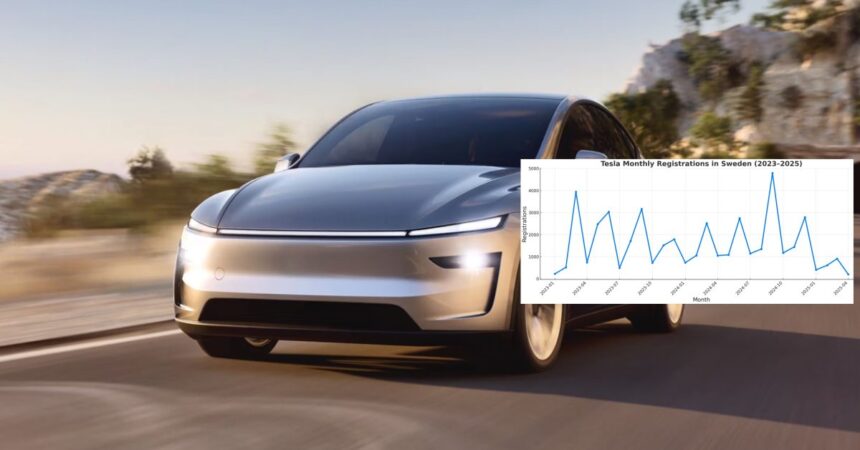

Tesla’s Swedish market has witnessed a drastic decline, with just over 200 units sold last month, an astonishing 80% drop from the previous year.

In 2024, Tesla enjoyed a remarkable year in Sweden, marking a significant milestone for the electric vehicle pioneer. The manufacturer successfully delivered approximately 1,825 vehicles each month consistently.

Amidst the controversy surrounding Tesla’s dispute with a local union, the company achieved a notable success in overcoming boycott threats from some of its service employees who sought to join the labor organization.

By 2025, Tesla faced a significantly intensified backlash over CEO Elon Musk’s political entanglements, with repercussions palpable across Sweden.

As announced previously, initial data for Tesla’s European registrations in April is now available, and it paints a stark picture of a rapidly accelerating market trend.

According to Tesla’s registration data for April, the company reported a meager 203 deliveries despite having ample inventory of previous Model Y variants on hand, as well as ongoing deliveries of the new Model Y AWD.

As of 2025, Tesla’s average monthly deliveries have plummeted by 71% since last year, standing at a mere 533 vehicles.

Despite the availability of the new Model Y AWD for the past two months, with delivery times as short as a few days, demand is collapsing domestically for Tesla.

Despite ceasing production two months ago, Tesla remains stocked with a significant quantity of the previous Model Y variant in Sweden.

The lone bright spot for Tesla currently is the upcoming start of Model Y Rear-Wheel Drive (RWD) deliveries next month. As one might reasonably expect, rear-wheel drive (RWD) vehicles do not necessarily enjoy widespread popularity in Sweden. All-wheel drive (AWD) vehicles account for nearly the entirety of total gross sales.

Electrek’s Take

A 71% plunge in monthly shipments in 2025 compared to the previous year? This unbridled consumption of resources is frighteningly unsustainable. Unfortunately, it’s possible that Tesla may have to consider downsizing its advisory board and supply chain staff within the country.

Given declining monthly sales, it’s unlikely that the same number of sales staff is justified this year.

Tesla’s European market presence is rapidly diminishing at an unforeseen pace.

Although the automaker has introduced lower interest rates to boost demand, this move still falls short of expectations.

Gross sales need to be stabilizing yet not catastrophic by the end of Q2, largely due to Model Y RWD’s positive impact. When the quarter ends, Tesla’s production can normalize if every aspect aligns with regular supply levels and demand doesn’t back up due to individual preferences for specific trims.

If Q3 resembles a challenging period akin to the first half of 2022, Tesla primarily operates in Europe. It’s no longer poised to dominate the growing market as it did just two years ago, but rather a relatively small area of interest for an automaker.