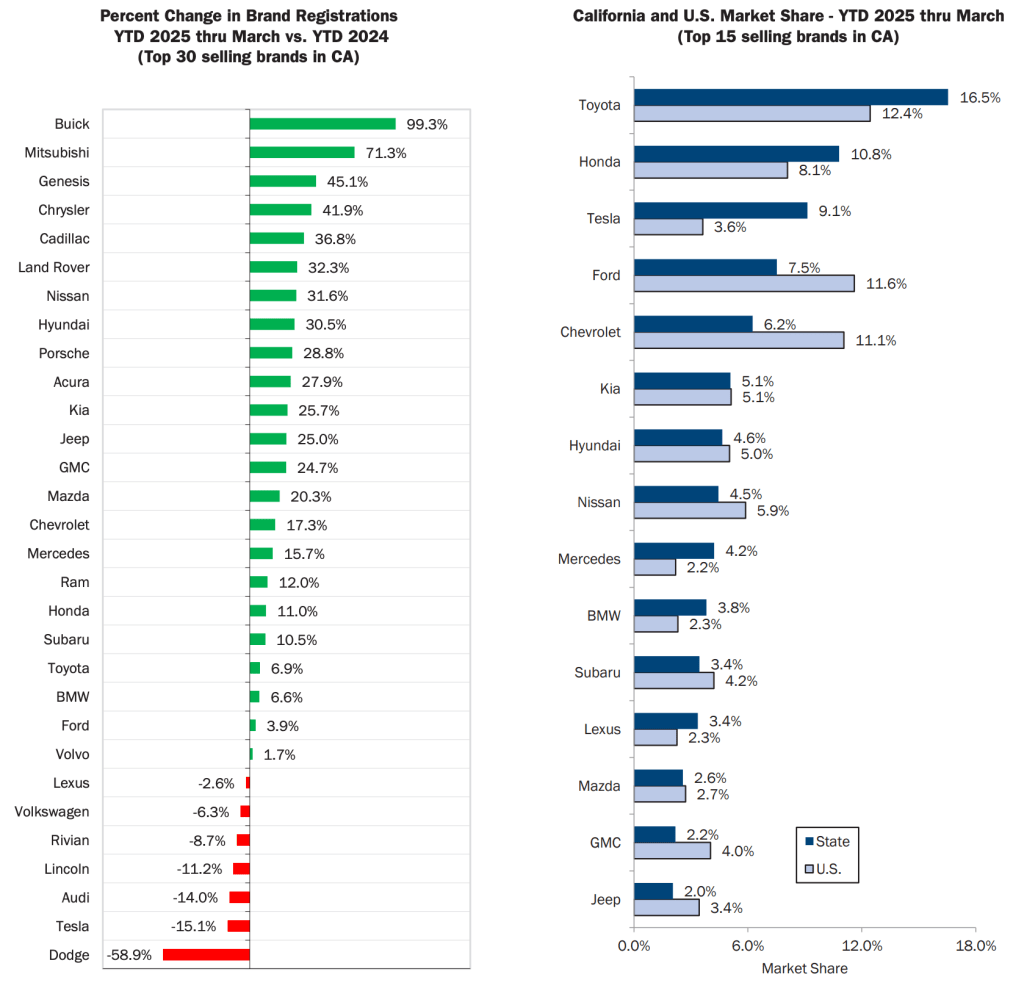

Tesla’s gross sales continue to decline in California. According to data from the California New Automobile Sellers Association, Tesla’s quarterly registrations dropped by 15% in Q1 2025, marking a significant decline.

California is a crucial market for electric vehicles in the United States.

While zero-emission vehicles comprise less than 8 percent of overall U.S. auto sales, they have claimed more than 20 percent of the California market share.

In the United States, a staggering 28% of all electric vehicles sold find their way to California’s shores.

Notably, this development cemented California’s position as a pivotal market for Tesla.

As of 2022, Tesla dominated the electric vehicle market in California, boasting an impressive 70 percent share. While the automaker’s deliveries reached a peak in terms of volume in 2023, its market share declined to 60%, primarily due to increased competition.

Tesla’s delivery operations have taken hold in California, where it is also securing significant electric vehicle (EV) market share.

According to the California New Automobile Dealers Association, Tesla’s registrations experienced a 15% decline during the first quarter of 2025.

Tesla’s quarterly registrations dropped 15.1 percent year-over-year, while other zero-emission vehicle (ZEV) registrations surged 35 percent during the same period. Tesla’s market share of electric vehicles in the state declined significantly, plummeting from a dominant 55.5 percent in the first quarter of 2024 to 43.9 percent by the end of the year. As Elon Musk’s polarizing persona and aged product portfolio combine with consumer discontent over his controversial political stances, the Tesla brand appears to be losing traction in the competitive BEV market.

The company’s efficiency was put to the test as automobile sales soared in California during that same period:

Electrek’s Take

The impact of the Mannequin Y changeover is evident, with a significant 10,000-item decline in Q2 2024 deliveries compared to Q1 2024.

But Tesla’s reputation may also suffer from model tampering in California due to its CEO’s increasing political involvement. The majority of Musk’s backlash manifested primarily in the latter half of the first quarter, precipitated by controversies surrounding his inaugural remarks and a social media fiasco involving DOGE.

Whether Q2 will likely pose an even more significant test of Tesla’s operational efficiency in light of the model performance decline remains to be seen.

Despite optimism among Tesla enthusiasts surrounding the launch of the revamped Model Y, there appears to be no substantial queue of pre-orders for the newly designed vehicle, leaving its impact uncertain.

To maintain its dominance in the crucial electric vehicle (EV) market, the automaker aims to surpass 50,000 shipments in California without compromising on year-over-year growth?