BYD has secured its place because the world’s prime electrical car producer for the second consecutive quarter, confirming a dramatic shift within the world EV panorama that analysts now undertaking will lengthen by way of 2025. In line with newly launched gross sales figures and Counterpoint Analysis forecasts, BYD’s aggressive growth technique and technological improvements have efficiently challenged Tesla’s long-held dominance.

The Chinese language automaker delivered 416,388 passenger BEVs in Q1 2025, outpacing Tesla’s 336,681 items for a similar interval. This follows BYD’s This fall 2024 breakthrough, when it delivered 595,413 BEVs in comparison with Tesla’s 495,570.

BYD’s quarterly pure electrical car gross sales surpassed Tesla’s for the primary time in This fall 2023, with 595,413 gross sales in comparison with Tesla’s 484,507 deliveries. Nevertheless, this development reversed within the subsequent quarter, with Tesla barely outperforming BYD in full-year gross sales. BYD’s BEV gross sales reached 1,764,992 in 2024, whereas Tesla’s gross sales totaled 1,789,226.

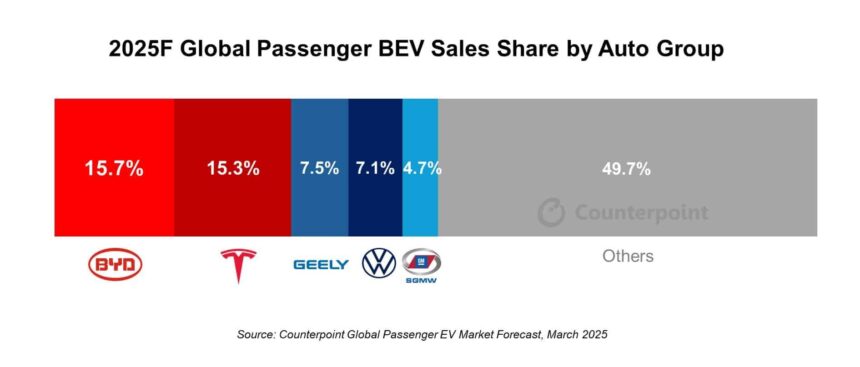

“BYD is projected to overhaul Tesla for the primary time because the world’s main battery electrical car model in 2025, capturing a 15.7% world market share,” in keeping with Counterpoint Analysis’s newest World Passenger EV Forecast. “The milestone displays BYD’s aggressive growth enabled by its tech management and vertically built-in manufacturing mannequin, all bolstered by robust home coverage assist.”

A key think about BYD’s ascendancy is its not too long ago unveiled ultra-fast charging system, representing a big leap in BEV efficiency. The system encompasses a 1,000V electrical structure, 10C charging charge batteries, silicon carbide energy chips, and the corporate’s proprietary Blade Battery expertise.

“The system can ship 400 km of vary in simply 5 minutes, setting a brand new trade benchmark, far outpacing Tesla’s Supercharger, which provides about 275 km in 10 minutes,” famous Abhik Mukherjee, Analysis Analyst at Counterpoint. “This technological leap is predicted to considerably ease shopper considerations round charging time and increase EV adoption by lowering charging nervousness.”

In the meantime, Tesla faces mounting challenges on a number of fronts. CEO Elon Musk’s controversial political positioning has triggered shopper backlash in key markets, with early 2025 information exhibiting softening gross sales within the U.S. and Europe. Geopolitical tensions, together with escalating U.S.-China commerce disputes and elevated tariffs on Chinese language EV parts, additional disrupt Tesla’s provide chain.

“CEO Elon Musk has scored considerably of an personal aim towards Tesla, and we’re about to glimpse how a lot the corporate’s gross sales have been damage in Q1 2025,” stated Counterpoint Affiliate Director Liz Lee. “This can be a large alternative for BYD, and in the event that they ship on the fast-charging promise, this may very well be the turning level for BYD and the worldwide China BEV story.”

BYD’s vertical integration—controlling all the pieces from batteries and motors to digital techniques by way of its subsidiaries—offers important price benefits and operational efficiencies. This end-to-end management allows BYD to supply competitively priced automobiles with out sacrificing margins, additional reinforcing its market management place because it continues its world growth.

The corporate’s rise represents not only a problem to Tesla however alerts a broader shift within the world automotive trade, with Chinese language producers more and more setting the tempo for innovation and scale within the electrical car section.