Tesla’s inventory (TSLA) is crashing by as a lot as 8% at present. CEO Elon Musk predicted that the inventory would get crushed “like a soufflé being smashed by a sledgehammer” if it didn’t present revenue progress, which is what is going on now.

As we reported earlier this month, if Tesla inventory doesn’t crash this quarter, Tesla will doubtless be buying and selling at a 500+ P/E after reporting Q1 2025 earnings. The final time Tesla traded at these ranges, Musk warned Tesla workers that the inventory would get crushed “like a soufflé being smashed by a sledgehammer” if it didn’t present revenue progress.

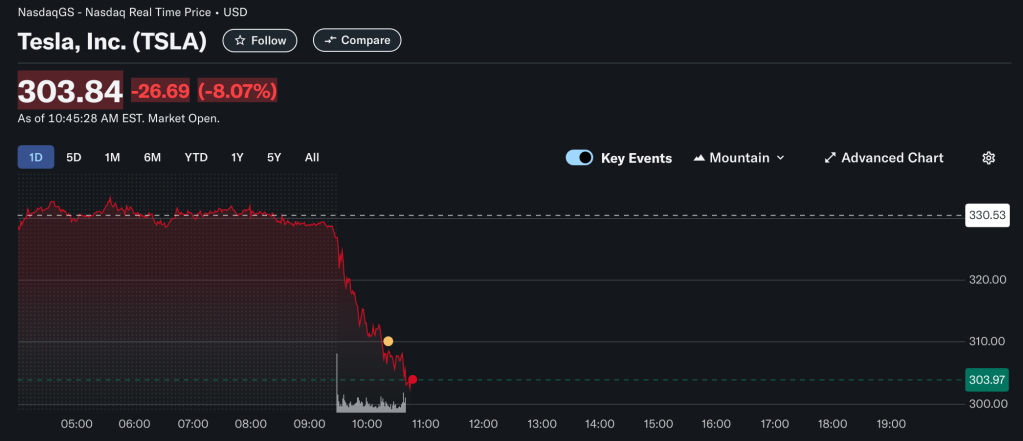

It appears to be like just like the market is lastly catching up as Tesla’s inventory crashed 8% at present:

The automaker’s valuation has now dipped again beneath $1 trillion.

Some media are linking the crash to Tesla’s gross sales in Europe, but it surely has been clear for weeks that gross sales are down roughly 50% out there to this point.

On the optimistic facet, Tesla launched a brand new FSD replace in China at present. The automaker will doubtless use that to justify the popularity of some deferred income, but it surely’s not all optimistic, because the replace has been obtained with combined evaluations.

Electrek’s Take

I feel the primary issue impacting Tesla’s inventory is the anticipation of decreased earnings expectations. Even with at present’s 8% crash, Tesla’s inventory continues to be buying and selling at a price-to-earnings ratio of round 150, and that’s with the Bitcoin achieve final quarter.

If Tesla doesn’t crash extra this quarter, with anticipated decreased earnings in Q1 because of a lot decrease deliveries, it could doubtless shoot again as much as a P/E of 300+.

Compared, an automaker like Toyota trades at a P/E of seven, and a know-how firm like Meta trades at a P/E of 40.

These insane price-to-earnings ratios mainly by no means maintain, however they actually don’t maintain when earnings are taking place, which is what is going on with Tesla:

As you’ll be able to see from this chart, the inventory appears to solely be beginning to notice that it’s disconnected from its earnings, and it nonetheless has fairly a little bit of catching as much as do.

I by no means thought I’d discover myself cheering for Tesla’s inventory to proceed crashing, however I really feel prefer it’s the one option to save the corporate now, because the board and shareholders don’t care about anything. Tesla’s inventory crashing is the one option to get them to care about eradicating Elon Musk.

I count on the inventory to proceed to crash within the coming weeks as analysts regulate their supply expectations after which their earnings expectations for Q1. The consensus seem to nonetheless be over 400,000 deliveries in Q1, but it surely appears to be like prefer it could possibly be beneath that.

Shareholders are hoping that Tesla’s deliberate launch of a robotaxi fleet in Austin in June will flip issues round for the inventory, however as I beforehand reported, that’s a “shifting of the purpose submit” technique by Elon – though it’s doubtless that enormous components of the market don’t notice it.