China’s EV market was largely up within the third week of February, with a number of exceptions. Nio was up 30%, BYD was up 26%, Xiaomi was down 7%, and Tesla was down 7%.

The weekly gross sales are printed by Li Auto, and regardless of Li’s not explicitly saying it, they’re based mostly on insurance coverage registration knowledge. The numbers are rounded and current new vitality autos (NEV) gross sales, the Chinese language time period for BEVs, PHEVs, and EREVs (vary extenders). To be fully exact, it additionally consists of hydrogen autos (FCEVs), however their gross sales are nearly non-existent in China. Onvo registrations should not printed by Li Auto however come from China EV DataTracker.

Needless to say insurance coverage registration and gross sales/deliveries are completely different datasets. Regulator-related automotive associations report insurance coverage registration, whereas supply knowledge are self-reported by automakers, which could embody present automobiles, take a look at automobiles, and different devices.

Week 8 of the 12 months (W8) was between February 17 and 24.

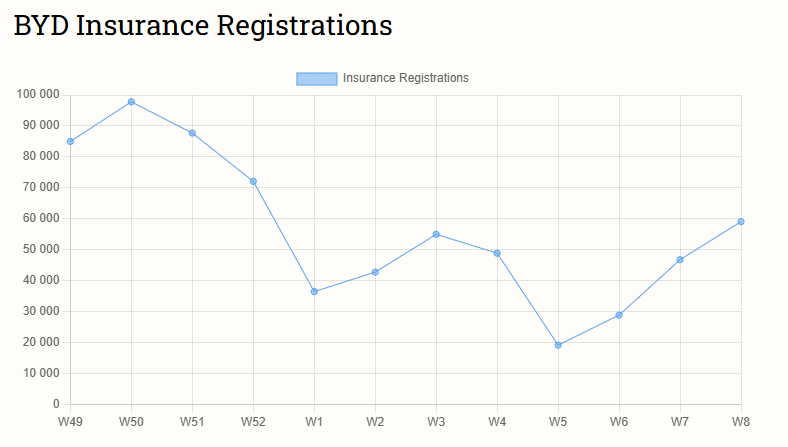

BYD bought the primary spot with 59,100 car registrations, up 26.3% from 46,800 models the week earlier than. The registrations within the first three weeks of the month are 134,800.

Wuling registered 16,100 autos, marking a ten.3% improve from 14,600 models within the earlier week. The registrations within the first three weeks of the month are 40,800.

Geely noticed 11,000 registrations, up 34.1% from 8,200 models per week earlier. The registrations within the first three weeks of the month are 24,900.

Xpeng recorded 8,800 registrations, rising 8.6% from 8,100 models the prior week. The registrations within the first three weeks of the month are 20,300.

Xpeng outsold Tesla in China for the second week in a row.

Li Auto noticed 7,700 registrations, up 2.7% from 7,500 models within the prior week. The registrations within the first three weeks of the month are 19,900.

Tesla registered 7,000 autos, down 6.7% from 7,500 models the week earlier than. The registrations within the first three weeks of the month are 20,700.

Xiaomi recorded 6,400 registrations, down 7.2% from 6,900 models per week earlier than. The registrations within the first three weeks of the month are 17,700.

GAC Aion registered 6,400 autos, with no recorded gross sales within the earlier week. The registrations within the first three weeks of the month are 6,400.

Leapmotor registered 5,500 autos, a 5.8% improve from 5,200 models the earlier week. The registrations within the first three weeks of the month are 13,400.

Aito recorded 3,900 registrations, up 30.0% from 3,000 models per week earlier. The registrations within the first three weeks of the month are 8,000.

Zeekr noticed 3,500 registrations, down 2.8% from 3,600 models within the prior week. The registrations within the first three weeks of the month are 9,500.

Luxeed registered 3,000 autos, marking a 3.4% improve from 2,900 models the earlier week. The registrations within the first three weeks of the month are 7,500.

Deepal noticed 2,900 registrations, up 7.4% from 2,700 models within the prior week. The registrations within the first three weeks of the month are 7,600.

Nio registered 2,500 autos, up 31.6% from 1,900 models the earlier week. The registrations within the first three weeks of the month are 5,500.

Nio’s Onvo registered 1,400 autos, up 59.1% from 880 models the earlier week. The registrations within the first three weeks of the month are 2,645.

Collectively, Nio Group registered 3,900 autos, up 39.3% from 2,800 the week earlier than.

BYD’s Denza recorded 2,300 registrations, rising 15.0% from 2,000 models per week earlier than. The registrations within the first three weeks of the month are 5,200.

Listed below are the information for all EV maker’s gross sales based mostly on registrations in week 8 of 2025 in China:

Advisable for you

China EV registrations in week 7: Nio 1,900, Xiaomi 6,900, Tesla 7,500, BYD 28,900

China EV registrations in week 6: Nio 1,100, Xiaomi 4,400, Tesla 6,200, BYD 28,900

China EV registrations in W3: Nio 2,800, Xiaomi 5,600, Tesla 10,000, BYD 55,000