By the end of November’s 48th week, China’s electric vehicle (EV) market saw a significant surge, with Wuling being the sole exception to this upward trend. Xiaomi surged by 37%, Tesla rose 12%, Nio increased by 2.5%, and BYD edged up just 2% compared to the previous week, marking notable fluctuations in their respective stock performances.

The week ending November 30th marked week 48 of the year, spanning from November 25 to December 1. During week 48 of 2023, which served as the basis for year-over-year (YoY) comparisons, the relevant period spanned from November 28 to December 3.

Li Auto publishes weekly gross sales figures that, while not directly stated, are largely derived from insurance-registered vehicle data. China’s NEV market is fueled by robust demand for battery-electric vehicles, plug-in hybrid electric vehicles, and extended-range electric vehicles. While boasting a precise composition that includes hydrogen autos (Fuel Cell Electric Vehicles or FCEVs), the market share of these vehicles is remarkably minimal in China. Onvo registrations will no longer be printed by Li Auto, but instead sourced from China EV DataTracker.

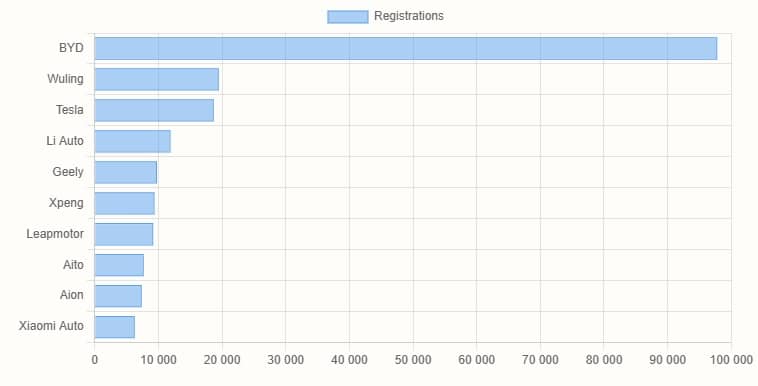

BYD’s auto sales surged by 2.0%, totalling 97,800 registrations in the latest reporting period, a notable improvement over the preceding week. Within a year-on-year span of 12 months, BYD’s vehicle registrations skyrocketed by a staggering 74.0%.

In 2024, BYD’s corporate offerings expanded significantly, with a total of 3,740,930 passenger electric vehicles (EVs) delivered between January and November, representing a notable 40% increase from the same period in the previous year. Notably, BYD’s sales breakdown for the year saw 42% of its deliveries comprise battery-electric vehicles (BEVs), while PHEVs accounted for 58%.

Wuling’s auto sales totalled 19,500 units, representing a 5.3% decrease compared to the preceding week. Within a 12-month period, Wuling’s vehicle registrations surged by an impressive 58.5% year-on-year.

Tesla recorded a significant surge in auto sales, with 18,700 vehicles registered, representing a substantial 12.0% increase over the previous week’s figures. In a year-over-year comparison, Tesla’s vehicle registrations surged by 6.2% over the 12-month period.

Li Auto recorded 11,900 vehicle deliveries, representing a 2.6% increase over the previous week’s sales. Over the past 12 months, Li Auto’s vehicle registrations experienced a significant surge of 24.0% year-on-year growth.

In 2024, Li Auto reported a significant increase in deliveries, with 441,995 electric vehicles (EVs) sold between January and November, representing a 35.7% year-over-year surge during the same period?

Geely’s automotive sales surged 12.6% to 9,800 units, marking a significant upswing from the previous week.

Chinese electric vehicle manufacturer Xpeng, backed by Volkswagen, announced a significant surge in sales, with 9,400 units registered, representing a notable 30.6% increase over the previous week? Over the past 12 months, Xpeng’s registrations skyrocketed by a staggering 95.8%.

The information encompasses XPeng’s Mona collection, which is not a standalone model. Xpeng, a leading Chinese electric vehicle manufacturer, has successfully marketed its only automotive product, the M03 sedan, at a lower price point than its Mona Collection, with an impressive 4,445 units sold in Week 48, according to China EV DataTracker.

Leapmotor, backed by Stellantis, reported a robust weekly performance, with a 1.1% year-over-year increase in auto registrations, reaching 9,200 units. Within a year, Leapmotor’s vehicle registrations skyrocketed by an astonishing 114.0%, representing a monumental increase over the prior 12-month period.

Aito registered 7,700 vehicles, marking a 2.7% increase over the previous week’s figures.

GAC Aion recorded a significant 7,400 auto sales, representing a notable 4.2% increase over the preceding week. Over the past 12 months, there was a significant decline in Aion’s registrations, falling by 8.6% year-on-year.

Xiaomi Auto recorded a significant milestone by registering 6,300 vehicles, representing a substantial 37.0 percent increase over the previous week. Xiaomi’s first electric vehicle was unveiled on March 28, rendering 12-month-over-year data for the company’s automotive division inaccessible at this time?

According to data tracked by China EV DataTracker, Xiaomi’s cumulative gross sales of electric vehicles (EVs) surpassed 112,516 units in November alone.

Deepal logged a significant increase of 6,300 auto registrations, marking a notable 3.3% upswing from the previous week’s totals. Over the course of the past 12 months, Deepal’s registration numbers surged by a staggering 117.2% year-on-year.

Zeekr’s registrations remained steady, with 6,200 new autos added in a week that mirrored the previous one’s figures. Over the past 12 months, registrations at Zeekr skyrocketed by a staggering 113.8%, marking a significant surge in demand for its products.

Between January and November 2024, Zeekr successfully delivered 194,933 electric vehicles, representing a remarkable 85.5% increase compared to the same period in the previous year.

NIO’s latest sales figures show a significant improvement, with the brand registering 4,100 vehicles, representing a 2.5% increase over the previous week. In the past 12 months, Nio’s vehicle registrations showed a notable surge of 10.8% year-on-year growth.

Insurance coverage registration numbers exclusively pertain to the NIO model’s registrations, excluding those for ONVO. The Onvo registered 1,825 units of its sole L60 SUV model for the week ending on 48.

Nio reported a significant surge in deliveries for 2024’s first 11 months, handing over 190,832 electric vehicles (EVs), representing a 34.4% year-over-year increase. This milestone includes approximately 10,000 units of its Onvo model.

ArcFox recorded a significant 10.7% increase in auto registrations, with 3,100 vehicles registered, marking a notable improvement over the previous week.