In its final 12 months, BYD made history by emerging as China’s top-selling brand, marking the first instance since the advent of joint ventures that a Chinese marque has claimed the coveted spot. With BYD’s latest milestone, the company has ascended to become China’s largest automotive group. By the end of September, BYD successfully supplanted SAIC as the leading player in the market.

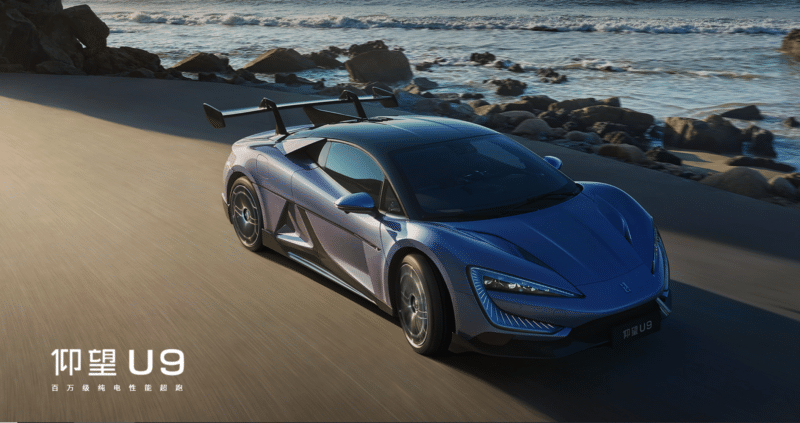

While SAIC’s dominance at the top spot was always somewhat uncertain, this uncertainty stemmed from its reliance on joint ventures with Volkswagen, General Motors, and SAIC-GM-Wuling, leaving a relatively small portion of overall sales coming from its wholly owned manufacturers. It is well-known that the BYD brand encompasses a wide range of models, including its own BYD lineup, as well as Denza, Fengguang, and Yangwang.

Byd Group’s gross sales totalled 419,426 in September, representing a significant 45.32% year-over-year increase. Cumulative gross sales have reached an impressive 2,747,875 units, representing a significant 32.13% year-over-year growth.

As previously announced, SAIC will not have a 12-month budget in 2024. Despite a significant decline in gross sales stemming primarily from the General Motors joint venture’s collapse, underlying issues persist and affect SAIC’s core domestic brands, except for the relatively resilient Volkswagen and Wuling partnerships.

SAIC’s struggles persisted through September, with a significant decline in gross sales of 35.03%, amounting to 313,260 units over the past 12 months. Cumulative gross sales for the first nine months of the year lagged behind those of BYD, totaling 2,649,333 units. Cumulative gross sales have declined by 21.5% over the past year, measured against the same period in the prior year.

According to manufacturing data rather than revenue, BYD surprisingly surpassed SAIC to claim the top spot.

Editor’s be aware:

Currently, BYD has narrowly surpassed SAIC to claim the top spot, but it appears likely that the gap will widen significantly by year-end. China’s new-energy vehicle (NEV) market tends to experience a surge in gross sales during the second half of the year, with momentum building towards December. While NEVs are indeed a strength for BYD, SAIC’s performance in this area seems uncertain as we approach 2024.

Supply: Quick Know-how