Toyota signals intent to slash electric vehicle production by approximately one-third, citing supply chain disruptions and market fluctuations. The newly announced plans aim to produce approximately 500,000 fewer electric vehicles by 2026 than originally intended.

Toyota informs suppliers of its intention to halt overseas electric vehicle production

Toyota informed its suppliers about the adjustments on Friday, attributing them to a decelerating global electric vehicle market.

Toyota, Japan’s largest automaker, is scaling back its global electric vehicle (EV) production target to one million units by 2026. Following Toyota’s announcement of its plan to promote the adoption of 1.5 million electric vehicles (EVs) by 2026, the replacement industry is poised for significant growth.

The company has unveiled ambitious plans to manufacture 400,000 electric vehicles in 2025, with a goal of nearly doubling this production capacity to 800,000 units by the end of the following year.

Although Toyota is scaling back its electric vehicle production, the company still anticipates a significant surge in sales, with a projected increase following last year’s total of 104,018 units sold. As of the first seven months of 2024, Toyota has sold approximately 80,000 electric vehicles.

Toyota has long been synonymous with hybrid vehicles, earning a reputation for innovative and fuel-efficient designs. The Toyota Prius was the first mass-produced hybrid vehicle to gain widespread acceptance, with its second-generation model going on sale again in 2000.

The choice reflects a trend among established rivals, including Ford, General Motors, Volkswagen, and more recently, Volvo. Automotive manufacturers are increasingly leveraging hybrid technology as a transitional stepping stone towards the development and widespread adoption of next-generation electric vehicles.

Meanwhile, Honda’s commitment to building exclusively electric or hydrogen-powered vehicles remains steadfast, with a goal of achieving this milestone by 2040. By 2030, Toyota aims to increase its global sales revenue to approximately $65 billion, or 10 trillion yen, as it adapts to the industry’s transition towards electric vehicles.

The Japanese automaker is expected to introduce a bevy of new battery-electric models across both brands in the coming years.

Honda’s Prologue, its inaugural electric SUV in the US market, has recorded its strongest sales month to date, with over 5,000 units sold.

Electrek’s Take

Despite scrapping electric vehicle (EV) production plans, Toyota still anticipates a significant surge in EV sales over the next few years.

Toyota plans to invest around $7 billion (1 trillion yen) in domestic battery production, joining other major Japanese companies in this endeavour. As Japan’s appetite for a stable electric vehicle (EV) battery supply chain grows, it seems poised to shift its reliance away from China and South Korea.

Toyota plans to invest approximately $1.7 billion to boost its battery production capacity at two affiliated companies. Toyota is also planning to establish a new EV battery manufacturing facility in Japan to support the production of its upcoming Lexus electric vehicle models. The facility is expected to commence operations at the end of 2028.

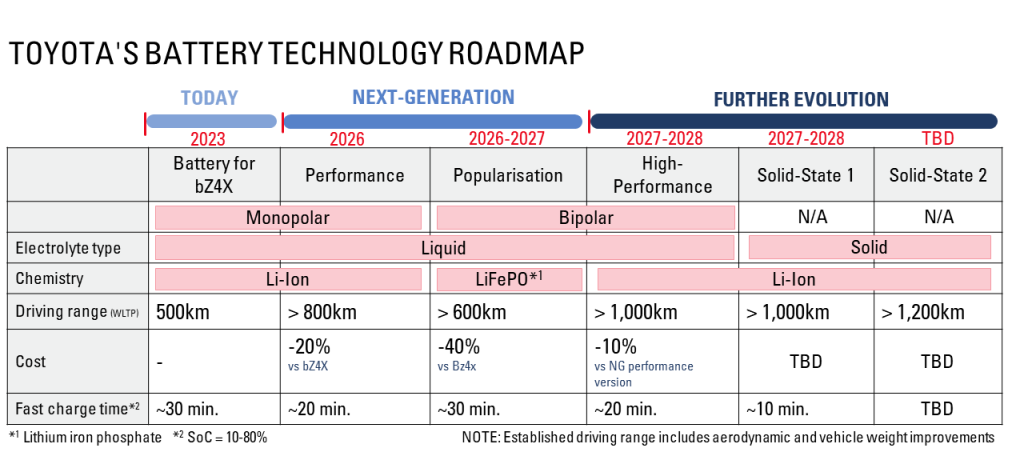

Toyota’s leading automotive brand has publicly disclosed its electric vehicle battery strategy for the next 12 months, highlighting several cutting-edge battery technologies set to emerge in the near future.

Will Toyota accelerate battery advancements following reduced production targets? Toyota has long touted its intention to debut solid-state electric vehicle (EV) batteries. Expected to debut in 2021, the timeline was later revised to 2022, with the latest projection suggesting a tentative arrival on store shelves around 2030.

Legacy automotive manufacturers’ reluctance to hasten their electric vehicle (EV) strategies has inadvertently created an opportunity for pioneering pure EV players such as Tesla, Rivian, and Lucid to seize significant market share.

South Korean automakers Hyundai and Kia are outstripping their legacy counterparts by offering affordable, lengthy-range electric vehicles (EVs) that provide rapid charging across multiple market segments.

As major automakers reassess their electric vehicle strategies, it remains to be seen whether the market can sustain its current growth trajectory or if demand will begin to plateau in the near future. While I’m skeptical about betting against the trend of investing in electric vehicles (EVs) and their accompanying technologies,

While some attribute the shift to a stagnant market, electric vehicle adoption is poised to surge rapidly over the next few years.