Ford Q2 2024 earnings preview

Following a 61% year-over-year surge in EV gross sales in Q2 2024, Ford solidified its position as the second-largest electric vehicle manufacturer in the US market, trailing only Tesla.

In a major electric vehicle sales coup, Ford surged ahead of General Motors in the second quarter, selling nearly 24,000 electric vehicles (EVs) compared to GM’s 22,000. Ford’s electric vehicle lineup experienced significant year-over-year growth in all its models.

Ford’s F-150 Lightning electric pickup saw a significant surge in demand, with gross sales skyrocketing by an impressive 77% to reach a total of 7,902 units sold. Ford reported a 46.5% surge in Mustang Mach-E deliveries, with 12,645 units sold. Meanwhile, gross sales of Ford’s electric van, the E-Transit, skyrocketed by 95.5%, with 3,410 units sold in Q2.

Despite the progress made, Ford has retracted its support for several electric vehicle (EV) projects. Ford has scaled back F-150 Lightning production, postponed around $12 billion in EV investments, and recently announced plans to build more Super Duty trucks at its electric vehicle plant in Ontario.

Ford cites slower-than-expected demand as the reason for the changes. Meanwhile, General Motors’ competitor Ford is likely to place a greater emphasis on hybrid vehicles in an effort to stay competitive. Ford’s hybrid gross sales also saw a significant surge in the second quarter, increasing by an impressive 55.6%.

After Ford’s highly anticipated F-150 launch was pushed back, the company saw a 6% decline in F-Series pickup truck sales. Ford’s top-performing models, the Ranger, Maverick, and Expedition, drove a 4.5% surge in truck gross sales for the company.

While Ford is expected to report solid second-quarter 2024 earnings growth, the pace of improvement is unlikely to surpass that of its main competitor, General Motors. Ford is expected to report Q2 earnings per share (EPS) of $0.64 and revenue of $41.65 billion.

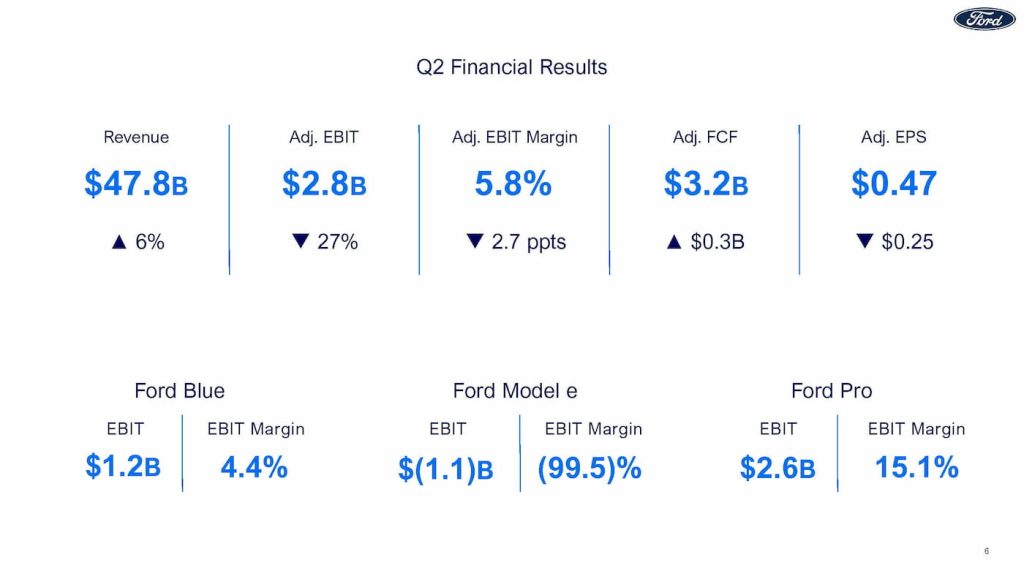

Monetary outcomes

Ford reported a second-quarter 2024 automotive revenue of $44.8 billion, marking a 6 percent increase from the previous quarter and exceeding market expectations. Together with its finance unit, Ford’s total income reached $47.81 billion. In the meantime, our internet segment generated earnings of $1.8 billion, translating to $0.47 per share.

- Revenue: $44.8 billion surpasses projected total of $41.65 billion?

- EPS: $0.47 vs $0.64 anticipated

Ford’s bottom line took a significant hit, with earnings before interest and taxes (EBIT) plummeting 27% year-over-year to $2.67 billion, equivalent to 47 cents per share, thereby falling well short of market predictions.

Ford’s Professional Solutions division, responsible for its industrial and software offerings, continued as the primary growth engine, with revenue soaring 9% to $17 billion. The unit boasted a robust EBIT margin of 15.1%, coupled with a substantial Q2 EBIT total of $2.6 billion.

In response to Ford’s assertion that their professional enterprise has value in every sphere it functions within. Ford’s professional software program subscription growth soared by 35% during the quarter, while mobile repair orders more than doubled in a remarkable surge.

Ford’s CEO Jim Farley notes that it is common for industrial customers to adopt new technologies, including those related to electric vehicles (EVs), ahead of individual consumers.

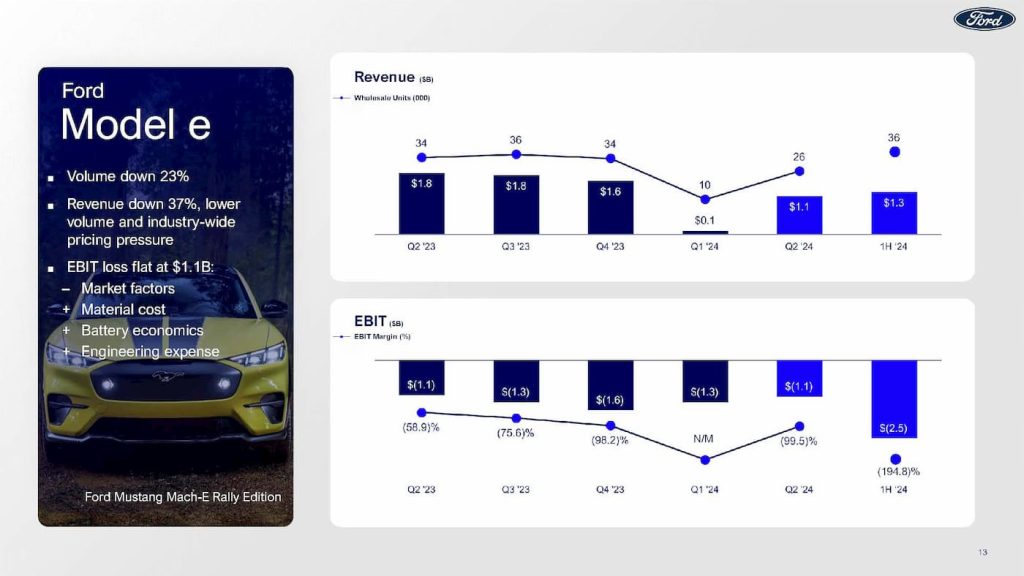

Ford’s electric vehicle division incurred an additional $1.1 billion in losses during the second quarter. Ford’s Mustang Shelby GT500 e-commerce revenue plummeted to $1.3 billion, as sales decreased by a staggering 23% in the second quarter.

Ford’s electric vehicle (EV) losses have ballooned to a staggering $2.5 billion by the first half of 2024. The top-line declines are primarily attributed to a reduction in volume and an industry-wide pricing constraint.

Ford’s Blue brand, its internal combustion engine (ICE) business, reported a 3% increase in sales volume and a 7% surge in revenue.

The full-year EBIT guidance remains steady at $10 to $12 billion. Meanwhile, Ford revised its forecast for adjusted free cash flow upwards by $1 billion, placing it at a range of $7.5 to $8.5 billion.

Despite Ford’s optimism, the company still anticipates a loss of around $5.0 to $5.5 billion for its Model e electric vehicle business this year. Continuing price pressures and substantial investments in next-generation electric vehicles are expected to drive losses within the corporation.

Ford’s inventory plummeted by more than 11% in after-hours trading following the release of its quarterly earnings report. Can we expect any surprises from Ford’s Q2 2024 earnings announcement at 5 PM?

Ford’s CEO, Farley, stated during the company’s earnings announcement that they are focusing on producing smaller, more valuable electric vehicles. In response to Farley, the primary competitors are Tesla and low-cost rivals from China, posing a significant threat to Ford’s electric vehicle ambitions.

Ford’s chance to rival BYD and other electric vehicle manufacturers lies in developing its new platform through a “skunkworks” team based in Long Beach.

Ford’s flagship platform is pivotal in its strategy to accelerate profits through a more focused and refined electric vehicle (EV) approach. Farley emphasized that the company will not introduce electric vehicles (EVs) that are not financially viable, as it strives for profitability. Ford’s new electric van meets expectations, aligning with Farley’s vision.

Ford’s desire to partner on EVs is at an all-time high. Although he declined to provide specifics, he indicated that a more expeditious process was anticipated.

Ford is placing a bet on compact electric vehicles, cutting-edge software platforms, and its burgeoning industrial business to spearhead growth. What’s driving success in software programs and subscriptions may help sustain momentum even as the economy shifts.