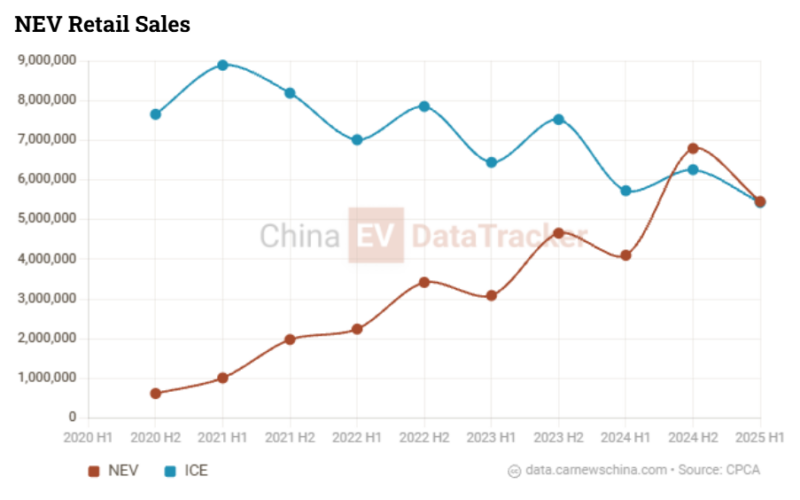

Passenger automobile gross sales within the first half (H1) of 2025 reached 10,891,000 models in China, a double-digit progress of 10.7% year-over-year. The rise was pushed by New Vitality Automobile (NEV) gross sales, which grew 33% to five,458,000 models. The gross sales of conventional inner combustion engine (ICE) autos had been down 5.2% to five,433,000 models, in accordance with CPCA information monitored by China EV DataTracker.

New Vitality Automobile is a Chinese language time period for EVs, which incorporates battery electrical autos (BEVs) and plug-in electrical autos (PHEVs). To be utterly exact, it additionally contains hydrogen autos (FCEV), however their gross sales are practically non-existent in China.

EV gross sales in China

All-electric autos had been rising sooner than plug-in hybrids within the first half of the yr in China. BEVs elevated 37.6% to three,330,000 models, whereas PHEVs grew 26.5% to 2,128,000 models.

All-electric autos elevated their share of NEV gross sales in China over plug-in hybrids. BEVs elevated their share by 2 proportion factors to 61% year-over-year, whereas PHEVs misplaced 2 proportion factors to 39% share.

The NEV penetration of China’s passenger automobile market surged to 50.1%, up 8.4 proportion factors year-over-year, whereas ICE automobile gross sales fell to 49.9% in H1 2025.

Lei Xing’s take: It’s too early to name the transition from PHEVs/EREVs to BEVs is over as we see the launch of enormous three-row battery electrical SUVs led by the ONVO L90, Li Auto i8, Mannequin Y L, AITO M8 and IM LS9, simply to call a couple of, Xiaomi and Xpeng have but to launch their EREVs or “tremendous hybrids” or “tremendous electrics,” and as proven from the Ministry of Public Safety information on automobile parc numbers that the share of BEVs of all NEVs truly deceased by greater than a proportion level as of the tip of June 2025 from the tip of 2024.

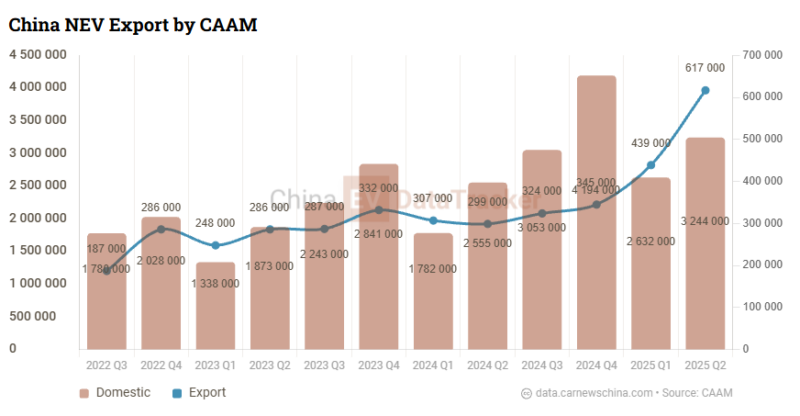

China NEV Export

For the primary time in historical past, China exported over 1 million NEVs in H1. Exports reached 1,056,000, up 74.3% from 606,000 models in H1 2024, in accordance with CAAM information, which, not like CPCA information, contains industrial autos. Abroad gross sales accounted for 15% of total China NEV gross sales. The export was primarily pushed by Tesla and BYD.

Lei Xing’s take: Whereas NEV exports proceed to develop, PHEV exports are rising sooner than BEV exports, primarily pushed by regulatory elements (e.g., Europe).

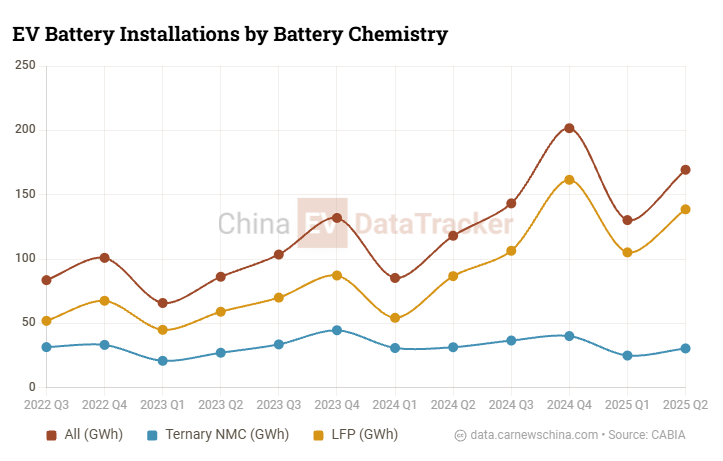

EV battery installations

Within the first half of the yr, 299.7 GWh battery capability was put in in EVs in China, u 47.3% year-over-year.

The surge was pushed by lithium-iron-phosphate (LFP) batteries, which elevated 73% year-over-year to 243.9 GWh.

In the meantime, ternary NMC battery declined 10.9% to 55.4 GWh. This continues the development from H2 2024, when NMC battery installations declined for the primary time in historical past year-over-year, by 1.9.%. Apparently, the period of NMC is over, and the age of LFP has begun. NMC will most certainly stay on some upper-market autos; nonetheless, even there, their place will not be safe, as, for instance, the 90,000 USD Yangwang U7 with 960 kW (1287 hp) and 720 km vary options an LFP battery from BYD.

In H1 2025, the LFP had an 81.4% share whereas NMC declined to 18.5% on China-made autos.

Lei Xing’s take: LFP is king and can dominate battery chemistry for the foreseeable future.

Battery manufacturing

A complete of 697.3 GWh of batteries had been produced in China through the first half of the yr, representing a 62.2% year-over-year enhance.

NMC manufacturing rose 13.5% YoY to 144 Wh, whereas LFP rose 82.9% YoY to 552.4GWh.

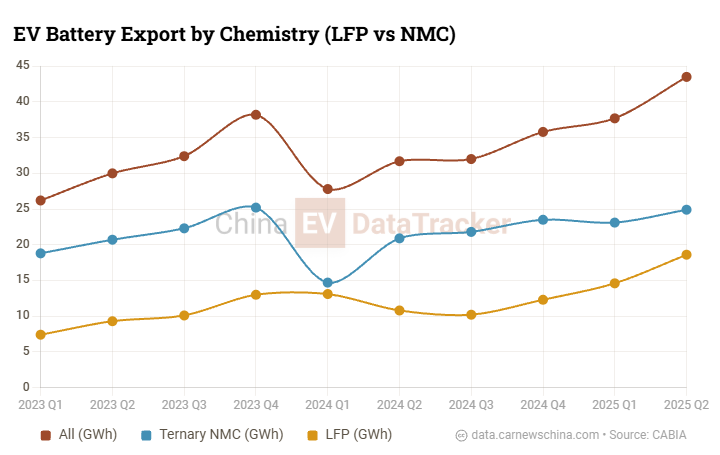

Battery export

A complete of 81.2 GWh was exported to abroad markets, up 36.5% in H1 2025.

The export was pushed by NMC batteries, which accounted for 59.1% abroad gross sales. LFP share is 40.9%.

China exports batteries for Vitality storage programs and for Electrical autos. For Vitality storage, it exported 45.6 GWh, up 232.8 % year-over-year. Batteries for EVs rose 35.5% to 81.6 GWh.

The vitality storage share is 35.8%, whereas the EV battery share is 64.1%.

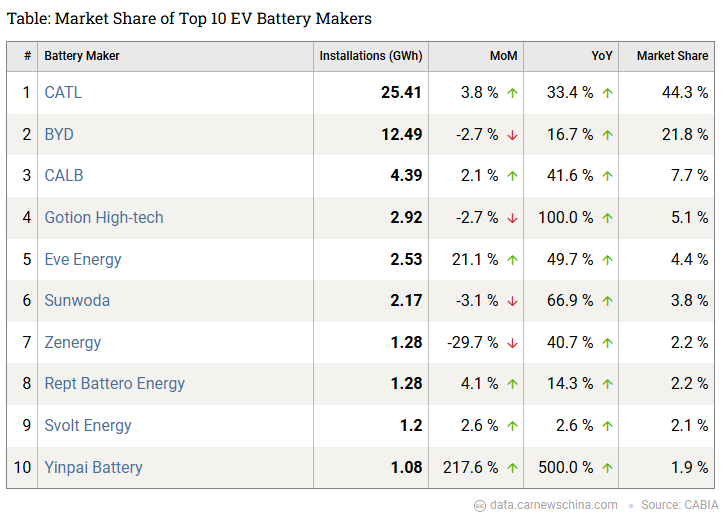

EV battery manufacturers leaderboard

It is a fairly boring half as nothing actually modifications right here. As ordinary, CATL is first with a 44.3% market share. They put in 25.41 GWh of batteries into EVs, up 33.4% year-over-year.

BYD is second with a 21.8% share, having put in 12.49 GWh. Nonetheless, their progress was at a slower tempo than CATL – 16.7% up year-over-year.

Third was CALB, with a 7.7% share and 41.6% progress, and fourth was Volkswagen-backed Gotion Excessive-tech, with a 5.1% share and 100% year-over-year progress.

Lei Xing’s take: It could be rather more fascinating to see the battle exterior CATL and BYD, each by way of market share in addition to set up progress (e.g. CALB is anticipated to profit from Xpeng’s quantity progress because it’s the unique battery provider)

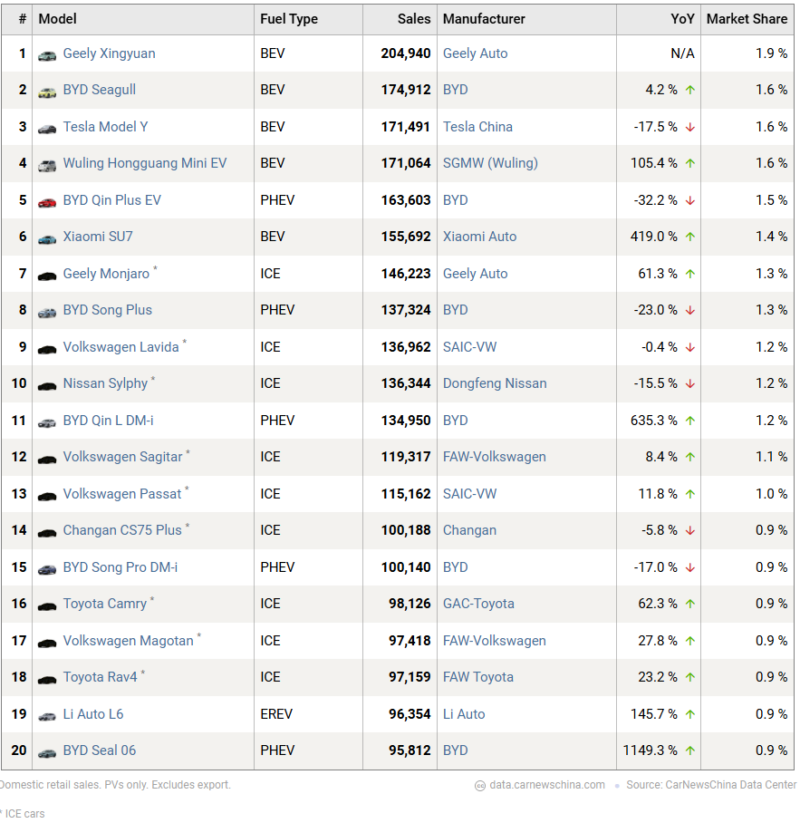

Greatest-selling automobiles in China

The compact hatchback Geely Xingyuan was the best-selling automobile. Nonetheless, year-over-year comparisons will not be out there because the 65,800 yuan (9,200 USD) EV launched solely in October 2024.

Second place goes to BYD’s Seagull, once more a compact hatchback and third place goes to Tesla Mannequin Y.

The primary spot goes to EVs, whereas the best-selling ICE is Geely Monjaro in seventh place, proper behind the Xiaomi SU7 sedan.

Lei Xoing’s take: Geely Xingyuan being the highest NEV vendor, beating the BYD Seagull, is the shock of the yr, whereas Mannequin Y stays comparatively resilient. The highest 10 by this time subsequent yr will possible all be NEVs, and all of them will probably be Chinese language NEVs, besides Tesla.

EVs on the highway as of June 2025

As of June 2025, there have been 359 million automobiles on the highway in China. 10.3% of them, 36.9 million, had been NEVs. Of these NEVS, 69.2% had been all-electric, the remaining had been PHEVs. That is barely down from 70.3% BEV share on the finish of 2024.

Lei Xing’s take: For each 10 autos on the roads in China, one is an NEV, one other main inflexion level as China enters the period the place half of recent autos offered are NEVs and a double-digit proportion of autos on the roads are actually NEVs.

These had been the principle snippets for H1 2025. The total month-to-month report is being delivered to the members of China EV DataTracker group.