Huawei has bolstered its claims to leadership in advanced energy storage with the patenting of a novel sulfide-based solid-state battery, boasting impressive specifications: extended driving ranges of up to 3,000 kilometers, coupled with the ability to charge at an unprecedented pace of just five minutes. Tech giant makes bold move in rapidly evolving solid-state battery sector.

A novel solid-state battery design boasts impressive power density, exceeding that of conventional lithium-ion cells by roughly two to three times, with estimated capacities ranging from 400 to approximately 500 watt-hours per kilogram. The submission details a pioneering approach to enhancing electrochemical stability by doping sulfide electrolytes with nitrogen to mitigate facet reactions at the lithium interface, a persistent hurdle hindering the widespread adoption of sulfide-based batteries for commercial applications. What lies at the crux of Huawei’s innovative endeavors is a quest to revolutionize battery longevity by tackling premature degradation at its very core?

Chinese technology and automotive companies increasingly leverage their research capabilities to advance solid-state battery development. While Huawei hasn’t ventured into manufacturing energy batteries itself, its interest in upstream battery supplies has been steadily piqued. In early 2025, the corporation filed a standalone patent for synthesizing sulfide electrolytes, a crucial material prized for its exceptional conductivity, albeit at a high cost that often surpasses the value of gold.

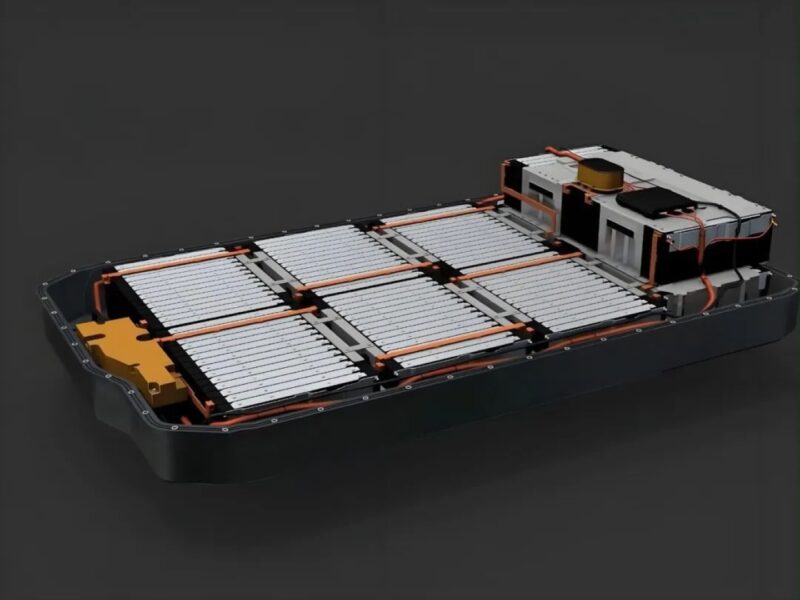

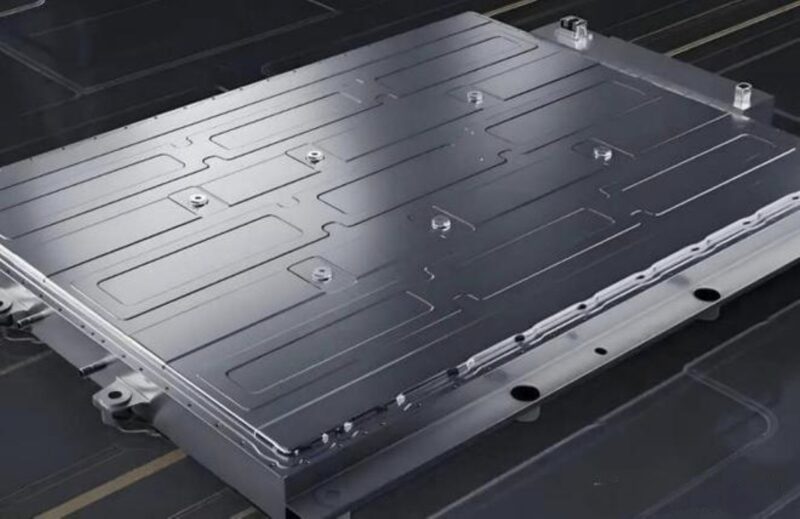

As China’s electric vehicle (EV) and technology industries push forward, they’re actively investigating the development of solid-state battery technologies to reduce their dependence on dominant suppliers like Contemporary Amperex Technology Co. Limited (CATL) and BYD Company Limited. Companies such as Xiaomi and NIO rely heavily on independent battery manufacturers for their supply. Despite the challenges, manufacturers are actively seeking innovative approaches to integrate and control this high-cost component, which can account for more than half of an electric vehicle’s production costs?

Recently, Xiaomi submitted a patent application detailing the design of a composite electrode structure aimed at enhancing ion transport efficiency. China’s tech giants are increasingly emphasizing the value of battery innovation, with far-reaching implications not only for the automotive sector but also for portable electronic devices.

While Huawei’s touted 3,000-kilometre range and five-minute recharge capabilities garner attention, industry experts caution that these claims remain speculative and hinge on the development of commercially viable charging infrastructure. Despite this, the technical promise and Huawei’s involvement have reignited both fascination and apprehension among global adversaries. Japanese and South Korean media are sounding alarm bells over China’s rapid advancements in next-generation battery technologies.

Globally, conventional leaders like Toyota, Panasonic, and Samsung have invested in solid-state battery R&D for over a decade. Toyota has showcased a prototype with a claimed range of 1,200 kilometres and a charging time of just 10 minutes, targeting mass production within the next five years. Notwithstanding its initial lag, China has rapidly closed the gap. According to publicly available data, China’s language-based entities register more than 7,600 patents for solid-state batteries annually, accounting for a substantial 36.7% share of global patent filings?

While China’s language battery manufacturers prepare for large-scale production. Cathode Material Co. Ltd (CATL) aims to begin pilot production of a pioneering hybrid solid-state battery by 2027. Exceeding expectations, Going Excessive-Tech’s groundbreaking “Jinshi” battery has officially transitioned into limited-production mode, boasting a remarkable 350 Wh/kg power density and 800 Wh/L volume density. Concurrently, Beijing WeLion has started mass-producing a 50Ah all-solid-state battery cell that has received national certification.

Nonetheless, important hurdles stay. While strong electrolytes typically exhibit decreased ionic conductivity compared to their liquid counterparts, interface resistance remains a significant obstacle to achieving maximum effectiveness. Exorbitant manufacturing costs currently range from approximately 8,000 to 10,000 yuan per kilowatt-hour. 1,100–1,400 USD), hinder mass-market adoption.

Huawei’s foray into the market fuels China’s drive to shape the next phase of battery advancement? Breakthroughs like these have the potential to revolutionize electrical mobility, dramatically reducing anxiety levels, cutting costs, and empowering automakers and technology companies with unprecedented energy independence, paving the way for a new era of innovation. The success of these guarantees hinges on the ability to rapidly translate laboratory findings into a viable manufacturing process that can be scaled up efficiently.