Tesla’s (TSLA) scenario in Europe continues to deteriorate, regardless of electrical automotive gross sales surging and the brand new Mannequin Y now being obtainable.

The European Car Producers Affiliation (ACEA) launched the newest full knowledge for European automobile gross sales for April 2025 right now, and it confirmed that Tesla’s whole gross sales in EU, EFTA, and UK amounted to 7,261 models – down 49% year-over-year:

Tesla’s deliveries in Europe are actually down 38.8% year-over-year for the primary 4 months of the 12 months.

Throughout that very same interval, battery-electric automobile gross sales grew 26.4% out there and 34.1% in April alone.

Final week, we reported that Tesla CEO Elon Musk claimed “each producer” is experiencing demand issues in Europe, with “no exception.”

As we are able to see from the ACEA knowledge, that’s not true. The Volkswagen Group, Renault, BMW, and SAIC are all up year-to-date and in April.

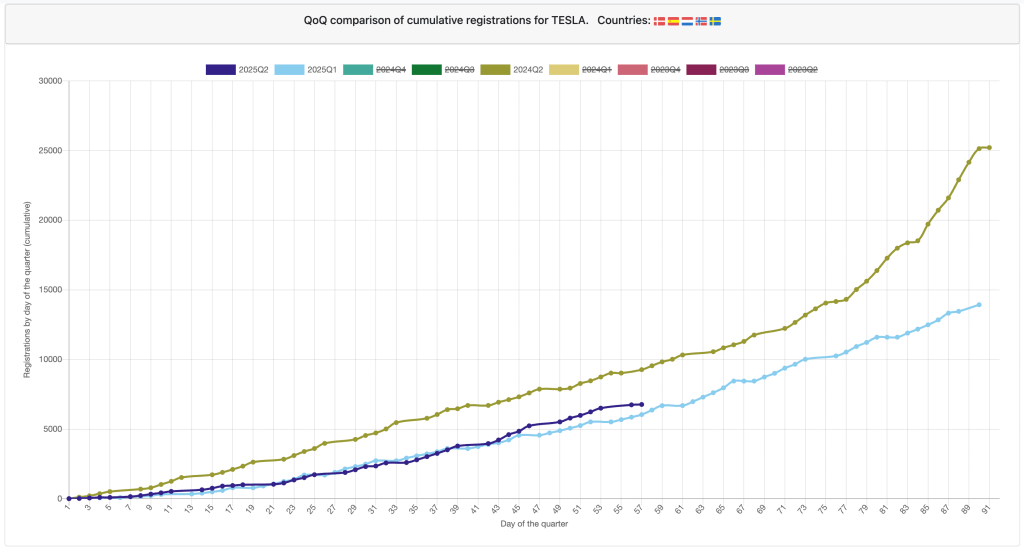

Tesla’s issues persist into Could. The info coming from European markets that report each day automotive registration exhibits that Tesla’s Q2 remains to be monitoring barely above Q1 and considerably under Q2 2024:

In Q1 2025, Tesla blamed its poor efficiency on the Mannequin Y changeover, however it doesn’t have this excuse in Q2.

The automaker is at present providing report reductions and incentives to purchase in most markets, together with Europe. It additionally has its new Mannequin Y obtainable, however it’s clear that Tesla is affected by demand downside as its gross sales are down in just about all markets.

Electrek’s Take

The narrative that everybody is having demand issues in Europe isn’t true, primarily once you give attention to battery-electric autos.

Gross sales are means up. Tesla is the exception in BEVs.

It’s true that the Mannequin Y changeover had an influence in Q1, however it wasn’t truthful accountable the total decline on it. A good portion of Tesla’s points in Q1 was associated to model harm, primarily attributable to its CEO, Elon Musk, and that is now changing into clear in Q2.

There’s room to get frightened as competitors is barely going to get harder.

The model harm occurring simply as clients are gaining extra choices isn’t constructive for Tesla.

At this level, it’s not clear what Tesla can do to show issues round in Europe. Distancing itself from Musk may assist, however even then, it appears like Tesla would want much more to get out of an nearly 50% drop.