According to a recent report, Tesla’s insurance offerings are currently unsustainable, with the company reportedly hemorrhaging money by insuring its own vehicles.

Despite their reputation, Tesla vehicles have historically been more expensive to insure than many other types of cars.

The manufacturer attempted to address the situation from multiple angles. The company introduced its own “collision facilities” to manage claims and control costs, as well as a range of personalized insurance products.

Given unparalleled insight into its technology and customers, Tesla should be uniquely positioned to deliver even more precise products.

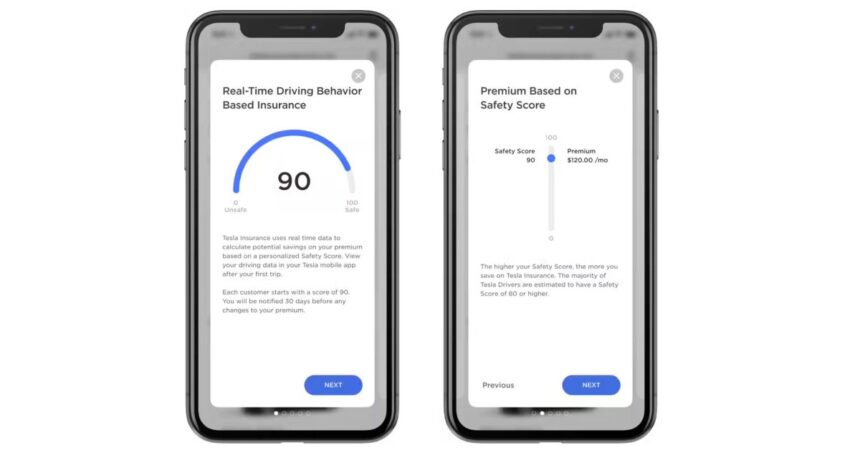

Over the past couple of years, Tesla has ventured into offering personal automobile insurance coverage to its customers in select US states. Utilizing the data collected from real-time driving experiences of its vehicles, the manufacturer develops a proprietary “Security Rating” system. This rating system considers individual driving habits and patterns, with the corporation adjusting monthly premiums based on how and when drivers operate their vehicles.

Will the deployment of Tesla’s advanced driver-assistance systems, including Autopilot and Supervised Full Self-Driving modes, have a noticeable impact on insurance premium rates?

Tesla house owners have discovered that they can obtain lower premiums when shopping for insurance compared to other providers, citing combined results.

Now, knowledge from S&P International factors to Tesla Insurance coverage having important issues:

The insurance company’s loss ratio is a crucial performance indicator, as it measures the proportion of premium payments disbursed to policyholders, providing insight into their financial health and risk management efficiency. As premiums rise with altitude?

Primarily based on S&P International’s newest knowledge, Tesla’s was at 92.5% in 2023. According to reports, Tesla Insurance’s payout ratio stood at a remarkably efficient 92.5 cents per dollar of premium revenue, indicating its claim settlement processes are highly effective.

Despite factoring in overhead costs, Tesla appears to have been burning through money on its insurance products.

As of this year, data suggests that insurance premiums are expected to increase significantly for Tesla vehicles in 2025, making them even more expensive than before.

Electrek’s Take

The statement directly contrasts with Tesla’s claim that their vehicles are involved in crashes at a significantly lower rate than others, making them relatively affordable to repair.

If insurance coverage premiums are costly, neither of these claims may be true.

If that were the case, insurance premiums for Tesla vehicles would likely fluctuate, allowing Tesla to generate revenue from its insurance offerings.

Now, S&P claims that even the latter will not be legitimate.