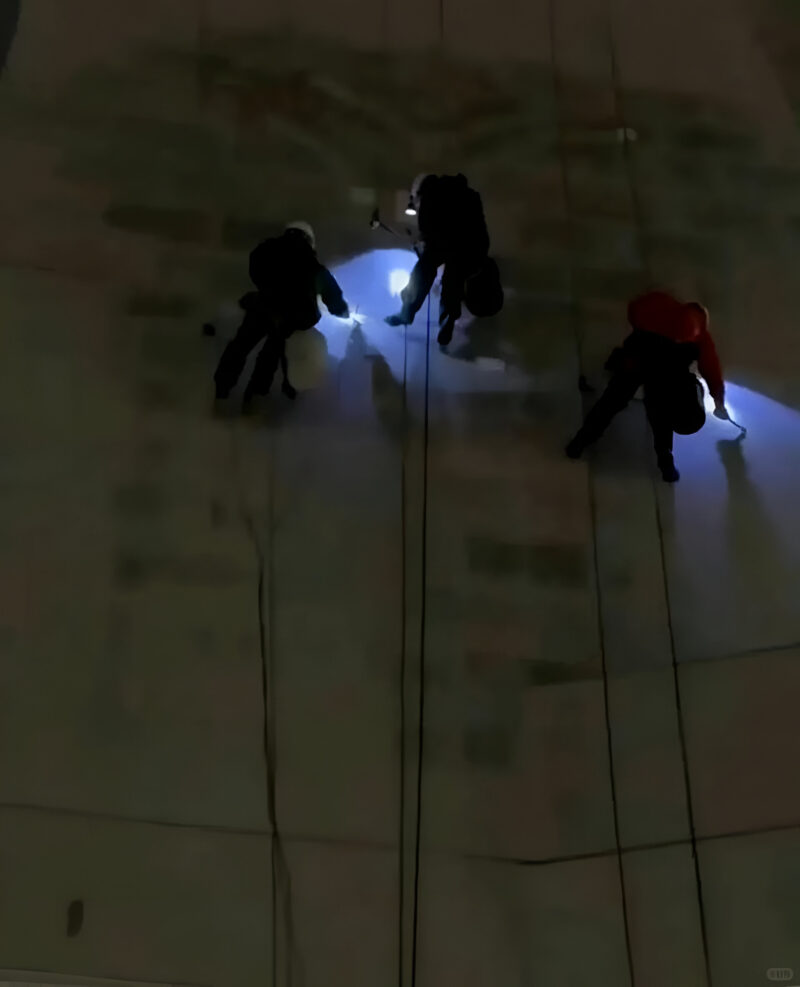

In recent days, an online user shared images showing the swift removal of Neta Auto’s branding from its headquarters in Shanghai over the course of just 24 hours. Staff removed the signage, utilizing ropes and scrapers to leave behind minimal residual marks. Neta has confirmed that the store’s closure was a result of the lease expiration at the end of the month, with the corporation preparing to relocate; however, the exact address of the new office remains undisclosed.

As a dark horse in China’s electric vehicle startup scene, Neta Auto has suddenly found itself at the forefront of a power struggle that will determine its future? Confirming reports indicate that the state-owned investors in Hozon New Vitality Car, parent company of Neta’s guardian entity, will gather for an emergency board meeting to strip founder Fang Yunzhou of his dual positions as chairman and chief executive. The company’s dramatic growth is attributed to its efforts to overcome staggering losses, navigate a severely damaged supply chain, and recover from manufacturing facility shutdowns.

Jia Fang, the founder of Horizon Entertainment in 2014 and subsequently serving as its authorized consultant, has played a pivotal role in Neta’s meteoric ascent and precipitous decline. As a newly minted CEO, he faces intense scrutiny from government-connected investors over his handling of company finances and operations. Disgruntled investors, once loyal, are now seething with frustration as consecutive losses have ballooned to a staggering 18.3 billion yuan (approximately $2.5 billion), accompanied by a crippling debt-to-equity ratio of a daunting 217%.

As tensions escalate to a critical point, reports indicate that another state-backed investor is urging Hozon to file for Chapter 11 restructuring, potentially signaling the downfall of one of China’s most prominent electric vehicle startups. According to sources, investors are calling for fundamental organizational overhauls rather than simply a personnel shake-up at the top.

Neta’s unique mixed-ownership model sets the scenario apart, blending personal entrepreneurial leadership with state-backed capital investment. While initially offering coverage and funding advantages, this system has evolved into a source of contention. Investors seeking stability and risk mitigation in their portfolios have been at odds with Fang’s bold expansion strategy, particularly his rapid foray into Southeast Asia and his ambitious goal of achieving profitability by 2026.

The global financial crisis has also had a significant impact on our operational efficiency. Sources indicate that China’s leading EV manufacturer faces a significant financial challenge, with outstanding payments to suppliers amounting to over 6 billion yuan (approximately $833 million USD). The crisis has reportedly prompted major supplier CATL to suspend deliveries, highlighting the gravity of the situation. Despite this setback, Neta’s domestic production remains halted, further stalling foreign order fulfillments despite securing a 2.15 billion yuan ($297 million) credit facility in Thailand.

Neta’s decline was starkly reflected in its dismal gross sales numbers. Following a peak of 152,000 units in 2022, deliveries declined significantly in 2023, falling to 127,500 vehicles, before plummeting by nearly half in 2024 to just 64,549 automobiles. The studies on mass layoffs, retailer closures, and provider protests have further eroded the public’s perception. Despite even the most aggressive cost-cutting measures, which were accompanied by worker-friendly incentives and aimed at streamlining the enterprise, the company’s financial stability remained elusive.

Fang’s management has recently come under even closer scrutiny. Following Zhang Yong’s departure in late 2024, the newly appointed CEO stepped into his role with ambitious goals: to publicly list the company, expand globally, and achieve positive gross margins by 2025. None have materialized, and Neta’s liquidity points continue to deteriorate. A planned debt-for-equity conversion aimed at curtailing provider debt encountered further setbacks, thereby undermining confidence further.

As state shareholders intensify pressure to remove Fang, the future of Neta hangs precariously in the balance, threatening potentially catastrophic consequences. If the board votes against him, the possibility looms that Fang may be stripped of control over the company he founded, signaling a precipitous descent into obscurity for one of the electric vehicle (EV) industry’s earliest trailblazers?