Despite the launch of Model Y production at Gigafactory Berlin, Tesla’s (TSLA) gross sales in Germany continued to decline in April.

American auto manufacturer experiences a significant decline of approximately 50% in European gross sales.

Tesla in Germany

Germany reported its vehicle registrations for April, marking the last major European market to do so.

Battery-electric car sales have surged by a notable 53%, according to the latest figures.

Despite a booming electric vehicle market, Tesla’s German delivery numbers for April 2025 were surprisingly low, at just 885 units.

Down 46% from the same period last year and a staggering 31% since its dismal start in the first quarter of 2025.

Tesla in Europe

Tesla attributed its lackluster first-quarter performance to the challenging transition of the Model Y production, but insisted that manufacturing had returned to normal by April.

However, gross sales have been sluggish to recover in Germany and other European markets.

With only a few small markets remaining to report their April registration data, it seems unlikely that Tesla will surpass the 7,000 mark for vehicles delivered in Europe.

Down approximately 50% from April 2024 levels.

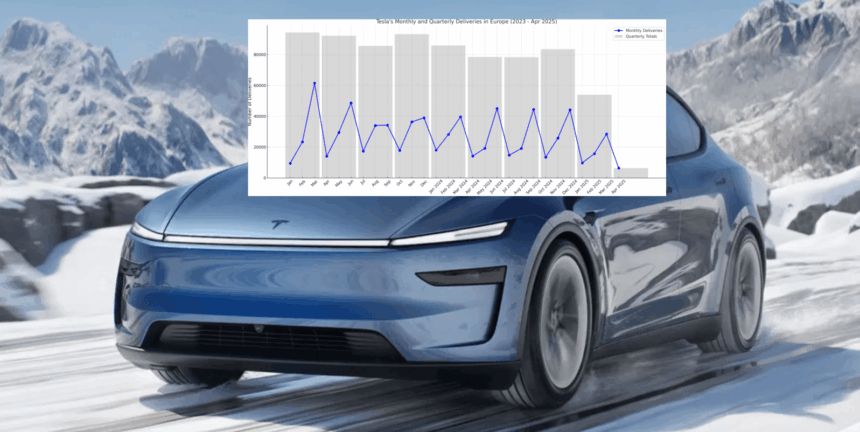

The decline in demand for Tesla’s products in Europe since 2023 has been marked, with the pace of this downtrend accelerating in Q1 2025 due to the transition away from Model Y and an overall decrease in production capacity?

Tesla is no longer making excuses for its subpar performance in Europe. Despite having not begun delivering the brand-new Mannequin Y RWD, it’s unclear how this could lead to a 50% decline in overall sales, given the existing demand backlog for the all-wheel-drive variant?

Electrek’s Take

The chart is somewhat impressive. While some may attribute the decline in performance to the transition to Model Y, data suggests that poor results persisted throughout April and may worsen in May as the new model’s availability expands.

Additionally, Tesla is now offering 0% financing for its new Model Y and Model 3 in numerous European markets, including Germany, as well as discounted leases requiring no upfront payment.

Despite the boost from Mannequin Y AWD deliveries and ongoing incentives, I predict that Q2 will mirror Q1’s performance for Tesla in Europe.

The actual test would be Q3, likely, since the Mannequin Y RWD is expected to arrive on the market throughout the entire quarter. Unless Tesla shows tangible signs of recovery in Q3 across its entire product range, it’s reasonable to forecast a significant decline in demand for its vehicles in the European market.