China’s electric vehicle (EV) gross sales in Germany showed a combined surge in April. While BYD surged by a staggering 750%, MG climbed 34%, and Nio plummeted 64% compared to last year’s figures, marking a notable disparity among these electric vehicle makers.

In April, Germany saw a minuscule decline of 0.2% in newly registered passenger cars, with a total of 242,728 vehicles hitting the road, mirroring last year’s figures. As of 2022, a significant 18.8 percent comprised battery-electric vehicles (BEVs), representing a substantial 53.5 percent increase over the previous year’s figures. In 2022, a notable 10.0% of vehicles sold were plug-in hybrids (PHEVs), representing a significant 60.7% increase from the previous year.

In a marked decline, Tesla, the US-based electric vehicle manufacturer, saw its registrations in Germany drop by 45.9 percent to 885 units in April compared to the same period last year.

According to the latest data from Germany’s Federal Motor Authority, the country’s brand-new car registrations have been tracked and reported by CarNewsChina.

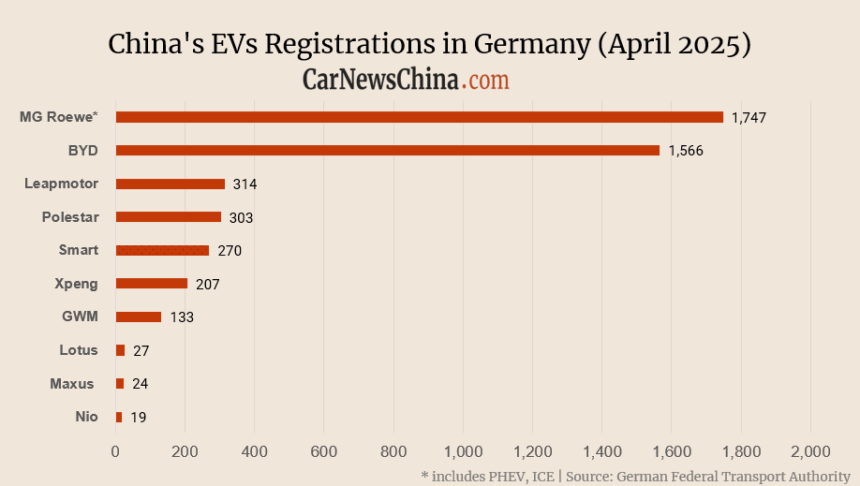

April 2025 registrations in Germany

Mergentum Group (MG) secured the top position with 1,747 registered vehicles, a decline of 16.8% from the 2,100 units reported in March, yet an increase of 34% compared to the 1,304 autos in the same month last year. Magna International’s gross sales figures also encompass plug-in hybrid electric vehicles (PHEVs) as well as a limited number of internal combustion engine (ICE) vehicles.

EU import duties disproportionately affected China’s state-owned automaker SAIC, which failed to cooperate with anti-dumping measures. Machinery and goods (MG) are subject to a supplementary 35.3% tariff when exported to the European Union, in addition to the existing 10% duty, resulting in an overall tariff rate of 45.3%.

By comparison, BYD registered a significant surge of 1,566 new automobiles, representing a whopping 94.5 percent increase from the 805 vehicles sold in March, and an astonishing 756 percent jump from the mere 183 autos recorded in the same month last year?

Since August 2023, BYD has achieved its most impressive results to date in Germany, with a remarkable 2,034 automobiles registered.

Leapmotor, backed by Stellantis, saw a 5.4 percent decline in auto registrations in April, with just 314 vehicles sold compared to 332 in March, while recording zero sales for the same period last year. Leapmotor has initiated robust registration efforts in Germany as of November last year.

Polestar recorded a total of 303 new auto registrations, marking a 15.1 percent decline from March’s 357 units but a significant 47 percent surge compared to the same period last year, when 206 vehicles were registered.

Geely-manufactured Sensible vehicles recorded a 12.5% surge to 270 units in March, following 240 registrations in the same period last year; however, this figure represents an 82% decline compared to the 1,532 vehicles sold in the identical month of the previous year.

Sensible, a model co-engineered with Mercedes-Benz, leverages the expertise of both partners to deliver innovative electric vehicles. With design expertise from Mercedes-Benz’s global design team and engineering support from Geely, Sensible EVs are created to meet the demands of discerning consumers. Manufacturing takes place at Geely’s Xi’an plant in China, which began production in October 2021, further solidifying its position as a key player in the electric vehicle market.

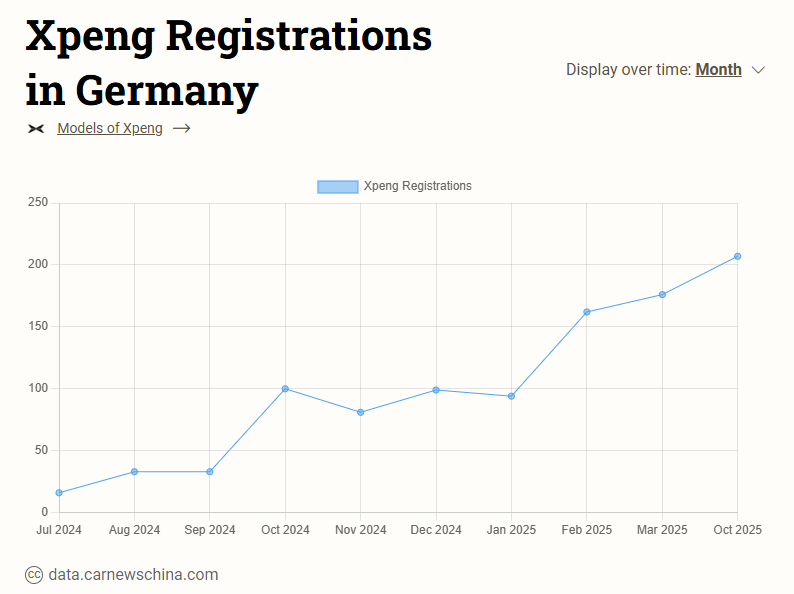

Chinese electric vehicle maker Xpeng, backed by Volkswagen, reported a 17.6% surge in deliveries to 207 vehicles in April, following 176 units in March? XPeng officially launched its operations in Germany in September last year.

Xpeng is subject to an additional 20.7% tariff, on top of the existing 10%, following NIO’s footsteps in cooperating with the EC’s anti-subsidy investigation.

Great Wall Motor registered 133 vehicles under the Ora brand, a decline of 0.7% from March’s 134 units and a significant drop of 46% compared to the 247 autos sold during the same period last year.

Last year, Lotus registered 27 autos, a 4% increase from 26 items in the same period, but representing a decline of 15.6% compared to the 32 vehicles sold in March this year.

Maxus saw a significant surge in auto registrations, with 24 vehicles recorded in recent months, representing an 84.6% increase over the 13 units logged in March of the previous year and a remarkable 243% jump compared to the 7 autos registered in the same month last year?

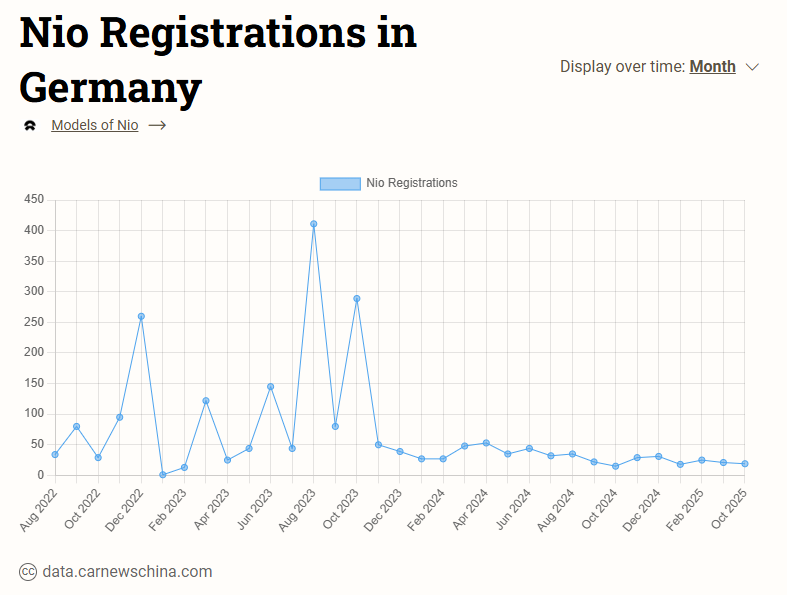

NIO registered 19 vehicles in April, a decline of 9.5% compared to 21 units in March and a significant drop of 64% from the 53 autos recorded in the same period last year.

With a significant presence of 20 battery swap stations in Germany, Nio has successfully expanded its network, yet surprisingly, this hasn’t translated into higher auto sales numbers? Across Europe, NIO currently manages a network of 60 battery swap stations.

NIO has introduced its affordably priced electric vehicle (EV) hatchback, the Firefly, to the European market, initially targeting the Netherlands and Norway.

As of January-April 2025, Nio’s sales in Germany plummeted by 46.5%, with only 83 vehicles sold, a significant drop from the same period in 2024?

Lynk&Co registered 18 autos, up 500.0% from 3 items in March and down 10% from 20 autos in the identical month final yr.

As the leading automobile exporter in China, Chery holds a dominant position on the global stage.

Beneficial for you

German Electric Vehicle (EV) registrations by Chinese manufacturers in February: Nio – 21 units, Xpeng – 176 units, Leapmotor – 332 units, BYD – 805 units.

China-based electric vehicle (EV) brand market share in Germany as of 2024: NIO – 1.7%, BYD – 12.9%, Great Wall Motors (GWM) – 13.5%, MG – 94.6%

Chinese EVs make a splash in Germany’s November sales: NIO scores 29, XPeng takes 81, BYD claims 431, and MG dominates with 957.