Neta Auto, the Chinese language electrical automobile producer dealing with mounting monetary troubles, secured a ten billion Thai baht (215 million USD) credit score line in Thailand final week. This growth seems to be the corporate’s final lifeline amid a deepening debt disaster that has seen its home operations grind to a halt.

The Thai market alternative comes at a crucial second for Neta. Regardless of publicly denying rumors about disbanding its R&D group, the truth of the corporate’s Shanghai headquarters tells a unique story. Chinese language media outlet Sina’s current on-site go to revealed a troubling scene: practically empty places of work throughout working hours, with the few remaining workers seemingly disengaged, spending time on their telephones or gathering for cigarette breaks properly earlier than closing time.

“Many suppliers have come to demand fee in current weeks,” revealed one headquarters worker who requested anonymity. “The corporate is at the moment negotiating options with suppliers, lots of whom have been owed cash for months or perhaps a yr or two. Given our dire scenario, it’s unclear who will truly receives a commission.”

A number of workers confirmed that Neta has been paying many staff solely half their salaries, with some receiving solely Shanghai’s minimal wage. “Many individuals have already left, and people who stay are principally simply going via the motions—little or no precise work is being executed internally,” one worker admitted.

The ten billion Thai baht credit score facility represents an important monetary injection for a corporation drowning in debt. Trade insiders estimate that Neta’s complete liabilities are approaching 10 billion yuan (1.4 billion USD), creating vital obstacles to securing new investments. Earlier this yr, Neta’s mum or dad firm, Hozon New Power Vehicle, introduced plans for a Collection E funding spherical of 4-4.5 billion yuan, with a lead investor anticipated to contribute roughly 3 billion yuan. Nonetheless, these funds have but to materialize.

“Everybody—suppliers, workers—is ready for financing to revitalize the corporate,” an worker defined. “Whether or not it’s debt-to-equity conversions for suppliers or workers accepting pay cuts, everyone seems to be hoping for rescue capital.”

The corporate’s Thailand push comes as its home operations have largely collapsed. Neta’s three main factories in China have reportedly shut down, whereas social media posts present direct gross sales shops closing in a number of cities, together with Nanjing, Shanghai, and Sichuan.

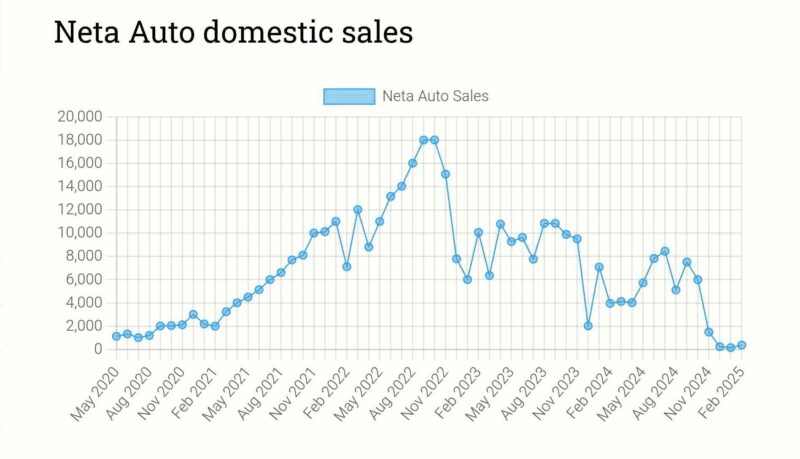

Neta’s monetary troubles are well-documented in its Hong Kong Inventory Trade prospectus, which revealed accrued losses of roughly 18.373 billion yuan (2.56 billion USD) between 2021 and 2023. Even in 2022, when Neta briefly topped the gross sales charts amongst China’s EV startups with 152,000 automobile deliveries, the corporate nonetheless couldn’t stem its losses.

The Thailand credit score line represents a strategic pivot towards worldwide markets, aligning with founder and chairman Fang Yunzhou’s reform plan introduced late final yr. In an inside letter, Fang outlined six vital reforms, specializing in abroad markets and merchandise with constructive revenue margins, aiming to attain constructive gross margins by 2025 and general profitability by 2026.

From a gross sales perspective, Neta has been in bother this yr domestically. Based on China EV DataTracker, its January gross sales decreased by 98% year-on-year, and in February, it bought fewer than 400 automobiles.

Compounding the corporate’s troubles, Neta just lately misplaced key technical expertise, with CTO Dai Dali reportedly becoming a member of Chery Vehicle and autonomous driving head Wang Junping shifting to SenseTime.

As collectors circle and operations sputter, the query stays whether or not Neta’s Thailand lifeline will present sufficient respiratory room to rescue an organization teetering on the sting of collapse or merely delay what more and more seems like an inevitable fall.

Supply: Sina

![Trump supporter arrested at Tesla protest after using a taser [video]](https://the-future-automobile.com/wp-content/uploads/2025/03/Trump-taser-Tesla-protest-150x150.jpg)