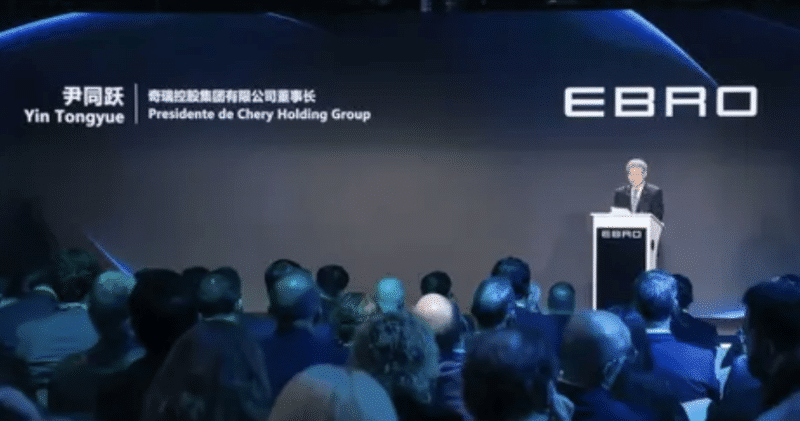

Chinese language automaker Chery has formally submitted its IPO utility to the Hong Kong Inventory Change, marking a major step within the firm’s long-held ambition to go public. This transfer comes after quite a few unsuccessful makes an attempt courting again to 2004, with components just like the 2008 monetary disaster and failed subsidiary listings hindering its progress.

This newest IPO try is the fruits of 20 years of effort. It coincides with a beneficial market setting for automotive firms, particularly as China’s auto business undergoes a major shift in direction of electrification and sensible expertise.

Chery’s latest monetary efficiency seems sturdy. The corporate reported substantial income and web revenue progress between 2022 and the primary 9 months 2024. In January-September 2024, Chery ranked third amongst home automakers in income and web revenue, trailing solely BYD and SAIC Motor.

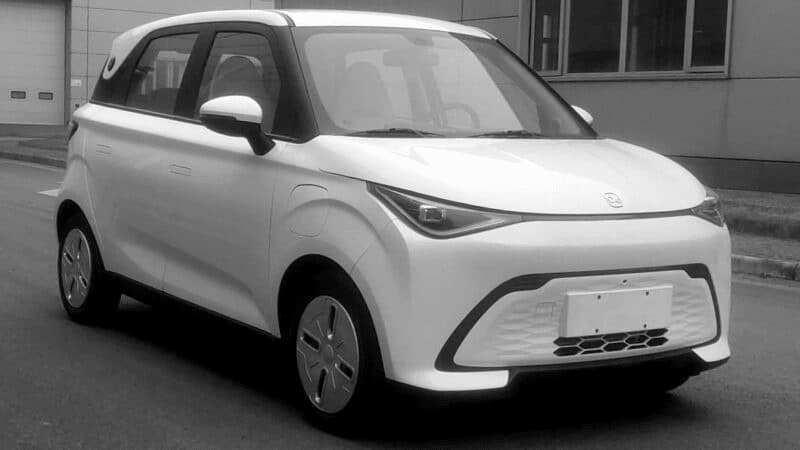

Nonetheless, an evaluation of Chery’s enterprise segments reveals a major imbalance. Whereas its conventional gasoline car enterprise has seen strong progress and stays its major income driver, its new vitality car (NEV) sector lags behind. This “sturdy in gasoline, weak in NEV” construction is a key concern as China’s NEV penetration charge continues to rise quickly.

A serious power for Chery is its dominant place in car exports. The corporate has been the highest Chinese language impartial passenger automobile exporter for 22 consecutive years and holds a number one market share in a number of key worldwide areas. Abroad markets contribute a good portion of Chery’s income.

The choice to lastly pursue an IPO is pushed by a number of components, notably the urgency to speed up its transition to electrical automobiles. The funding required for NEV analysis and improvement necessitates entry to capital markets. Moreover, whereas at present profitable, Chery’s reliance on abroad markets creates a must diversify and strengthen its place within the home NEV market.

In conclusion, Chery’s Hong Kong IPO submitting marks the top of a protracted journey but in addition alerts the beginning of a brand new chapter because it navigates the challenges and alternatives of the evolving automotive panorama, notably within the fiercely aggressive NEV sector.