Trump’s US Commerce Secretary, Howard Lutnick, who not directly owns Tesla (TSLA) shares by means of his agency, has publicly beneficial shopping for Tesla shares at the moment.

That is possible the primary time {that a} sitting US Commerce Secretary publicly recommends to purchase a selected inventory.

The circumstances during which this primary is going on are genuinely astonishing.

Lutnick is understood for his multi-billion-dollar stake and long-time management on the funding financial institution Cantor Fitzgerald.

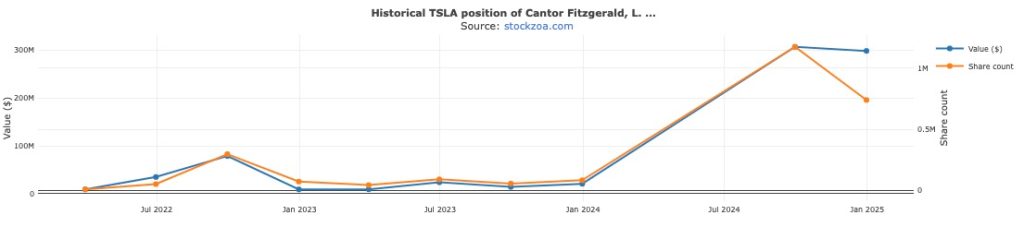

Beginning in 2022, Cantor Fitzgerald started to purchase Tesla shares and considerably elevated its funding within the automaker in 2024 throughout a bull run:

After Trump gained the election final yr with the assistance of a $250 million political donation from Elon Musk, the Tesla CEO began to suggest Lutnick for the numerous position of Secretary of the Treasury. He tweeted:

My view fwiw is that Bessent is a business-as-usual alternative, whereas Howard Lutnick will really enact change. Enterprise-as-usual is driving America bankrupt, so we’d like change a method or one other,”

Trump ended up going for Bessent, however Lutnick nonetheless managed to land the position of Secretary of Commerce – with the assistance of Musk’s push.

After being nominated by Trump, Lutnick stated that he could be divesting from his holdings, that are primarily linked to Cantor Fitzgerald, inside 90 days.

The 90 days usually are not up but, however there isn’t a replace on whether or not he has began divesting but.

Immediately, he went on Fox Information and beneficial viewers purchase Tesla shares:

“I feel if you wish to study one thing on this present tonight, purchase Tesla. It’s unbelievable that this man’s inventory is that this low cost. It’ll by no means be this low cost once more,”

Right here’s the video:

The blatant inventory pump comes after Tesla’s inventory misplaced greater than 40% of its worth up to now this yr.

Musk makes use of 238 million Tesla shares value over $55 billion as collateral for private loans. If Tesla’s inventory goes too low, he may doubtlessly be compelled to promote his shares to cowl the debt.

Moreover, on the analyst facet, Cantor Fitzgerald simply upgraded Tesla’s inventory to a purchase earlier this week – elevating their value goal to $425 a share. Tesla’s inventory closed at $235.86 at the moment.

Howard Lutnick’s son, Brandon, is now accountable for Cantor Fitzgerald as Chairman.

Right here’s a abstract of Cantor Fitzgerald’s Tesla holdings:

- Early 2022: The agency held a really small place (solely ~8,400 Tesla shares in Q1 2022) however quickly elevated to about 297,000 shares by Q3 2022 (value ~$79 million on the time). This massive buy-in throughout mid-2022 marked a major ramp-up of their Tesla publicity.

- Late 2022: By the tip of 2022, Cantor dramatically in the reduction of its stake – holding roughly 72,000 shares in This fall 2022. This discount from practically 300k shares the prior quarter coincided with a steep drop in Tesla’s inventory value in late 2022 (shares fell by roughly 50% throughout This fall 2022).

- 2023: All through 2023, Cantor Fitzgerald saved a modest Tesla place, fluctuating within the tens of hundreds of shares. For instance, they reported ~44,000 shares in Q1 2023, elevated to 91,000 by Q2 2023, then adjusted to 56,000 in Q3 2023 and 83,000 by This fall 2023.

- These strikes counsel lively buying and selling round Tesla’s short-term strikes, with no big long-only stake throughout 2023. Notably, it seems Cantor fully exited Tesla in early 2024 – Tesla was not listed of their Q1–Q2 2024 13F filings, implying they bought off the remaining shares throughout that interval (when Tesla’s value rallied to native highs).

- Re-entry in 2024: Within the second half of 2024, Cantor Fitzgerald made a daring re-entry into Tesla. Their holdings surged to about 1.2 million shares in Q3 2024 (valued ~$307 million as of September 30, 2024). This coincided with a mid-2024 pullback in Tesla’s inventory value, suggesting Cantor purchased the dip. By the tip of 2024, they trimmed the place all the way down to ~740,000 shares (from 1.2M), possible taking earnings after Tesla’s value rallied late within the yr.

Electrek’s Take

I imply, wow. That is one thing else.

The actual fact alone {that a} US secretary would suggest shopping for a selected inventory is despicable, but it surely’s much more insane when it’s the inventory behind the fortune of Elon Musk, who has a relationship with Lutnick.

Lutnick’s Cantor invests in Tesla -> Musk invests in Trump -> Trump appoints Lutnick at Musk’s advice -> Tesla’s inventory crash –> Trump recommends shopping for Tesla automobiles –> Lutnicks recommends shopping for Tesla shares.

I’m no lawyer so I’m not going to assert whether or not that is authorized or not, but it surely’s definitely not moral.

Tesla have to be actually struggling if that’s what they’re doing now: utilizing US officers to advertise Tesla’s shares.