Tesla’s (TSLA) accounting practices are elevating crimson flags as a brand new report from the Monetary Instances reveals that $1.4 billion is lacking.

Many Tesla shorts and detractors have questioned Tesla’s accounting for years, however they’ve by no means gained a lot traction – till now.

At present, the Monetary Instances has launched a brand new report pointing to a $1.4 billion hole in property:

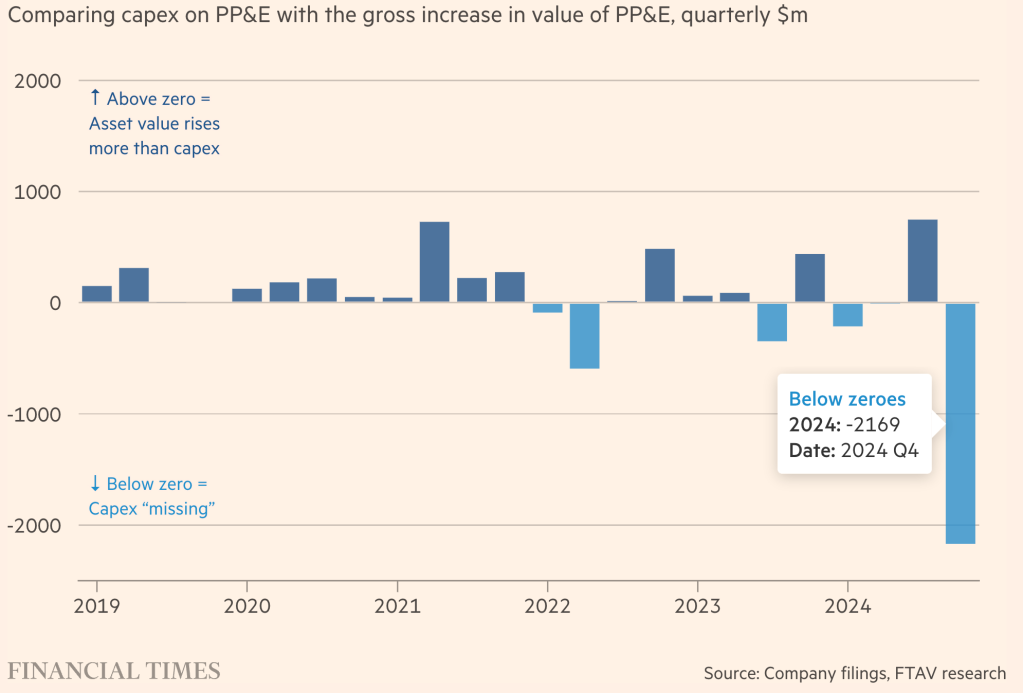

Examine Tesla’s capital expenditure within the final six months of 2024 to its valuation of the property that cash was spent on, and $1.4bn seems to have gone astray.

The article factors out that Tesla stories having spent $6.3 billion on “purchases of property and gear excluding finance leases, internet of gross sales” within the second half of 2024, whereas property, plant, and gear rose by solely $4.9 billion in that interval.

Accounting consultants agree that, most often, the capex quantity matches carefully to the rise in gross PP&E, however some elements could make a distinction: gross sales or impairments of property, overseas change, and so forth.

Nonetheless, Tesla didn’t report any important sufficient change within the common suspects to justify the distinction.

The report additionally factors to different crimson flags, like Tesla claiming to sit down on $37 billion in money and but it raised $6 billion in new debt final yr.

Whereas it’s commonplace for firms with important money piles to lift money owed, it’s lower than splendid on this present surroundings.

Lastly, the FT report additionally factors to Tesla not providing share buyback or dividend regardless of claiming a $15 billion working money circulation final yr, increased than its CAPEX. That is uncommon for giant firms and places Tesla in a really small membership that features different firms like Temu.

In 2022, CEO Elon Musk stated that he would push for Tesla to make use of a few of its money for share buybacks, nevertheless it by no means occurred.

Jacek Welc, professor of company finance on the SRH Berlin College of Utilized Sciences, compares these crimson flags to current monetary scandals, like Wirecard, Longtop Monetary Applied sciences, and NMC Well being.

Electrek’s Take

I’ve some expertise in monetary accounting, having discovered the fundamentals from the wonderful Brian Bushee at Wharton, however I by no means felt that I used to be educated sufficient to make such an accusation in opposition to Tesla.

Shady accounting at Tesla is one thing individuals have been mentioning for years, nevertheless it’s the primary time I’ve seen it getting traction from a serious monetary outlet just like the Monetary Instances.

That is doubtless going to place strain on Tesla and its auditors.

Nonetheless, for these hoping for Tesla to get in sizzling water for cooking the books, I’d stay cautious. Not solely might there be explanations for this, however with Trump and Musk kneecapping the SEC, repercussions are unlikely.