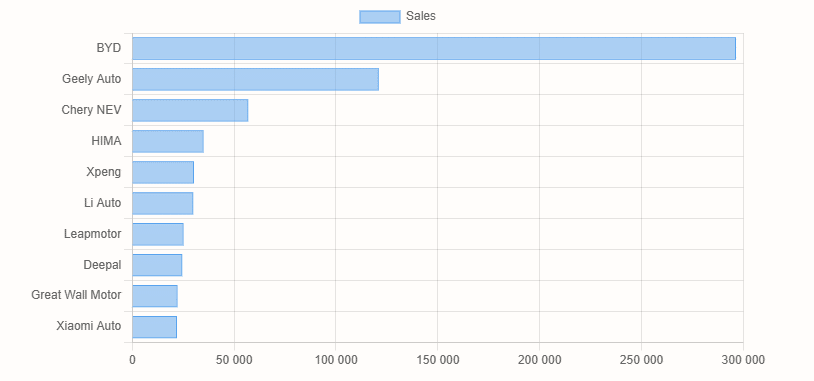

Within the first month of the yr, all Chinese language EV makers’s gross sales had been down MoM, with Geely being an exception. BYD was down 42%, Nio 56%, and Xpeng 17%, whereas Geely was barely up 4% in contrast with December.

Key factors to observe:

- Xpeng outsold Li Auto, turning into the winner amongst EV startups

- Nio model was down from the earlier yr. Group gross sales had been up solely due to the Onvo ramp-up

- Chinese language New Yr affected gross sales as standard

- Geely Auto didn’t thoughts the CNY and elevated EV gross sales in comparison with December as the one automaker

- Xiaomi maintains robust numbers

All supply information come from firm filings or social media posts, that are reported on the primary of every month. Xiaomi is the exception, because it supplies solely imprecise numbers reminiscent of “20,000+” items. Subsequently, the info comes from the China EV DataTracker estimate. The report exhibits wholesale numbers, together with exports, if there are any.

Knowledge present gross sales of recent power automobiles (NEVs). NEV is a Chinese language authorities time period for BEV (battery electrical car), PHEV (plug-in electrical car), and FCEV (fuel-cell electrical car). FCEV (hydrogen) gross sales are nearly non-existent in China.

The leaderboard is up to date as of February 3, 18:35 China time.

January 2025 Gross sales

BYD bought 296,446 passenger NEVs in January 2025, down 41.8% from 509,440 in December and up 47.5% from 201,019 the earlier yr.

Cumulative cumulative car gross sales in 2024 reached 4,250,370 automobiles, up 41,1% from 3,012,906 items in 2023.

BYD gross sales embrace the BYD-branded automobiles, Denza, Fang Cheng Bao, and Yangwang manufacturers.

Geely Auto bought 121,071 passenger NEVs in January 2025, up 4.2% from 116,206 in December and 83.9% from 65,959 the earlier yr.

Cumulative gross sales 2024 reached 893,235 NEVs, up 83.2% from 487,461 items in 2023.

Geely Auto NEV gross sales embrace Zeekr, Lynk&Co, and Geely and Geely Galaxy.

HIMA bought 34,987 EVs in January, down 29.3% from 49,474 items in December. HIMA (Concord Clever Mobility Alliance) is Huawei’s EV alliance, which incorporates 4 manufacturers: Aito, Luxeed, Stelato, and Maextro.

Xpeng bought 30,350 passenger NEVs in January 2025, down 17.3% from 36,695 in December and up 267.9% from 10,668 the earlier yr.

About half of Xpeng’s gross sales had been pushed by the Mona collection. Xpeng itself is a mass-market model, and the Mona collection is entry-level in contrast with the primary model. It presently sells just one automotive – the Mona M03 sedan, which begins at 119,800 yuan (16,500 USD) and was launched in August 2024. Xpeng bought over 15,000 items of Mona M03 in January.

Li Auto bought 29,927 passenger NEVs in January 2025, down 48.9% from 58,513 in December and 4.0% from 31,165 the earlier yr.

Li Auto gross sales are primarily pushed by the L6 SUV, which accounts for about 50% of Li gross sales. The L6 was launched in April 2024 for 249,800 yuan (34,500 USD) as one of many most cost-effective Li Auto fashions. Li Auto stated the EREV SUV surpassed the 200,000-unit supply milestone final month.

Li Auto sells primarily EREVs, with Li Mega minivan being an exception. It’s an all-electric MPV launched in early 2024 however struggles to realize gross sales. In December, the corporate bought somewhat over 1,200 items in China, making it about 2% of firm gross sales.

Cumulative gross sales in 2024 reached a record-breaking 500,508 NEVs, up 33.1% from 376,030 items in 2023. Li Auto reported it’s the first Chinese language EV startup to surpass the five hundred,000 annual milestone.

On January 25, the Beijing-based firm introduced its whole deliveries exceeded 150,000 items. Xiaomi plans to promote 300,000 automobiles in 2025, surpassing 135,000 items in 2024.

Nio group bought 13,863 passenger NEVs in January 2025, down 55.5% from 31,138 in December however up 37.9% from 10,059 the earlier yr.

Nio most important model bought 7,951 automobiles, down 21% from 10,055 items in January 2024 and 62% from 20,610 in December.

Entry-level model Onvo bought 5,912 of its solely automotive, the L60 SUV, down 44% from 10,528 items in December. Onvo launched in September, and the corporate’s president, Alan Ai, beforehand introduced that if the corporate doesn’t attain 10k deliveries in December, he’ll resign.

Onvo L60 begins at 149,900 yuan (20,770 USD) in China with a 60 kWh BYD battery. Many analysts have identified the potential cannibalization between Onvo and Nio fashions, particularly its best-seller, the ES6 SUV being at risk.

Nio ES6 (EL6 in Europe) begins at 338,000 yuan (46,600 USD) and, in lots of points, affords comparable specs as Onvo L60. Nio ES6 is presently chargeable for about 35% of Nio gross sales. Nio ET5/T is chargeable for one other 40%.

Cumulative gross sales in 2024 reached 221,970 NEVs, up 38.7% from 160,038 items in 2023. In 2025, Nio plans to promote 440,000 automobiles of which half can be attributed to Onvo.

Xiaomi stated it bought over 20,000 items of its solely automotive, the SU7 sedan. In accordance with a China EV DataTracker estimate, the corporate’s January gross sales had been 21,960 items, down 12.3% from 25,035 items in December.

Xiaomi launched its first automotive, the SU7 sedan, in March final yr. Deliveries started in April. The SU7 begins at 215,900 yuan (29,800 USD) in China. The corporate will launch its second automotive, the YU7 SUV, in July.

Changan and SAIC haven’t but shared their information, and it isn’t sure they may, as they often don’t publish NEV month-to-month gross sales studies. We are going to keep watch over it.