California’s EV market share surged to a record-breaking 22.3% in the third quarter, with gross sales continuing their steady upward trend. After a brief surge, Tesla reclaimed its position as the country’s second-leading seller of mass-market vehicles, trailing only perennial leader Toyota.

The California New Car Dealers Association regularly publishes a quarterly “California Auto Outlook,” providing a detailed analysis of key industry trends and metrics for the preceding quarter. The company has recently released its Q3 report, and we’ll delve into the details for valuable takeaways.

In California, electric vehicle (EV) gross sales have consistently grown over the past few years. Throughout the year, their percentage fluctuated from 20.5% in the first quarter to 21.8% in the second, before peaking at 22.3% in the third. This quarter’s growth, while slightly slower than expected, marks a significant milestone in the state’s history.

California is poised to end the year with an impressive 23% share of battery-electric vehicle (BEV) sales, only slightly falling short of our projection of around 25%+ by the close of the year. While still lower than previous years? Purified Ice, a dominant player in its market, has seen its market share decline steadily over the past year, falling to 64.6% as of 2023, down from 71.6% in 2022.

Compared to the rest of the United States, California’s electric vehicle market share stood at 7.9% in Q3, with gross sales approximately three times higher than the national average – a phenomenon that is even more pronounced when excluding California from the national data, as its significant market share skews the overall figures.

In the third quarter alone, more than one-quarter of California’s newly registered vehicles were plug-in hybrids. With the growing diversity of electric vehicles, including conventional hybrids, gasoline-electric hybrids, and hydrogen fuel cell-powered cars, a notable proportion – exceeding one-third or 37.3% – are “alternative” vehicles that depart from traditional internal combustion engine designs.

While hybrid and electric vehicle (EV) sales surged in the third quarter, plug-in hybrid sales remained steady at around 3%.

New electric vehicle (EV) registrations in California experienced a notable decline in the third quarter, dropping to 100,597 from 103,061 in the second quarter. Automotive sales plummeted overall, with electric vehicles (EVs) accounting for an increasingly larger market share. As a direct consequence of seasonal fluctuations in automotive sales, a year-over-year comparison reveals a 21.1% increase in overall automobile sales during Q3, with battery-electric vehicle (BEV) sales experiencing an even more substantial surge of 56.3% compared to the same period last year?

In a highly competitive showdown playing out in California, two automotive giants are vying for supremacy: Toyota and Tesla. The stakes? Dominating the Golden State’s electric vehicle (EV) market, particularly in the region where Tesla got its start. For decades, Toyota has maintained its top spot as the number one automaker, with the iconic Camry reigning supreme for several years as the best-selling vehicle in California – that is, until the Model 3’s arrival, which was eventually surpassed by the Model Y. With its ubiquity on California roads, the Mannequin 3 has garnered the moniker “California Camry”.

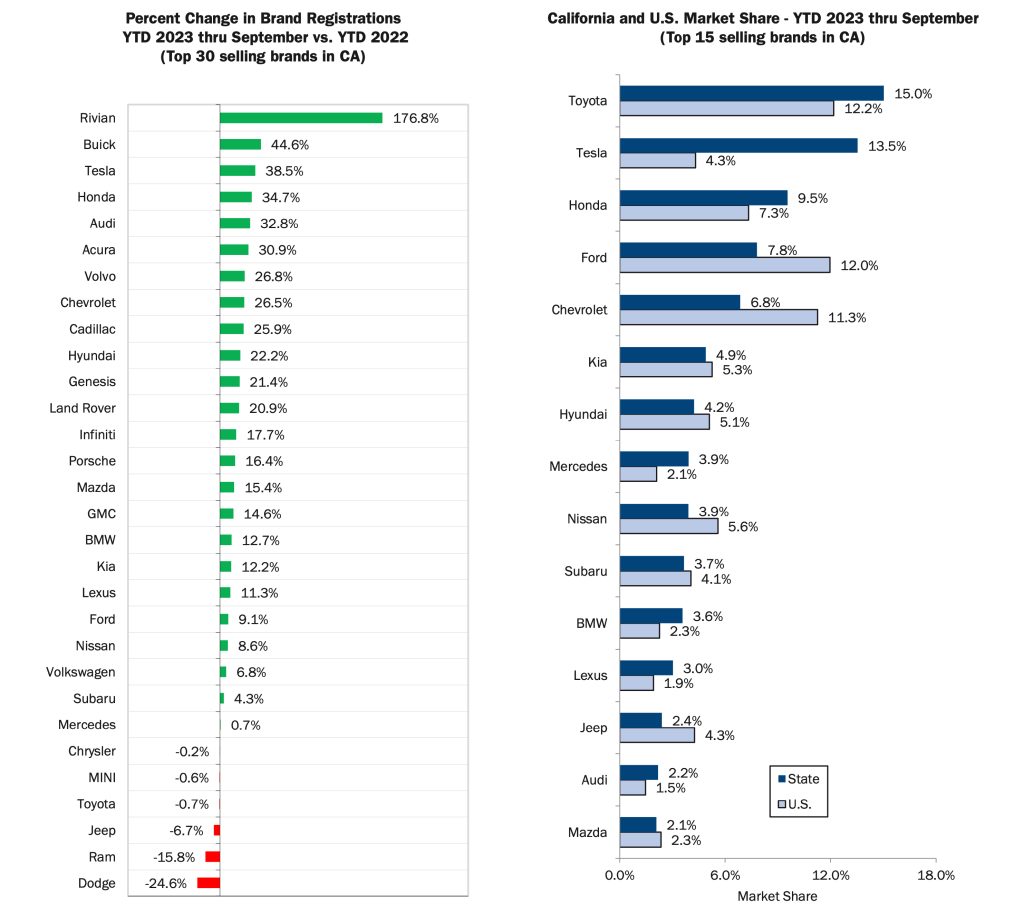

While Tesla surpassed Toyota as the best-selling individual model, Toyota still held the top spot for overall sales due to its broader lineup of models compared to Tesla’s more limited range. However, in Q2, we saw that Tesla managed to narrowly outsell Toyota for the first time, primarily driven by the phenomenal success of Model 3 and Model Y sales, which have remained (and continue to be) the top-selling models in the state by a significant margin.

Again, however, in Quality Question 3, Toyota succeeded in securing the top position for a second time. In the second quarter, Toyota sold 70,314 vehicles, a 4% increase from the 67,482 units moved during the same period last year. Meanwhile, Tesla’s sales dropped by 13% to 60,061 vehicles, down from the 69,212 units sold in Q2 of the prior year. Tesla’s quarterly delivery numbers typically experience a downturn, yet gross sales still demonstrated significant growth compared to Q3 last year.

Due to this development, Toyota has leapfrogged Tesla, boasting a 20,000-unit lead in auto sales year-to-date; accordingly, it seems unlikely that Tesla will reclaim the top spot as the best-selling model by the end of 2023. Despite being comfortably in second place, the firm still boasts a sizeable advantage of around 50,000 cars year-to-date compared to Honda.

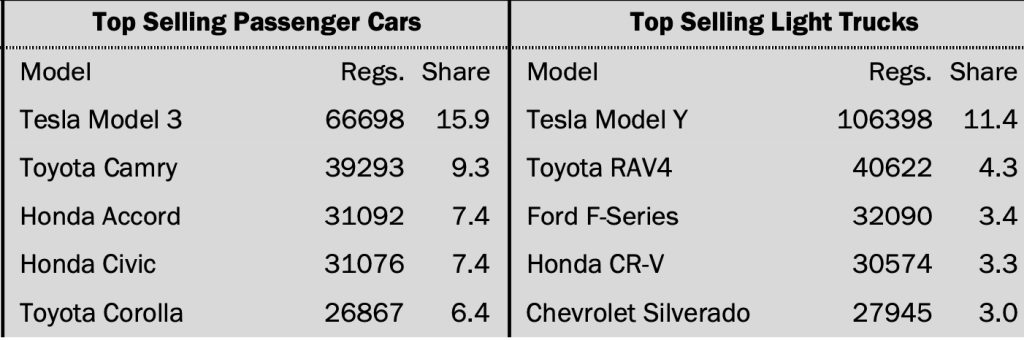

Despite being a newcomer to the market, Tesla still reigns supreme on the list of best-selling cars, with an astonishing 106,398 units sold as of now, leaving all other competitors far behind at just 66,698 units. Toyota’s RAV4 and Camry models have achieved remarkable sales figures for the period, with the RAV4 selling 40,622 units and the Camry shifting 39,293 vehicles to date.

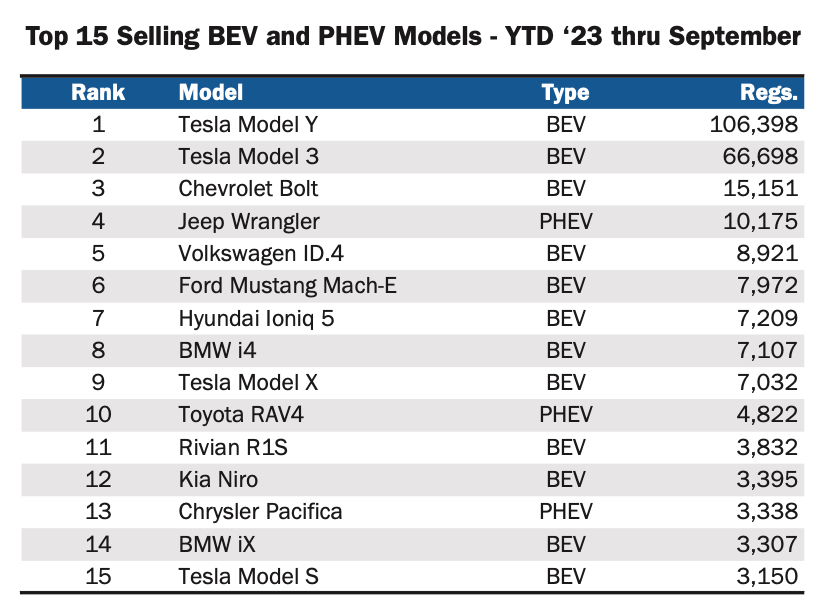

Rivian’s continued robust sales growth is highlighted by a 176.8% year-to-date increase; meanwhile, new data reveals the top-selling BEVs and PHEVs: the Wrangler 4xe ranks fourth in California, behind Model Y/3 and the Chevy Bolt; Northern California sees a 25.7% BEV share YTD, compared to 21.1% in Southern California (the pace picks up elsewhere, but not everywhere); and franchised dealerships experience a 103% year-over-year increase in BEV sales, versus a 42% gain at direct sellers.

Electrek’s Take

As a quarterly ritual, we analyze this data due to California’s tendency to set the national pace for technology adoption, a trend that has consistently played out in electric vehicle (EV) sales.

Two years ago, California lagged behind with just 7% of new car sales being electric vehicles (EVs), while the rest of the country saw a significantly higher adoption rate of around 2%. Currently, the national unemployment rate stands at 7%, while California’s rate has climbed to 22%.

Can the country’s prospects for development be accurately forecasted over a two-year period? That information would have significant value if examined.