As the global electric vehicle (EV) landscape continues to accelerate, Toyota is reportedly withdrawing from the market due to China’s accelerated push towards a fully electrified automotive sector? Japanese automaker informs joint venture partners of planned production cuts in China.

As China drives the global auto industry’s electrification, numerous traditional automakers are struggling to stay afloat in a shrinking market.

The Japanese automaker Toyota has been the latest to succumb. Toyota is prolonging its previously announced production reduction, initially slated for October and November, by an additional three months.

Toyota’s strategic alliance with FAW Group is highlighted in a recent correspondence, stating that “production levels from December to February next year are expected to continue their significant decline.”

The letter clarified that the target for gross sales to Toyota dealers will decrease to $66,000 by December, $60,000 in January, and $38,000 in February.

As the Chinese market continues to exhibit extreme volatility, the corporation is compelled to adapt and adjust its strategy to ensure a seamless transition. While market leaders such as BYD and Tesla have successfully reduced costs throughout the year, this has created a challenging environment for traditional automotive manufacturers to remain competitive.

China’s electric vehicle (EV) market continues to surge forward, leaving traditional automakers like Toyota struggling to regain traction.

As prices for affordable electric vehicles (EVs), such as the BYD Dolphin, start from around $17,500 in China, traditional manufacturers like Toyota are increasingly struggling to compete in the market.

Toyota has previously implemented layoffs in the region through a joint venture with China’s Guangzhou Automobile Group (GAC). The JVs manufacturing facility employed approximately 19,000 people, producing models including the bZ4X.

Following the launch of the bZ4X in China last October, Toyota reduced prices by 15% in February after the electric SUV struggled to gain momentum.

Toyota has launched its first all-electric sedan, the bZ3, in China, a collaborative effort with FAW, aimed at reviving interest in the burgeoning market. Despite the initial momentum, the recall over the summer season proved to be a significant setback.

The Japanese automaker announced in July that it would be bringing together engineers from its three joint ventures in China – BYD, FAW, and GAC – to collaborate on a “Toyota-led growth challenge” aimed at closing the gap with its competitors.

Despite ranking third globally behind BYD and Volkswagen, Toyota’s Chinese market share is eroding.

According to data from the China Association of Automotive Manufacturers, Toyota sold 1.26 million vehicles to dealerships through September, a decline of 9% compared to last year. Meanwhile, BYD has witnessed a staggering 60% surge in gross sales over the same period.

Electrek’s Take

Toyota’s reluctance to fully commit to electric vehicles is proving costly in the world’s biggest automotive market. As electric vehicle (EV) manufacturers like BYD and Tesla continue to gain momentum, they are steadily increasing their market share, while less competitive players struggle to keep pace.

Despite being affected by the transition, Toyota’s woes pale in comparison to those of its Japanese peers – Nissan, Honda, and Mitsubishi – which are bearing the brunt of the disruption.

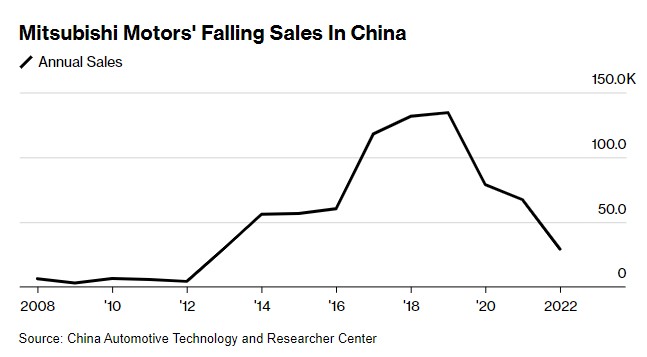

Mitsubishi has suspended its operations in China following a drastic decline in sales, which plummeted from more than 134,500 units sold in 2019 to just 34,500 the previous year.

Nissan’s gross sales suffered a significant 20% decline last year, causing it to tumble from its position among the top five automakers in terms of market share.

The sudden shift to electric vehicles has left many manufacturers reeling, with some paying a hefty price for their lack of preparedness. While China’s auto market was initially dominant, other key markets are poised to take notice?