Ford’s German operations are facing a precarious outlook as the company prepares to significantly scale back its local workforce. Ford’s new job cuts would significantly imperil its future operations in Cologne, as the German commerce union sees them as a harbinger of decline.

Ford’s Job Cuts Spark Backlash in Germany?

By November 20, Ford announced its intention to eliminate an additional 4,000 positions in Europe by the end of 2027. Most of these positions are expected to be located in Germany, with approximately 2,900 of them having been eradicated.

Ford’s transfer came on the heels of significant losses in recent times, stemming from an extremely disruptive influx of new electric competitors. Ford attributes sluggish sales of its electric vehicles and a deteriorating economic landscape to the reduction in force.

Ford’s impending job cuts have been discussed by members of the state parliament’s finance committee in North Rhine-Westphalia, mirroring concerns expressed in Germany’s media outlets.

SPD parliamentary group chief Jochen Ott condemned the job cuts announced on November 20, describing them as a direct violation of the February 2023 settlement. He criticized the lack of transparency surrounding the decision-making process and the late notification given to the works council, calling it a “blatant breach of trust” and an “insulting blow”.

Germany’s largest commerce union, IG Metall, has voiced concerns that Ford’s plans pose a significant threat to the long-term viability of its remaining German manufacturing sites.

Ford, a significant employer in Cologne, may need to cut approximately one-quarter of its current 12,000-strong workforce by the end of 2027. By that time, General Motors would likely have reduced its workforce by half within just a decade.

Ford’s German factory in Cologne is currently producing two electric models, the Explorer and Capri EVs, but a shortage of demand is prompting the company to slow down production. Ford has begun manufacturing Capri electric vehicle models just last month, following the launch of its electric Explorer in June.

Electrek’s Take

Ford faces a challenge in maintaining its stronghold in Europe as new rivals emerge and intensify competition within the market. As China becomes increasingly saturated with low-cost electric vehicles (EVs), domestic automakers are seeking opportunities overseas to drive innovation, and Europe has emerged as a prime target market.

Chinese automakers BYD, MG, NIO, and others are unveiling cutting-edge electric vehicle designs tailored specifically to meet the demands of European consumers. As traditional players like Ford, Volkswagen, and Toyota were squeezed out of their comfort zone in the domestic electric vehicle (EV) market, Chinese EV leaders are now seeking to expand their global footprint even further?

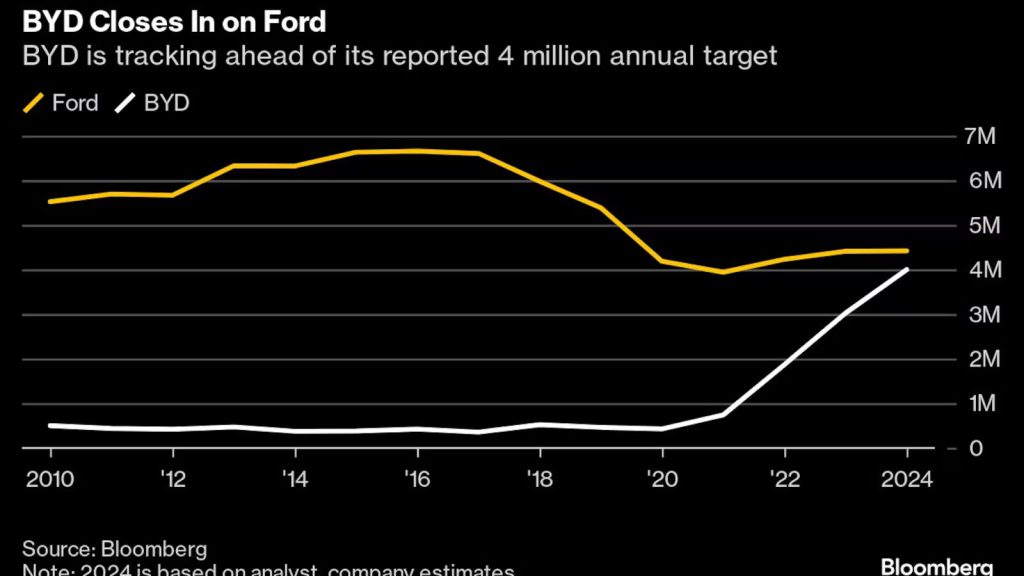

As global sales momentum builds, BYD has surpassed Nissan and Honda to claim top spot in international deliveries for the first time this year. As Ford’s pursuer closes in,

According to a recent report, BYD is rapidly gaining ground on Ford in global deliveries, poised to surpass the American automaker ahead of schedule.

Ford’s CEO Jim Farley conceded the looming threat posed by Chinese automotive manufacturers, stating, “Given our company’s struggles in competing with the Japanese and South Koreans, we need to address this issue.”

Ford is reorienting its strategy to focus on developing smaller, more valuable electric vehicles (EVs) built around a novel cost-effective platform. Despite these developments, the flagship model, a midsize electric truck, won’t reach consumers until 2027. By that time, it might already be a case of too little, too late.