Toyota is securing significant funding as it strives to gain ground in the electric vehicle (EV) market. According to sources close to the situation, Toyota and its partners are reportedly planning to invest approximately $4.7 billion in Denso, the world’s second-largest automotive supplier.

Toyota intends to divest around 10% of its stake in the company, valued at approximately $4.7 billion, by year-end. Toyota accelerates next-gen electric vehicle technology development in response to growing market demand.

Sources suggest that Toyota’s contribution is likely to account for roughly half of the total 10%, with Toyota Industries and Aisin comprising the remaining half. Denso intends to repurchase certain shares to mitigate any potential impact on market prices. The provider’s shares plummeted 6% in pre-market trading.

The proposed sale of the auto business could potentially be the largest transaction in the industry for more than 10 years, with an estimated value of approximately $4.7 billion (700 billion yen).

According to London Stock Exchange Group (LSEG) data, the sale could potentially rank as the second-largest IPO behind the $9 billion share sale by Japanese financial institution in March, pending further details. Funding plays a pivotal role in facilitating the successful transition to electric vehicles (EVs), highlighting the need for substantial investment in this crucial sector.

A Toyota spokesperson refused to comment on Denso’s situation, citing it wasn’t ready to discuss the matter. Denso similarly remained tight-lipped, choosing not to issue a statement.

Toyota plans massive $4.7 billion injection into EV ecosystem?

Toyota has introduced a range of enhancements in recent months to help it catch up with electric vehicle (EV) leaders like Tesla.

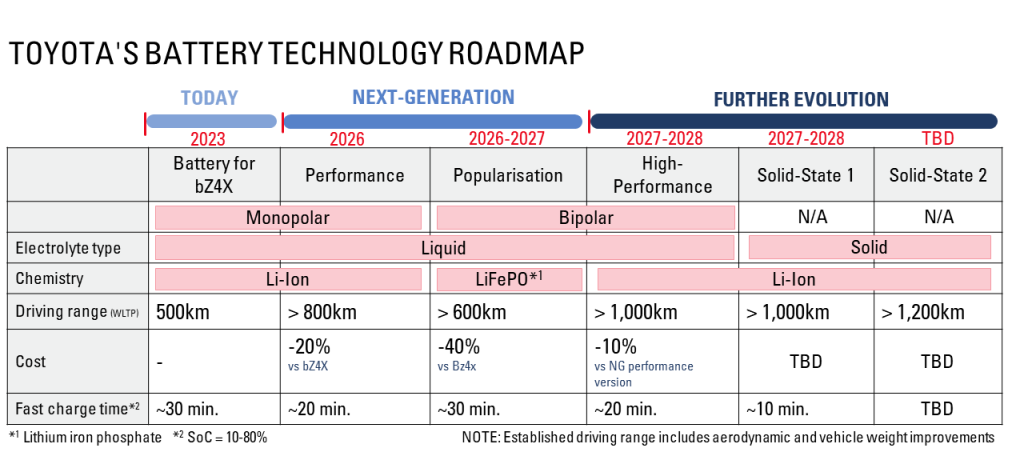

At a June workshop, Toyota showcased cutting-edge technology, next-generation electric vehicle (EV) batteries, innovative designs, and upgraded manufacturing processes aimed at boosting efficiency.

Toyota’s forthcoming electric vehicles, slated for release in 2026, are expected to boast an impressive range of nearly 500 miles (approximately 800 kilometres).

Building on its industry rivals’ successes, the automaker is poised to adopt Tesla’s innovative approach by introducing Giga casting technology into its manufacturing process.

Toyota’s move to fundraise follows an earlier statement that it may invest in a 250 billion yen ($1.7 billion) stake in KDDI Corp in July, just after unveiling its latest technological advancements.

Toyota is expected to remain a significant investor in Denso. The automobile manufacturer retained a 24 percent stake at the end of September.

Electrek’s Take

As a global leader in the automotive industry, Toyota boasts the resources and expertise necessary to thrive in the emerging electric vehicle (EV) era.

Notwithstanding its initial trepidation, it lags significantly behind the competition. As electric vehicles (EVs) gain popularity among consumers, Toyota is witnessing a decline in its market share in significant regions such as China and Thailand?

The corporation has repeatedly touted accelerated electric vehicle production for several years, yet tangible progress remains elusive. The proposed allocation of $4 billion in funding may help accelerate the transition process.

Toyota’s highly anticipated electric vehicle technology is poised to hit the market in 2026, marking a significant milestone for the automotive giant. As legacy automakers struggle with the costly transition to electric vehicles, Toyota is proactively bolstering its financial reserves in preparation.

A swift transition from Toyota to a new CEO is improbable in the near future. Toyota intends to rely heavily on its hybrid technology in the near term.