Following the release of its nine-month outcomes for the year, Volkswagen’s chief financial officer revealed a stark decline in electric vehicle orders across Europe, with a 50 percent drop reported. Volkswagen’s order intake slowed down, largely due to a decline in demand across the broader automotive market.

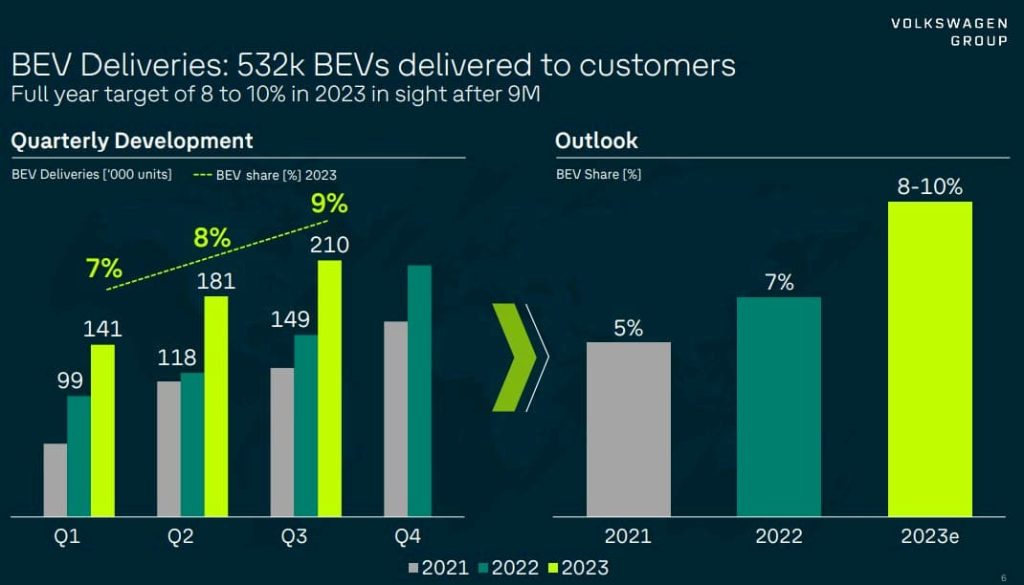

The Volkswagen Group announced a 45 per cent year-on-year increase in electric vehicle deliveries, totalling 531,500 units over the first nine months of the year.

Volkswagen’s electric vehicle (EV) market share reached 9% in the third quarter, with a cumulative total of 7.9% as of September. The corporation remains committed to achieving its revised annual target range of 8-10% growth.

In Europe, Volkswagen’s most significant electric vehicle (EV) market accounted for more than 341,000 units sold (+61%) as of September. In China, the automotive manufacturer’s largest profit driver saw a sales boost, with 117,100 units sold, representing a 4% increase. Electric vehicle deliveries within the United States surged by 74 percent to reach a record-breaking 50,300 units.

Meanwhile, Volkswagen’s Chief Financial Officer (CFO) and Chief Operating Officer (COO), Arno Antlitz, stated during an interview with a prominent media outlet that electric vehicle (EV) orders in Europe have declined significantly to around 150,000 units. Compared to the previous year’s total of 300,000, that represents a 50 percent decrease?

As of this year’s first quarter, European countries have absorbed more than 64 percent of all electric vehicle (EV) shipments from Volkswagen since the beginning of this 12-month period. Although Chinese deliveries showed minimal growth, XPeng’s CEO, Antlitz, warned that the company might struggle to maintain its electric vehicle (EV) market share until new models featuring their latest software, XPeng, begin hitting the roads.

European Volkswagen electric vehicle orders decline sharply.

Despite a significant decline in European Electric Vehicle (EV) orders compared to the previous year’s figures, Volkswagen observed a resurgence in demand during the third quarter.

Despite orders being below target levels, a steady supply momentum is still expected to continue. He linked the decline in demand to broader market trends.

Hildegard Wortmann, head of Volkswagen’s advertising and sales, explained earlier this month that “our order intake has fallen short of our ambitious projections due to a lower-than-anticipated overall market trend.”

The Volkswagen spokesperson credited the company’s strong third-quarter performance to a significant backlog that was finally being cleared. Supply chain and logistics issues are gradually being resolved, leading to a decrease in the duration of supply delays.

Volkswagen reduced its electric vehicle (EV) market share to an estimated 8-10% by the end of last year, down from 11% just a few months prior. The German manufacturing operations of the automaker faced cuts last month as a result of sluggish demand’s impact on its performance.

The corporation is pinning its hopes on a revamped version of its best-selling electric vehicles, the ID.4 and ID.5, to turn things around. The latest fashion trend includes the introduction of an innovative electric powertrain and advanced battery technology, resulting in increased range capabilities and modernized infotainment systems.

Volkswagen has officially launched its highly anticipated ID.7 flagship model, which has been available for ordering for several weeks already. The all-new electric sedan starts at approximately $62,000 (€56,995), boasting an estimated range of up to 385 miles on the Worldwide Harmonized Light Vehicle Test Procedure (WLTC).

Electrek’s Take

Automotive giants Ford and General Motors are joining a growing list of manufacturers in slowing down their electric vehicle (EV) launch plans.

General Motors is putting off production of the Equinox, Silverado RST, and GMC Sierra Electric Vehicle to protect profit margins. Meanwhile, Ford is revving up efforts to hit its target of producing 600,000 electric vehicles by next year? Strikes erupt amidst a backdrop of rising global interest rates and underwhelming demand for certain electric vehicle models.

While some automakers have hit pause on their environmental goals, Hyundai and Volvo remain committed to theirs. Automakers are relying heavily on the electric vehicle (EV) momentum to drive the rollout of new models across various market segments.

Despite a slowdown in European Electric Vehicle (EV) orders earlier this year, Volkswagen reports that demand began to pick up pace in the third quarter with the introduction of fresh models to the market.

Despite short-term turmoil, some automakers are hesitating in their electrification strategies, while others remain committed to accelerating their electric vehicle (EV) initiatives. As the automotive industry continues its electrification trajectory, those who invest in this technology today can expect to reap significant benefits by the end of the decade.

As demonstrated by China, the world’s largest electric vehicle (EV) market, a swift and profound transition is not only possible but also imminent, rendering those who fail to adapt increasingly vulnerable.