Ford is cutting approximately 4,000 European jobs as it struggles to adapt its production pace to the rapid market shift towards electric vehicles. The US auto giant highlighted the profoundly unsettling impact of the rapidly evolving electric vehicle (EV) landscape, where newcomers are exerting significant financial pressure on established players in the sector. As Ford makes its move into the electric vehicle market, it finds itself playing catch-up with Chinese leader BYD, which has been rapidly closing the gap in global deliveries.

Ford to slash hundreds of European jobs amid electric vehicle challenges.

“Ford has a history in Europe that spans over 100 years,” said Dave Johnston, the company’s European vice president for Transportation and Partnerships, during a conversation on Wednesday.

As the automotive industry transitions to electric vehicles (EVs) and new competitors emerge, Ford must adapt to remain a dominant player in the market. The corporation has suffered significant financial setbacks recently due to an influx of innovative electric vehicle entrants disrupting the market.

Ford is set to eliminate an additional 4,000 positions across its European operations by the end of 2027 as it continues to restructure its business. The company attributed its struggles to a “challenging financial landscape” and “unrealized expectations” surrounding electric vehicle demand.

While the deliberate cuts will predominantly impact Germany, a select few may also have a ripple effect on the UK. According to Ford’s announcement at a recent press event, various European markets are expected to experience “modest decreases.” “

Ford is deliberately curbing production of its innovative electric Explorer and Capri models, which are manufactured at its upgraded Cologne EV facility in Germany, following a recent expansion.

A Ford representative verified the move, attributing it to a rapidly declining electric vehicle sector.

Ford has confirmed that it will discontinue short-term working days at its Cologne plant by the first quarter of 2025.

An pressing name to motion

Ford’s Chief Financial Officer, John Lawler, reaffirmed the company’s commitment to Europe and its resolve to meet the 2035 emissions target in a correspondence with the German authorities. Notwithstanding this, he also issued a call to action, urging all stakeholders to collaborate in advancing the transition. Lawler added:

What Europe and Germany notably lack is a comprehensive, coherent strategy to drive e-mobility forward, mirroring substantial investments in charging infrastructure, robust incentives to encourage consumers to switch to electric vehicles, enhanced price competitiveness for manufacturers, and increased flexibility in setting CO2 emissions targets.

Despite previous setbacks, Ford remains committed to being an active player in the European market. Ford’s European automotive technology will shift towards being software-defined, boasting a distinctive and innovative design approach.

The company will focus on its commercial operations under the Ford Professional umbrella while selectively competing in passenger car segments to fuel revenue growth.

Ford has invested $2 billion in its Cologne plant to reconfigure it for electric vehicle production. Following the initial roll-off of the first all-electric Explorer from the production line in June, Ford introduced a second electric vehicle to its lineup – the newly launched Capri – just last month.

The American automaker has made significant cuts to its German management team over the past 12 months. Recently, Ford suffered a significant blow when it lost two of its most experienced and highly valued management team members. Only two administrators remain, a significant reduction from the initial nine appointed just 12 months prior.

Electrek’s Take

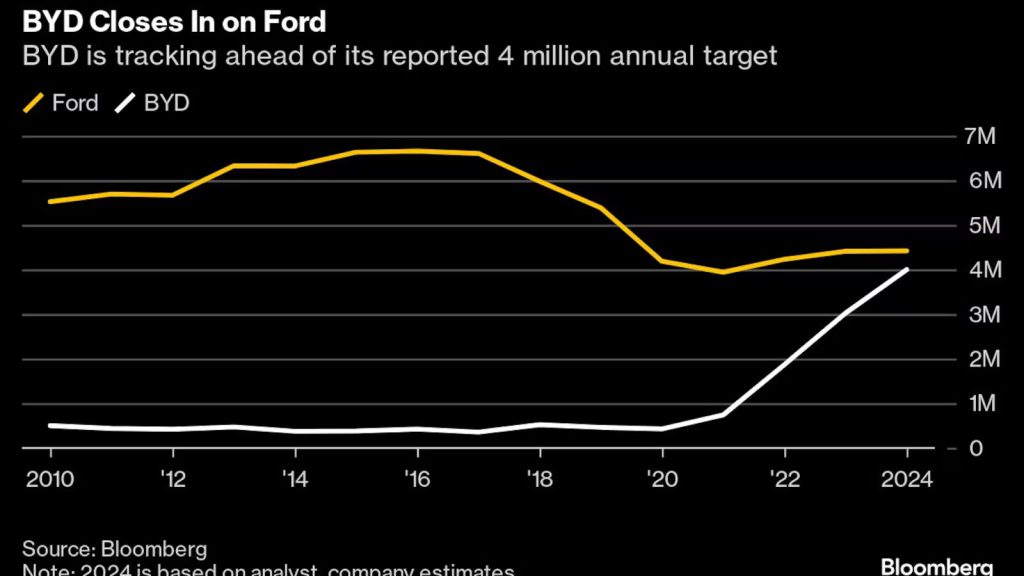

As Ford undergoes restructuring in Europe, traditional manufacturers are increasingly struggling to maintain their market share, with electric vehicle (EV) leaders such as China’s BYD gaining traction globally?

After establishing a stronghold in their domestic market, BYD and other Chinese electric vehicle (EV) manufacturers are now looking abroad to fuel further growth?

Although BYD has emerged as the leading electric vehicle (EV) model in regions such as Southeast Asia and Central and South America, it is poised for a significant surge in sales over the next few months. The EV giant recently launched its inaugural manufacturing facility in Thailand, with further sites planned in Hungary, Brazil, Mexico, Pakistan, and Turkey throughout the year.

As Chinese automaker BYD rapidly closes the gap with US-based Ford in global vehicle deliveries, Although BYD is most renowned for its affordable electric vehicles, such as the Seagull, which starts at under $10,000 (69,800 yuan) in China, it is swiftly expanding into new segments including pickup trucks, mid-size sport utility vehicles, and high-end models.

Ford’s Chief Executive Officer, Jim Farley, cautioned industry rivals last year that if they failed to keep pace with China’s advancements, a significant proportion – potentially 20% to 30% – of their revenue was at risk.

According to Farley, the CEO, the challenge arises because his company has struggled to compete effectively against Japanese and South Korean counterparts.

While Ford’s electric vehicle (EV) unit is expected to post a significant loss of between $5 billion and $5.5 billion this year, BYD reported a record-breaking $1.6 billion (RMB 11.6 billion) in Q3 net profit as its EV sales continue to soar. In October, BYD achieved its eighth consecutive month of record-breaking vehicle sales, surpassing 500,000 passenger cars sold for the first time ever.

Ford is pinning its hopes on a range of affordably priced electric vehicles to turn things around, utilizing its new cost-effective platform. By 2027, the inaugural EV model based on this innovative platform will make its debut in the form of a groundbreaking electric truck.

Can Ford flip issues round? Will it’s too little, too late to make a difference now? Tell us your ideas within the feedback under.