Ford reported its third-quarter earnings after the market closed on Monday, exceeding Wall Street’s income and earnings per share forecasts. Despite this, the corporation continues to invest billions in its electric vehicles. Take a closer look at Ford’s third-quarter 2024 earnings report.

Third-quarter earnings preview

Ford’s U.S. retail gross sales surged 3 percent in the third quarter, with overall gross sales edging up 1 percent compared to Q3 2022. Despite a sluggish start to the year, general car sales have surprisingly surged by 2.7% through the first nine months of 2024.

Despite Ford’s efforts, it lagged behind General Motors and the Hyundai Motor Group (comprising Kia and Genesis) in terms of US electric vehicle sales.

Ford’s electric vehicle (EV) gross sales surged 12% during the third quarter, totalling 23,509 units sold. Despite the challenges, General Motors achieved remarkable success by offering 32,095 electric vehicles, a staggering 60% increase from the previous year, ultimately outpacing its main competitor in the process. GM now leads Ford by a margin of just over 2,700 electric vehicles (EVs), with 70,450 units delivered compared to the Blue Oval’s 67,689.

General Motors announced a stellar performance for its third quarter, exceeding expectations with a staggering $48.8 billion in revenue. Although the corporation doesn’t provide a distinct breakdown of its electric vehicle (EV) performance, it does indicate that it is nearing the pivotal moment when EV gross sales will reach profitability.

Ford’s electric vehicle (EV) losses escalated to $2.5 billion through the first half of 2024 after the company invested an additional $1.1 billion in its Mannequin e venture? Ford anticipates a loss of between $5 billion and $5.5 billion for its electric vehicle operations by the end of this year.

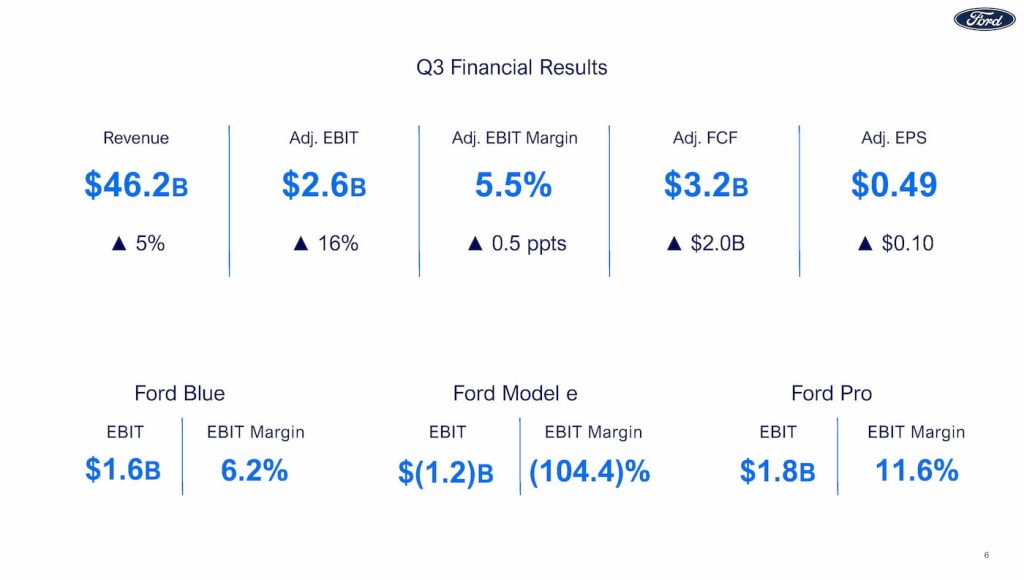

According to expectations, Ford is poised to announce a third-quarter net income of approximately $45.2 billion, accompanied by earnings per share (EPS) of $0.42.

Ford’s third-quarter earnings surpassed expectations, yet electric vehicle (EV) sales had an unexpected impact on profit.

Ford revealed a third-quarter profit of $46 billion and adjusted earnings per share (EPS) of $0.49, exceeding market expectations for the period. Ford celebrated its tenth successive quarter of year-over-year growth.

- $46 billion exceeds expectations of $45.2 billion.

- : $0.49 vs $0.42 anticipated.

Meanwhile, Ford’s online revenue declined by 25%, reaching $900 million in its third-quarter financial report. The company cited a $1 billion “electric-vehicle-related expense” as part of its strategy pivot, amidst decreased income.

Ford’s Professional Solutions division, a leading provider of industrial and software offerings, drove growth, with sales and revenue increasing by 9% and 13%, respectively. The unit achieved $1.8 billion in operating profit, boasting a notable EBIT margin of 11.6%.

Adjusted for one-time items and restructuring costs, quarterly earnings per share were $0.43, exceeding analysts’ expectations.

Despite some initial momentum, Ford’s foray into electric vehicles still grapples with significant challenges. Ford’s Mannequin e mismanaged another $1.2 billion in Q3?

Despite a 33% slide in income to $1.2 billion, Ford credited decreases in material and battery prices for generating nearly $1 billion in value gains thus far.

Despite efforts to boost performance, Mannequin’s e-losses continued to escalate, totalling a staggering $3.7 billion through the first nine months of 2024, largely attributed to “industry-wide pricing strain”?

“We’re poised for success, says Ford’s CEO Jim Farley, as the automotive industry undergoes a transformative shift, with Ford+ at the forefront of this evolution.”

Ford has undertaken significant initiatives to drive progress in critical domains such as software development and cutting-edge electric vehicles.

Ford anticipates a loss of approximately $5 billion on its Model e venture in 2024. The company now anticipates adjusted EBIT of approximately $10 billion, at the lower end of its previously guided $10-to-$12 billion range.

Ford’s inventory fell by approximately 5% after its Q3 earnings announcement, prompting investors to seek more guidance on the company’s direction.

Ford’s Q3 Earnings: Seeking Insights into a Turbulent Market Submissions of updates will occur beneath.