As Japan’s biggest automaker faces increasing competition from low-cost Chinese electric vehicle (EV) manufacturers such as BYD, its market share and profitability are under threat. Toyota’s global production declined for the first time in four years during the initial six months of 2024. Is the corporation’s slow transition to electric vehicles a key factor in their lackluster performance?

Toyota’s global production plummets amidst faltering electric vehicle momentum.

While it’s widely acknowledged that Toyota has been hesitant in embracing a full-scale transition to electric vehicles,

For the first six months of fiscal year 2024, the corporation manufactured approximately 4.71 million vehicles, representing a 7% decline compared to the record 5.06 million produced during the same period in the previous year. For the first time in four years, Toyota’s global manufacturing output has declined.

Following the suspension of production on its best-selling Yaris Cross and Corolla Fielder models due to issues with certification in Japan, Toyota’s domestic output declined by 9.4% during the first half of the year?

Toyota’s announcement of a Prius recall resulted in a subsequent decline in production volumes. Abroad, Toyota’s global production declined by around 6% to approximately 3.17 million units. North American demand contracted by 1.7% during the same period, whereas European markets saw a 3.2% surge in volume.

Toyota suffered a significant downturn in China, with production plummeting 17%. As traditional players in the automotive industry, Toyota faces a significant challenge in keeping pace with Chinese electric vehicle (EV) leaders like BYD, whose affordable models have gained immense popularity.

At a starting price of around $9,900 (approximately 69,800 yuan), BYD’s most affordable electric vehicle, the Seagull, remains at the top of the bestseller list.

Between April and September 2024, Toyota’s global gross sales declined by 2.8%, amounting to approximately five million units. The steepest drop in two years was seen, with domestic sales plummeting by 9.3% and international sales decreasing by 1.6%.

While electric vehicle (EV) gross sales surged 32.5% to 78,178 units, Toyota announced a 30% reduction in its production plans for all-electric vehicles by 2026.

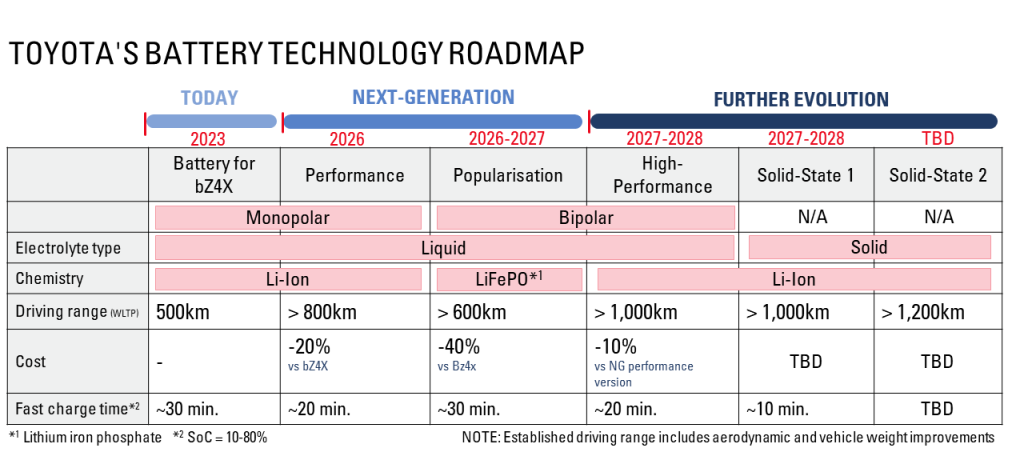

Toyota’s electric vehicle battery roadmap outlines a strategic push for widespread adoption of EVs, driven by the automaker’s commitment to reducing carbon emissions across its entire lifecycle.

In the near term, Toyota plans to expand its portfolio of electrified vehicles, including hybrid, plug-in hybrid, battery electric, and hydrogen fuel cell models.

By 2025, Toyota aims to increase its global electrified vehicle production capacity to over 3.8 million units annually, leveraging advanced technologies and partnerships.

Toyota’s collaboration with Panasonic on prismatic lithium-ion batteries for BEVs is a key component of this strategy, as the partnership will enable mass production of high-performance EV batteries.

The automaker’s focus on hybrid electric vehicles will also play a significant role in driving demand for EVs, particularly in regions where infrastructure and charging networks are still developing.

Toyota has revised its electric vehicle production target, anticipating the construction of approximately one million units by 2026, a decrease from its initial projection of 1.5 million vehicles.

Electrek’s Take

As a laggard in the shift towards electric vehicles, Toyota is grappling with the consequences. It’s not exclusive to China alone.

Chinese electric vehicle manufacturers, such as BYD, are rapidly expanding globally as their domestic market becomes increasingly saturated with affordable competitors.

BYD unveiled its third electric vehicle (EV) in Japan during the summer season, the Seal, often likened to Tesla’s Model 3. The Seal, alongside the Dolphin and Atto 3, ranks among BYD’s most successful electric vehicles. Starting at around $24,500 (£1.8 million or ¥3.63 million), the Honda Dolphin EV poses a significant threat to market leaders like the Toyota Prius and Nissan LEAF.

Recently, the Central Japan Financial and Commerce Bureau hosted a seminar to explore advancements in the electric vehicle industry.

The event featured nearly 90,000 parts from 16 global automotive manufacturers, with around 70 auto component companies in attendance.

The BYD Atto 3 electric SUV, starting at a remarkably affordable price of under $20,000 (approximately 140,000 yuan) in China, stole the show. What’s behind this seemingly affordable price?

On Wednesday, BYD announced its quarterly financial results, with the company’s automotive sales continuing to soar to unprecedented heights.

As Toyota touts its next-generation battery advancements for more eco-friendly and affordable electric vehicles (EVs), can the automaker’s efforts truly make a meaningful impact in today’s competitive market? By 2027, the corporation claims that its upcoming “Popularisation” LFP battery technology will boast a WLTP-rated driving range of over 600 kilometers or approximately 373 miles.

According to data, BYD was responsible for nearly a third of the LFP battery installations in China during September, underscoring its significant market share. While China’s lithium-iron-phosphate (LFP) battery share dominates at approximately 75%,