General Motors (GM) sustained its momentum in the current year, exceeding Wall Street’s expectations for the third quarter once again. As a surprise to many, General Motors has vaulted past competitors Ford and Hyundai to become the second-largest electric vehicle (EV) seller within the United States, outpacing both despite offering fewer incentives.

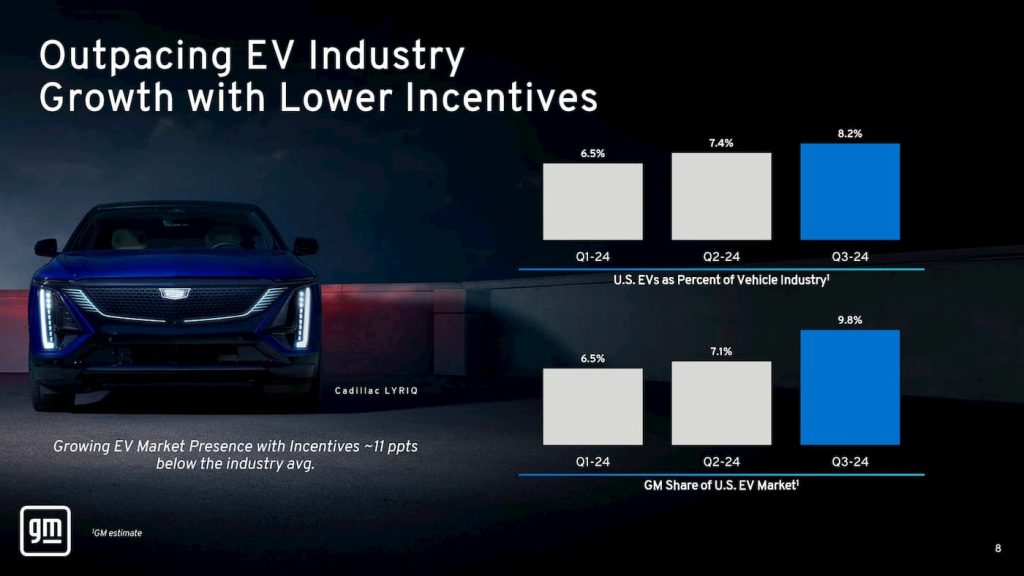

General Motors’ electric vehicle sales surged in the third quarter, with 32,095 units sold, marking a 60% increase from the same period last year. This significant growth propelled GM’s share of the US electric vehicle market to nearly reach double digits.

Rory Harvey, General Motors’ government vice chairman of global markets, noted that their electric vehicle portfolio is growing faster than the market due to the fact that they now have an all-electric car for nearly everyone, according to the results announced.

The rapid expansion enabled the company to leapfrog Ford and Hyundai, ultimately becoming North America’s second-largest electric vehicle (EV) seller.

The General Motors (GM) expansion is driven by a desire to offer customers a range of options, including electric SUVs such as the Chevy Blaze EV and affordable models like the Chevy Equinox EV. General Motors has officially released the highly anticipated $35,000 Equinox LT trim. Here are the improvements:

For a price tag below $7,500, that’s earlier than the EV tax credit deadline.

Since its launch, General Motors has sold over 15,000 Chevrolet Equinox models in the third quarter, touting it as the “most affordable electric vehicle” in the US market, boasting a range of more than 315 miles.

The automaker also offers premium models such as the Cadillac Lyriq and electric pickup trucks, including the GMC Hummer EV, Chevrolet Silverado EV, and GMC Sierra EV.

The General Motors’ market share experienced a notable increase, growing from 7.1% in the second quarter to a significant 9.8% by the end of the third quarter in 2024? The corporation’s growing electric vehicle (EV) market share persists despite a notable lag behind industry averages, with incentives hovering at just 11 percentage points lower than the sector norm.

General Motors’ positive factors contributed to a significant increase in its electric vehicle (EV) market share during the third quarter, as the company offered significantly fewer incentives than rivals Tesla and Hyundai/Kia.

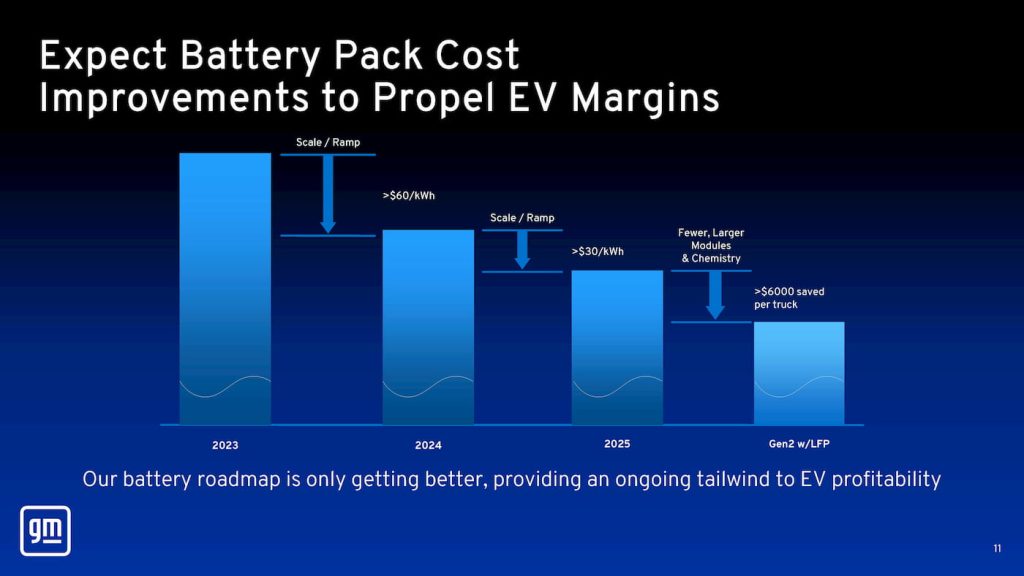

The primary driver of progress lies in the advancements surrounding General Motors’ dedicated Ultium electric vehicle (EV) platform, combined with decreasing battery cell costs and increasing domestic production in the United States.

In a recent comment, General Motors President Mark Reuss subtly took aim at Ford, questioning whether the corporation was interested in having “skunkworks” develop affordable electric vehicles, specifically referencing Ford’s California-based team building an economy-friendly EV platform for mass production.

General Motors has announced that it is approaching a critical milestone in its electric vehicle (EV) sales, with profits from gross EV sales expected to reach the crossover point.

By 2025, General Motors anticipates that its ongoing advancements will generate a significant tailwind in terms of electric vehicle profitability, estimated to be in the range of $2 billion to $4 billion.

General Motors has officially reaffirmed its commitment to delivering 200,000 electric vehicles this year, with the expectation of achieving a positive electric vehicle variable profit in the fourth quarter.

As General Motors introduces a slew of innovative fashion designs, including the cutting-edge Cadillac Escalade IQ, Optiq, and Vistiq models, the company anticipates the positive momentum will continue through to the end of 2024. By 2023, General Motors plans to introduce its next-generation Bolt EV, marking the beginning of a “family” of Bolt models, according to Mark Reuss.

General Motors generated a whopping $48.8 billion in income during the third quarter, significantly surpassing expectations of approximately $45 billion. Meanwhile, earnings before interest, taxes, and amortization (EBIT) surged 15.5% year-over-year to $4.1 billion.

General Motors’ Q3 results demonstrating strength have led to an upward revision of its full-year 2024 earnings guidance. The company now anticipates adjusted operating profits ranging from $14 billion to $15 billion, a revised target that surpasses its initial projection of $13 billion to $15 billion.