China’s automakers are feeling the pinch of Japan’s slow adoption of electric vehicles (EVs). Nissan’s gross sales have been plummeting recently, lagging behind electric vehicle (EV) leaders such as Tesla and BYD in their efforts to adapt to the rapidly evolving market.

Nissan’s sluggish electric vehicle (EV) transition in China is taking a toll on the automaker.

Nissan’s fortunes in the world’s largest electric vehicle (EV) market are wavering, with declining sales posing a significant challenge for the company. The Japanese automaker saw a significant decline in Chinese sales in August, with a staggering 29% drop, resulting in just 65,000 units sold.

Among the 65,000 vehicles sold, a mere 106 (a paltry 0.16%) were the Nissan Ariya, the Japanese automaker’s innovative electric SUV. Infiniti, Nissan’s luxury brand, has seen a significant decline in sales of its D60 EV model, with gross sales plummeting by 60 percent compared to the previous year. Electrifying news: D60 EV’s gross sales plummet by a staggering 55% this year.

Gross sales in the region have consistently declined over the past several months. Nissan’s gross sales plummeted by 28% in June and a further 22.6% in July, outpacing the declines experienced by its Japanese peers, including Toyota.

The consequences unfold following a staggering 20% decline in Nissan’s gross sales last year, causing it to tumble out of the top 5 automaker rankings by market share?

In China, Nissan faces a significant market, accounting for approximately one-third of the company’s global revenues. Nissan reportedly derives 34% of its online revenue from China, outpacing every other Japanese car manufacturer, according to estimates from Goldman Sachs.

Nissan slashes its sales forecast in China for the fiscal year ending 2024, targeting 800,000 vehicles – a 23% decline from the previous year.

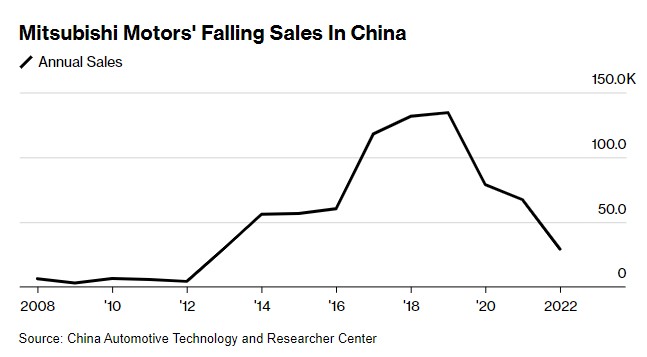

As Nissan’s sales slump in China, it’s surprising that the brand isn’t basking in the glow of the country’s electric vehicle (EV) boom? Mitsubishi announces plans to suspend its operations in the region effective July, marking a significant milestone in the company’s evolving strategy.

After reaching a peak of 134,500 units sold in 2019, Mitsubishi’s gross sales in China have cratered, with only 34,500 vehicles purchased last year. China’s swift pivot towards electric vehicles precipitated the crisis at the automaker.

Meanwhile, Toyota faced difficulties maintaining its footing in China’s competitive electric vehicle market, prompting the company to lay off employees this summer.

Nissan plans to unveil an extensive strategy for China this autumn as part of its latest medium-term plan.

According to Seiji Sugiura, a senior analyst at Tokai Tokyo Analysis Institute, traders require assurance that companies are committed to electric vehicles by developing a distinct approach that showcases their dedication.

Electrek’s Take

Despite being an early pioneer in the electric vehicle (EV) space with the release of the LEAF in 2010, significant technological advancements have been made in the past decade.

As China’s electric vehicle (EV) manufacturers, such as BYD, NIO, and XPeng, capitalise on the industry’s transformation, they’re incorporating innovative technologies and features while maintaining a competitive edge through lower prices compared to their peers.

The outcomes are telling. Within the third quarter, BYD acquired an impressive 431,603 electric vehicles, narrowly missing out on surpassing Tesla’s tally of 435,059.

As of this year, BYD has surpassed both Volkswagen and taken the title as China’s best-selling passenger vehicle brand, with its models in high demand among local consumers. The automotive manufacturer is rapidly expanding its global presence, having already established a strong foothold in markets such as Thailand, Brazil, Colombia, and Israel through affordable electric options like the popular Dolphin electric hatchback.

China’s automotive market serves as a microcosm for the global industry’s current state. As electric vehicle (EV) gross sales accelerate, consumers increasingly opt for brands offering more value proposition.