Despite multiple setbacks and intensifying competition from Ford, Stellantis, and Chinese automakers, the General Motors board opted to allocate $6 billion to boost shareholder value rather than invest in the company’s long-term prospects.

Following a six-week UAW strike at General Motors that stemmed from labor negotiations, the automaker’s board members approved a $10 billion accelerated inventory buyback program. This week, the board launched its initiative with a $6 billion buyback, accompanied by a 33% hike in shareholders’ quarterly dividend to 12 cents per share – a move that appears to be a transparent attempt to placate investors at the expense of the company’s long-term viability and a shocking abdication of fiduciary responsibility.

Stellantis is severe

Despite being slow to join the electric party in 2020 and 2021, Stellantis seemed hesitant to commit to a comprehensive electrification strategy, as many other Original Equipment Manufacturers (OEMs) eagerly announced their intentions to transition to all-electric offerings by 2035. Despite facing challenges, Carlos Tavares’ leadership appears to be tackling the issue head-on in a significant manner.

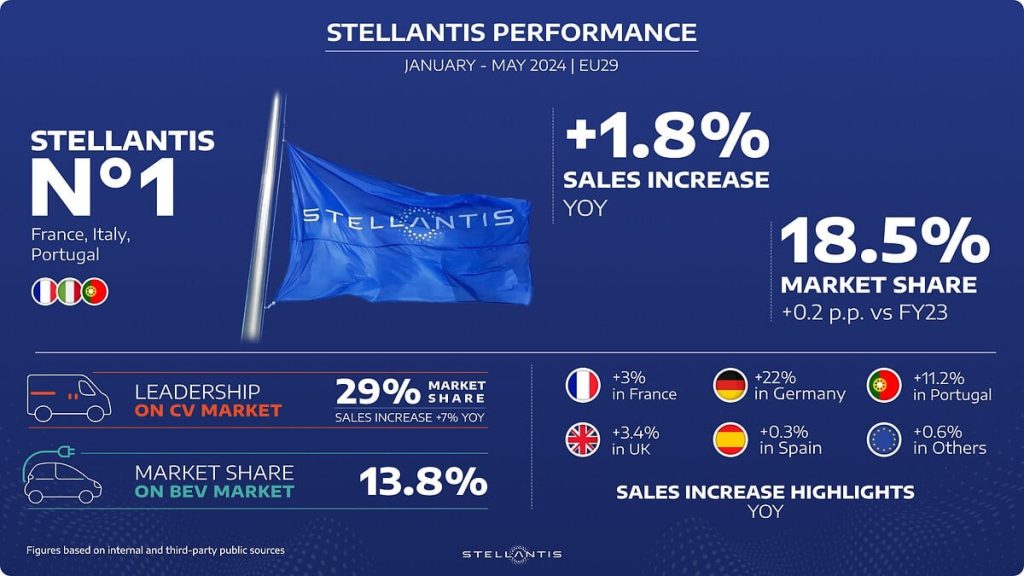

“While the broader BEV market may be slowing down, Stellantis remains steadfast, securing a 13.8% market share in the EU27 region.” “In France, the corporate’s electric vehicles led the charge, with sales surging 56% to capture a commanding 37.9% market share.”

In Germany, Stellantis, the world’s second-largest producer of electric vehicles, is cutting costs. The corporation has seen a notable 22% increase in gross sales for the year, maintaining its market leadership position in Italy through its popular offerings including Fiat, Alfa Romeo, and the well-received new Lancia lineup.

As Stellantis reevaluates its strategy, it seems they’ve suddenly remembered that Jeep is a youthful brand known for its fun factor, prompting them to announce plans to release a reasonably priced, $25,000 all-electric Jeep Renegade well ahead of schedule.

The automotive industry’s recent consolidation has been nothing short of astonishing. Just consider Stellantis, the entity formed by the merger between Fiat Chrysler Automobiles (FCA) and PSA Group. It may not be the most robust example, but it is certainly one worth examining. Ford, GM’s arch-rival, is securing prime new product expertise, equally effectively. Ford is accelerating its drive to deliver an affordable electric vehicle, with the aim of getting it to market at speed; meanwhile, its compact Maverick hybrid truck and E-Transit electric van continue to lead their respective categories.

As electric vehicle (EV) sales continue to surge, Hyundai and Kia are narrowing the gap with Tesla, boasting double-digit growth in the market without benefiting from Stellantis’ early start in the low single digits. Hyundai’s partnership with Tesla has driven down the price tag of 300-mile, rapid-charging electric vehicles, making them more affordable than the average US new vehicle purchase price of $47,218.

Concurrently, Kia’s design team makes a significant leap forward with models such as the recently updated EV6, the American-made, seven-passenger EV9, and the upcoming compact EV3, each of which boasts a winning design aesthetic for the Korean brand.

It’s not simply legacy manufacturers

Start-ups like Rivian, with its compact R3, pose a significant threat to General Motors’ dominance as they introduce modern, innovative products that directly compete with GM’s core offerings such as the Chevy Silverado (Rivian R1T), Tahoe (R1S), and Blazer/Equinox (R2) lines, which are still struggling to gain traction in the market against Tesla’s phenomenally popular Model Y.

The complexities of the Chinese language are still waiting to be fully understood.

Chinese market poses significant challenge to General Motors.

As recently as a few years ago, GM relied heavily on China to purchase its Buicks, with some sales trickling in here and there. However, Chinese homegrown producers have made significant strides over the past decade, leaving it unclear whether Buick will remain an attractive brand in the world’s largest auto market – or even the US – within the next five-to-ten years.

Meanwhile, General Motors’ ambitious claims about its Ultium platform reducing prices through large-scale economies seem to have hit a snag, as the company is manufacturing significantly fewer mainstream electric vehicles like the Silverado and Blazer than anticipated?

To survive the impending seismic shift in the automotive industry’s transformation towards electric and hybrid vehicles, General Motors must not only adapt its product portfolio but also rethink its business model and strategic priorities. Higher product. Cheaper product. While simultaneously addressing its workforce’s financial needs is crucial, so too is securing sufficient funding to enable them to not only contribute to the development of GM’s next-generation EVs but also afford to purchase them, as the latest UAW agreement attempted to do, albeit without guaranteeing pensions for employees hired after the 2007/08 bailout.

GM’s inventory reduction efforts are being augmented by a strategic inventory buyback program. As a devoted General Motors enthusiast, I fervently hope that the organization will reconsider its stance.